THE JOHNSONS CREDIT QUESTIONS

They are considering trading their car in for a new or used vehicle so that Harry can have a dependable transportation for commuting to work. The couple still owes $5130 to the credit union for their current car, or $285 per month for the remaining 18 months of the 48 month loan. The trade-in value of their car plus $1000 that hairy earned from a freelance interior design job should I let the couple to pay off the auto loan and leave $1250 for down payment on the newer car. The Johnsons have a greed on a sales price for the newer car of $21,000.

(a) make recommendations to Harry and Belinda regarding where to seek financing and what APR to expect.

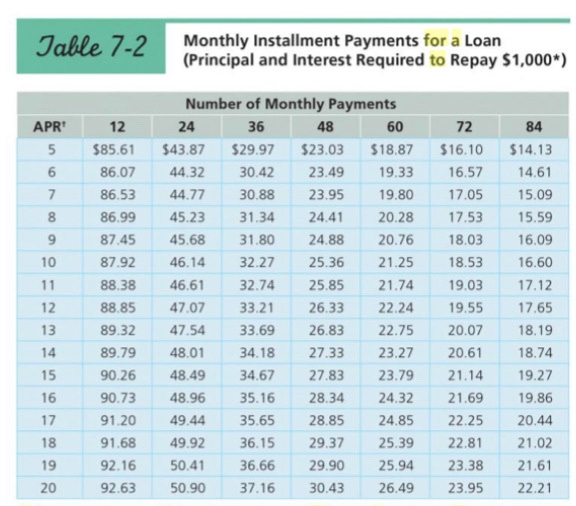

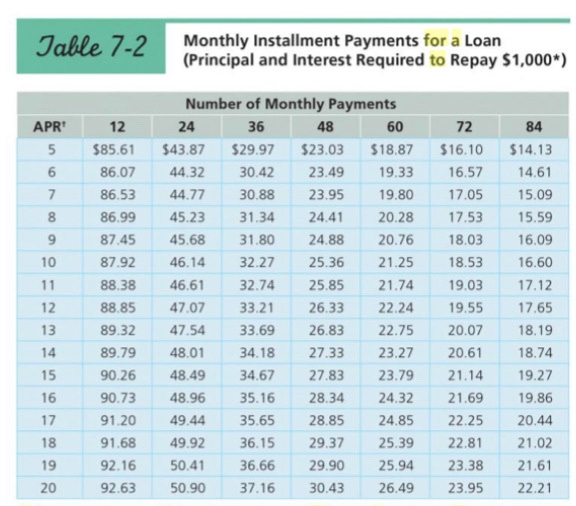

(b) using the Garman/Forgue companion website for the information in table 7-2, calculate the monthly payment for a long period of three, four, five, and six years at 6% APR. Describe the relationship between the loan period and the payment amount period.

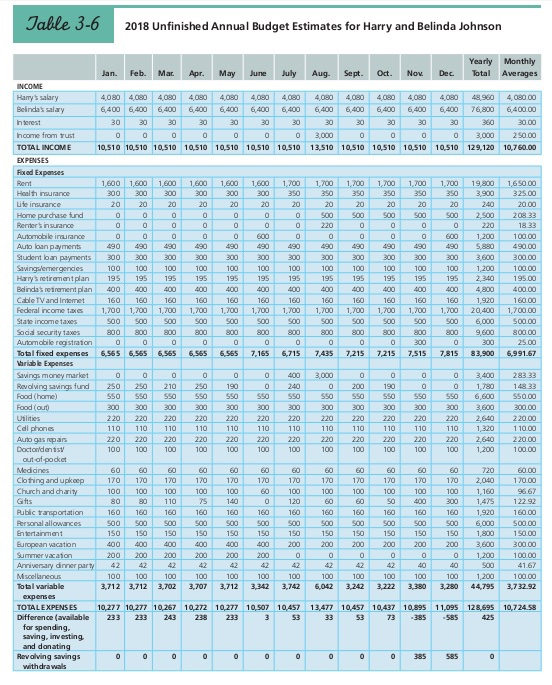

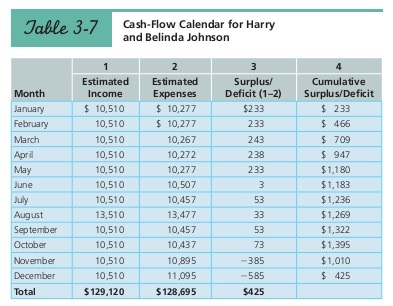

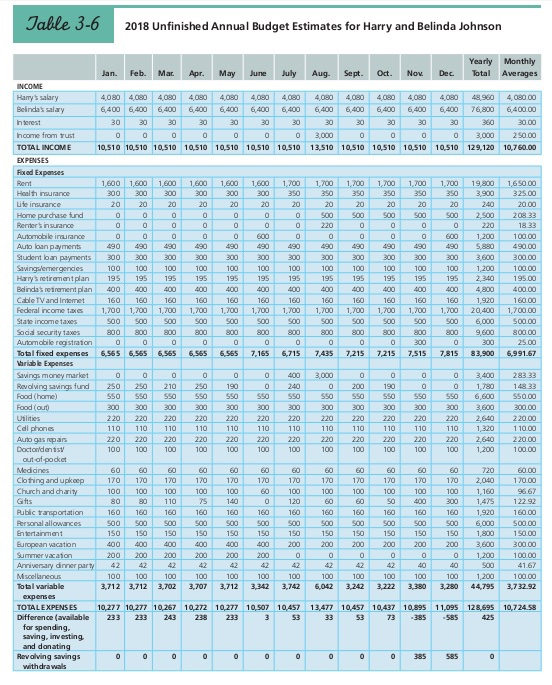

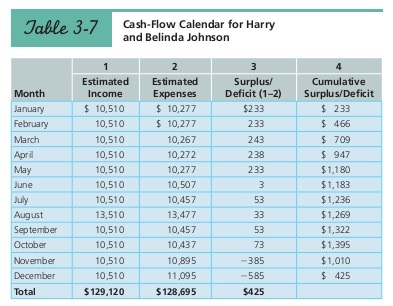

(c) Harry and Belinda have a cash flow deficit projected for several months this year (see table 3-6 and table 3-7). Suggest how, when, and where they might finance shortages by borrowing.

Jable 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson 20 2.340 Yearly Monthly Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. . Dec. Total Averages INCOME Harry's salary 4080 4080 4,080 4,080 4080 4080 48.980 4,080.00 Belindas salary 6,400 6.400 6.400 6,400 6.400 6,400 6,400 6,400 6,400 6.400 6,400 76,800 6,400.00 Interest 30 30 30 30 30 30 30 30 30 30 380 30.00 Income from trust 0 0 0 0 0 3,000 3,000 250.00 TOTAL INCOME 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13.510 10,510 10,510 10,510 10,510 129,120 10,760.00 EXPENSES Fixed Expenses Rent 1.600 1.600 1 600 1,600 1600 1,600 1.700 1.700 1.700 1.700 1.700 1.700 19,800 1650.00 Health insurance 300 300 300 300 300 300 350 350 350 350 350 350 3.900 325.00 Life insurance 20 20 20 20 20 20 20 20.00 Home purchase und 0 0 0 0 0 500 500 500 500 500 2 500 208.33 Renters insurance 0 0 0 0 0 0 220 1833 Automobile insurance 0 0 0 0 600 0 0 0 0 600 1,200 100.00 Auto loan payments 490 490 490 490 490 490 490 490 5.880 490.00 Student loan payments 300 300 300 300 300 300 300 300 300 300 300 3.600 300.00 Savings/emergendes 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 Harrys retirement plan 195 195 195 195 195 195 195 195 195 195 195 195 195.00 Bdindarrement plan 400 400 400 400 400 400 400 400 400 400 4800 400.00 Cable TV and intemet 160 160 160 160 180 160 160 180 160 160 160 160 1.920 160.00 Federal income taxes 1,700 1,700 1,700 1.700 1.700 1,700 1.700 1.700 1.700 1.700 1,700 1,700 20,400 1,700.00 State income taxes SOO 500 500 SOO SOO SOO SOO SOO SOO 500 500 6,000 500.00 Social security faces 800 900 800 800 800 800 800 800 800 800 800 9,600 800.00 Automobile registration 0 0 0 0 0 0 0 0 300 O 300 25.00 Total fixed expenses 6,565 6,565 6,565 6,565 6,565 7,165 6,715 7,435 7,215 7,215 7,515 7,815 83,900 6,991.67 Variable Expenses Savings money market 0 0 0 0 400 3,000 0 0 3.400 283.33 Revolving savingsfund 250 250 210 250 190 0 240 0 200 190 0 0 14833 Food (home) S50 550 550 SSO 550 550 550 550 SSO SSO 550 SSO 6.600 550.00 Food out 300 300 300 300 300 300 300 300 300 300 300 300 3.600 300.00 Utilities 220 220 220 220 220 220 220 220 220 220 2640 220.00 Cdl phones 110 110 110 110 110 110 110 110 110 110 110 110 1,320 110.00 Auto gas repas 220 220 220 220 220 220 220 2.640 220.00 Doctonden is 100 100 100 100 100 100 100 100 100 100 100 100 1,200 100.00 out of pocket Medicines 60 60 60 60 60 60 60 60 60 60 720 60.00 Clothing and upkeep 170 170 170 170 170 170 170 170 170 170 170 170 2040 170.00 Church and charity 100 100 100 100 100 100 100 100 100 100 100 1,160 96.67 Gifts 80 110 75 140 120 SO 400 300 1,475 122.92 Pubic Yansportation 160 160 160 160 160 160 160 160 160 160 160 160 1.920 160.00 Personal allowances 500 500 500 500 500 500 500 500 500 500 500 6.000 500.00 Entertainment 150 150 150 150 150 150 150 150 150 150 150 150 1,800 150.00 European vacation 400 400 400 200 200 200 200 200 3.600 300.00 Summer vacation 200 200 200 200 0 0 0 0 0 0 1.200 100.00 Anniversary dinner party 42 42 40 500 4167 Miscellaneous 100 100 100 100 100 100 100 100 100 100 100 100 1.200 100.00 Total variable 3,712 3,712 3,702 3,707 3.712 3,342 3,742 6,042 3.242 3.222 3,380 3.280 3,732.92 expenses TOTAL EXPENSES 10,277 10,277 10.267 10,272 10,277 10.507 10,457 13,477 10,457 10.437 10,895 11,095 128,695 10,724.58 Difference (available 233 233 243 238 233 3 53 33 53 73 -385 -585 for spending. saving, investing and donating Revolving savings 0 0 0 0 0 0 0 0 0 385 585 0 withdrawals 200 Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson Month January February March April May June July August September October November December Total Estimated Income $ 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13,510 10,510 10,510 10,510 10,510 $ 129,120 2 Estimated Expenses $ 10,277 $ 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 $ 128,695 3 Surplus/ Deficit (1-2) $233 233 243 238 233 3 53 33 53 73 -385 -585 $425 Cumulative Surplus/Deficit $ 233 $ 466 $ 709 $ 947 $1,180 $1,183 $1,236 $1,269 $1,322 $1,395 $1,010 $ 425 Table 7-2 Monthly Installment Payments for a Loan (Principal and Interest Required to Repay $1,000*) APR 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 12 $85.61 86.07 86.53 86.99 87.45 87.92 88.38 88.85 89.32 89.79 90.26 90.73 91.20 91.68 92.16 92.63 Number of Monthly Payments 24 36 48 60 $43.87 $29.97 $23.03 $18.87 44.32 30.42 23.49 19.33 44.77 30.88 23.95 19.80 45.23 31.34 24.41 20.28 45.68 31.80 24.88 20.76 46.14 32.27 25.36 21.25 46.61 32.74 25.85 21.74 47.07 33.21 26.33 22.24 47.54 33.69 26.83 22.75 48.01 34.18 27.33 23.27 48.49 34.67 27.83 23.79 48.96 35.16 28.34 24.32 49.44 35.65 28.85 24.85 49.92 36.15 29.37 25.39 50.41 36.66 29.90 25.94 50.90 37.16 30.43 26.49 72 $16.10 16.57 17.05 17.53 18.03 18.53 19.03 19.55 20.07 20.61 21.14 21.69 22.25 22.81 23.38 23.95 84 $14.13 14.61 15.09 15.59 16.09 16.60 17.12 17.65 18.19 18.74 19.27 19.86 20.44 21.02 21.61 22.21