Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Lexington Building has the following income and expense figures: Initial Investment = $1,815,000 Gross Potential Income = $1,436,000 Operating Expenses = $332,000 Net

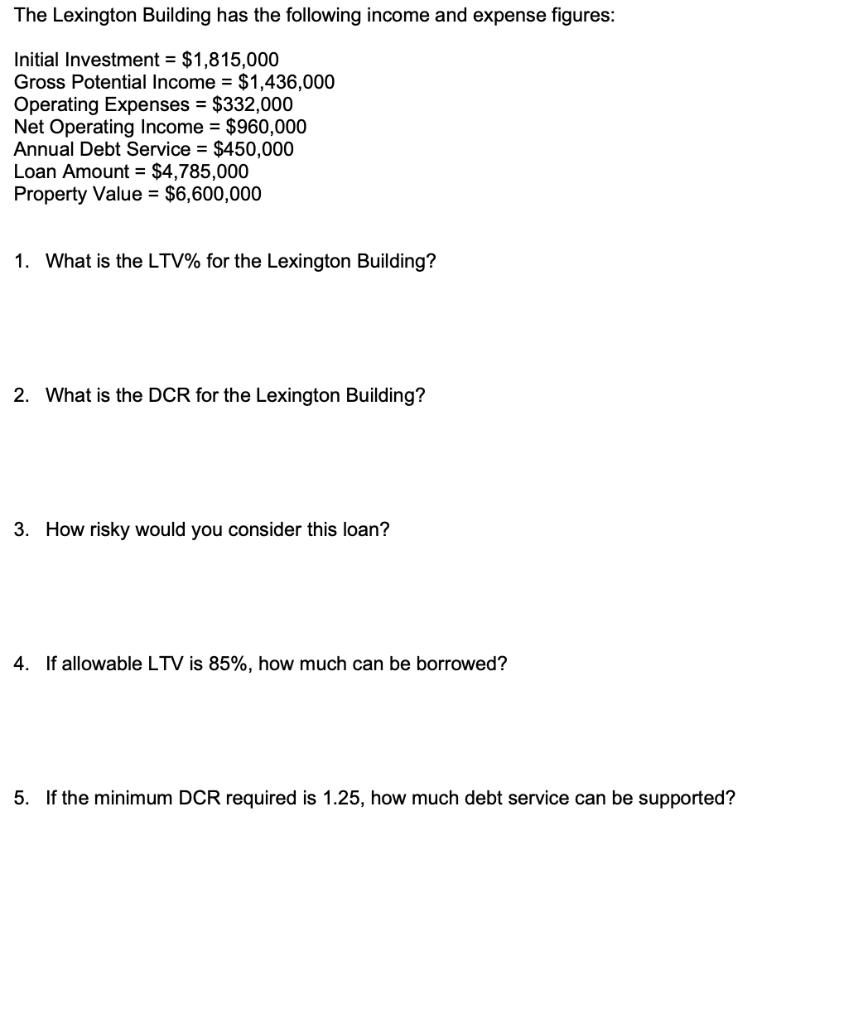

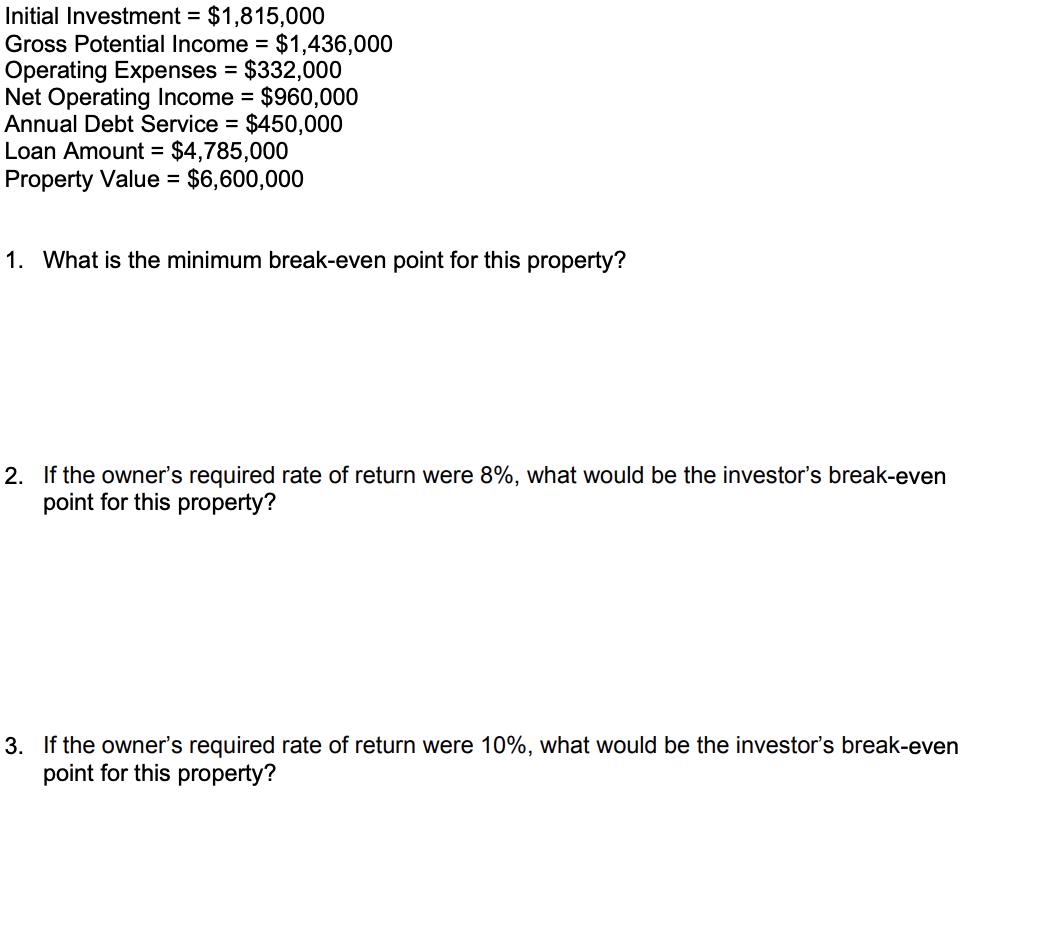

The Lexington Building has the following income and expense figures: Initial Investment = $1,815,000 Gross Potential Income = $1,436,000 Operating Expenses = $332,000 Net Operating Income = $960,000 Annual Debt Service = $450,000 Loan Amount = $4,785,000 Property Value = $6,600,000 1. What is the LTV% for the Lexington Building? 2. What is the DCR for the Lexington Building? 3. How risky would you consider this loan? 4. If allowable LTV is 85%, how much can be borrowed? 5. If the minimum DCR required is 1.25, how much debt service can be supported? Initial Investment = $1,815,000 Gross Potential Income = $1,436,000 Operating Expenses = $332,000 Net Operating Income = $960,000 Annual Debt Service = $450,000 Loan Amount = $4,785,000 Property Value = $6,600,000 1. What is the minimum break-even point for this property? 2. If the owner's required rate of return were 8%, what would be the investor's break-even point for this property? 3. If the owner's required rate of return were 10%, what would be the investor's break-even point for this property?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The LoantoValue LTV ratio for the Lexington Building can be calculated as LTV Loan Amount Property Value x 100 LTV 4785000 6600000 x 100 LTV 7250 The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started