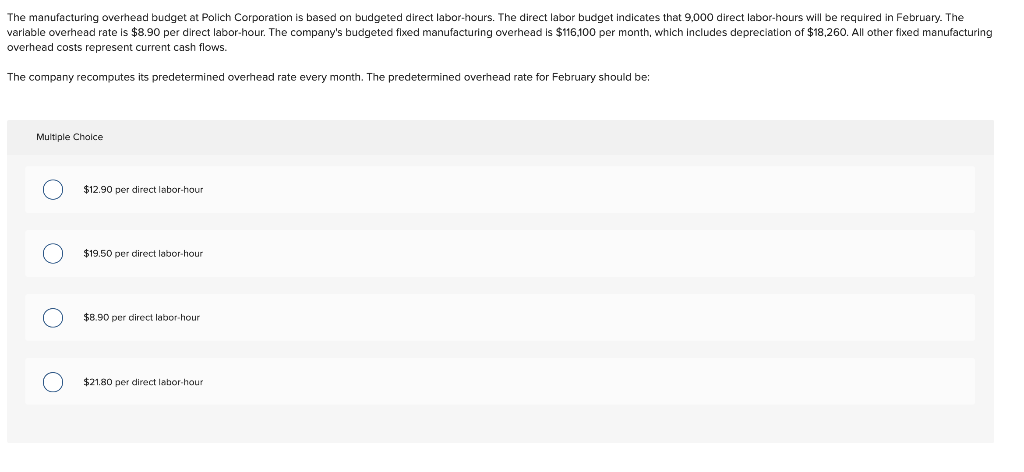

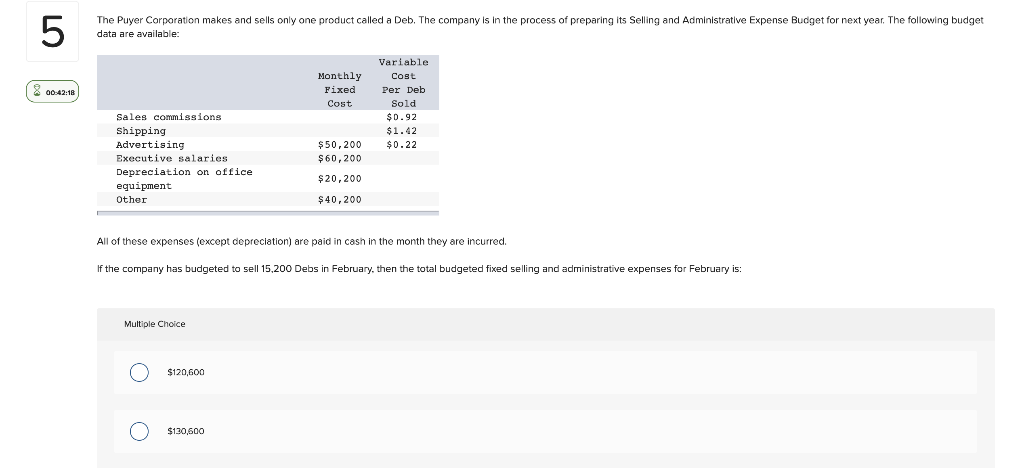

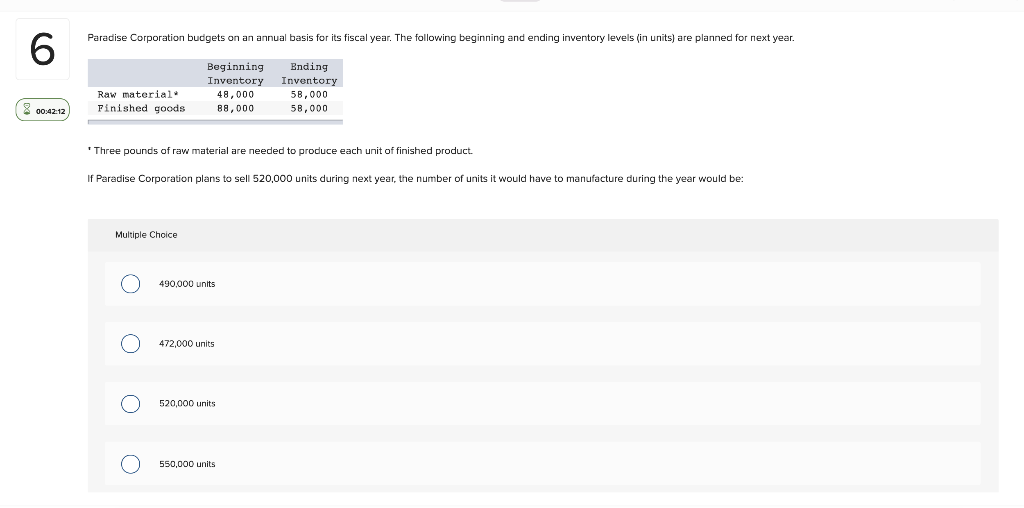

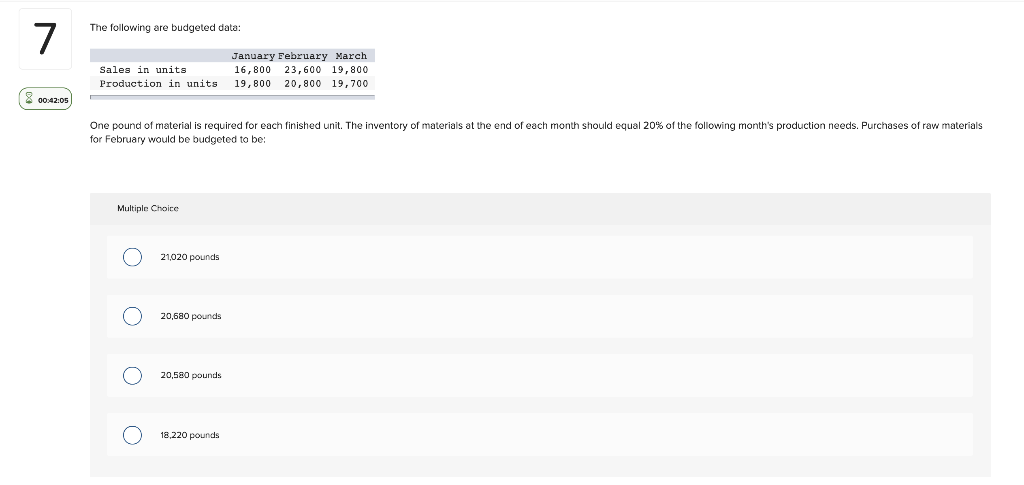

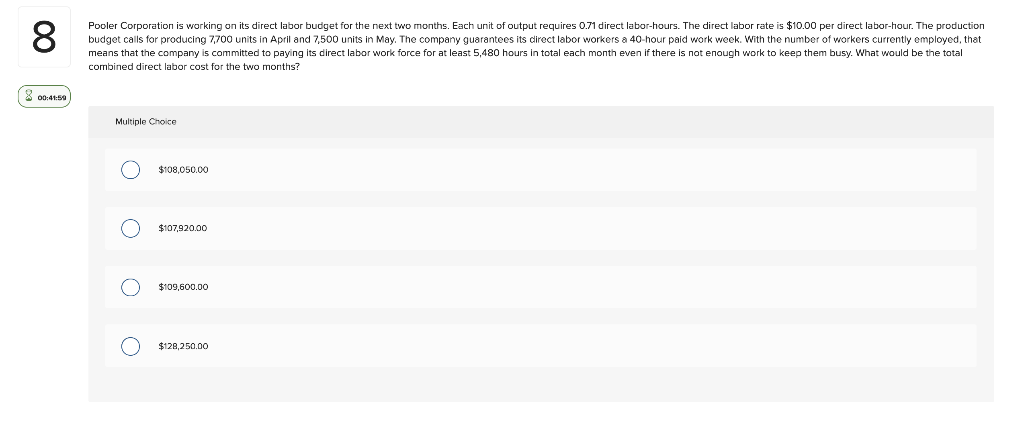

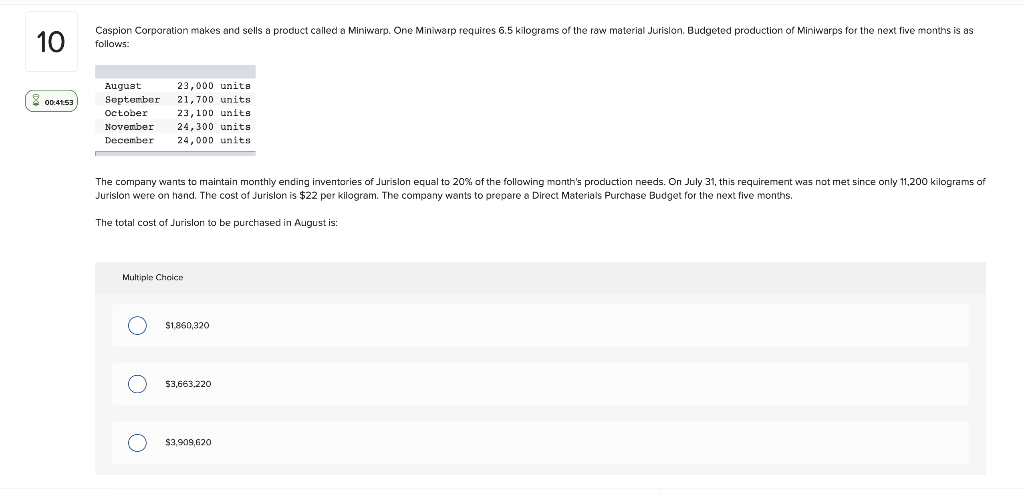

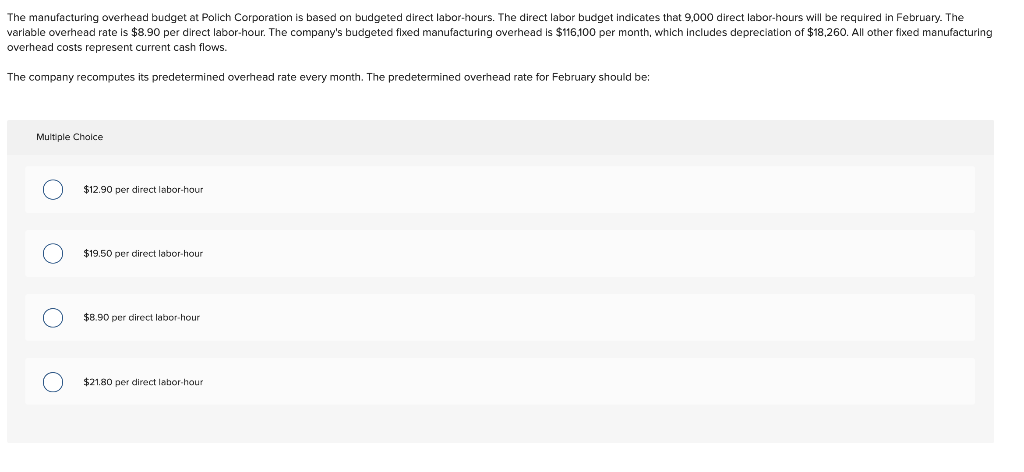

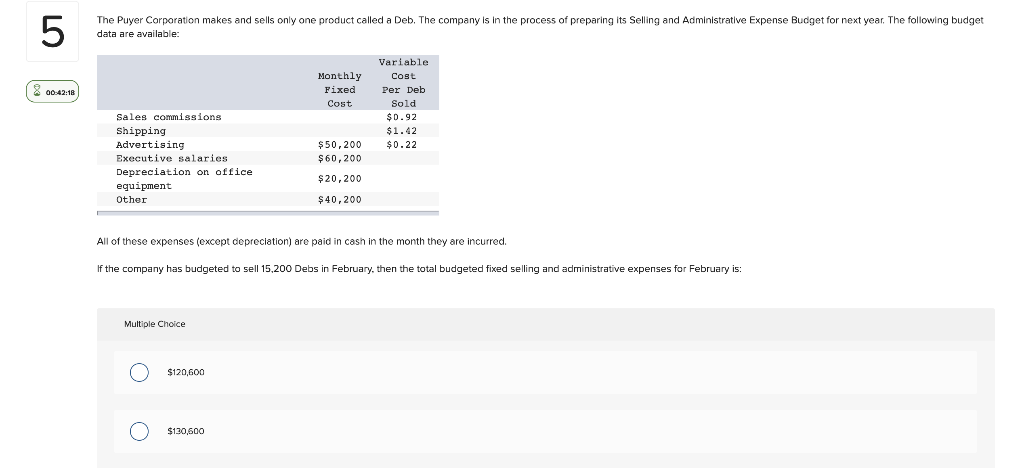

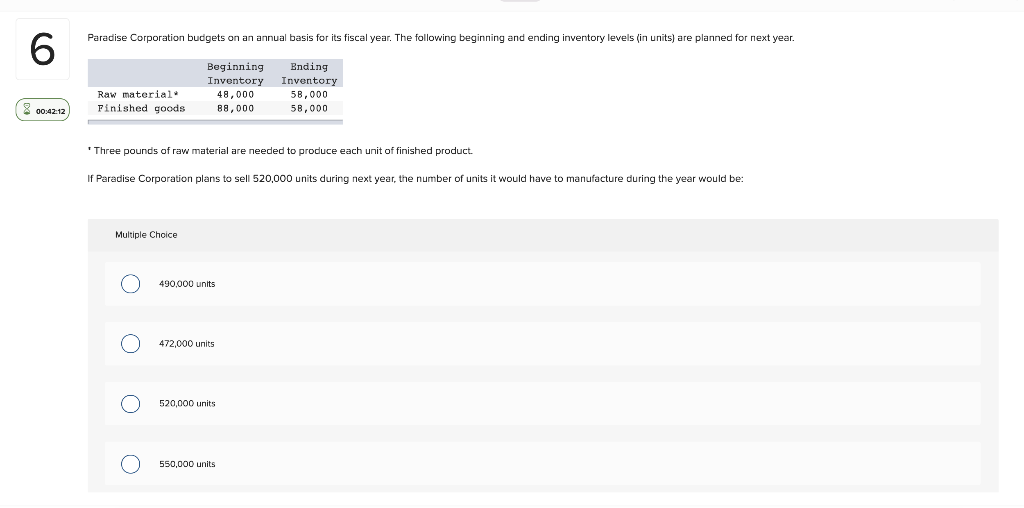

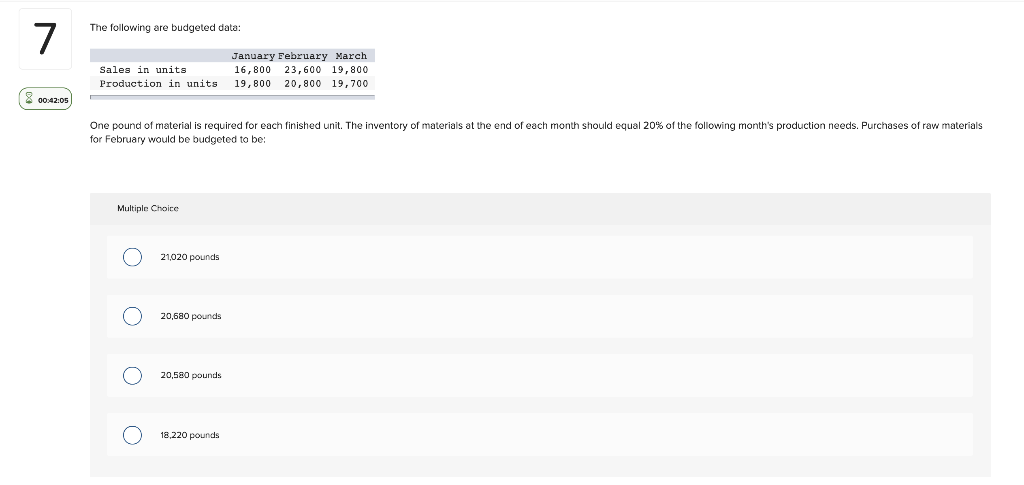

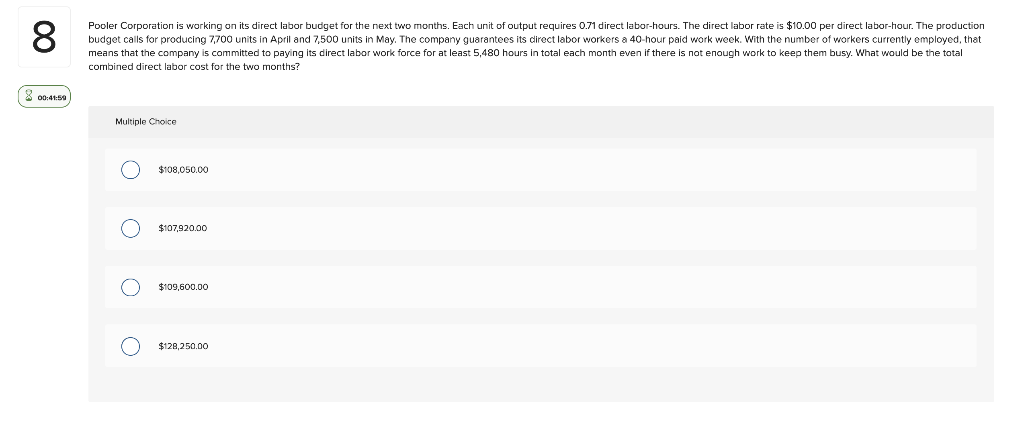

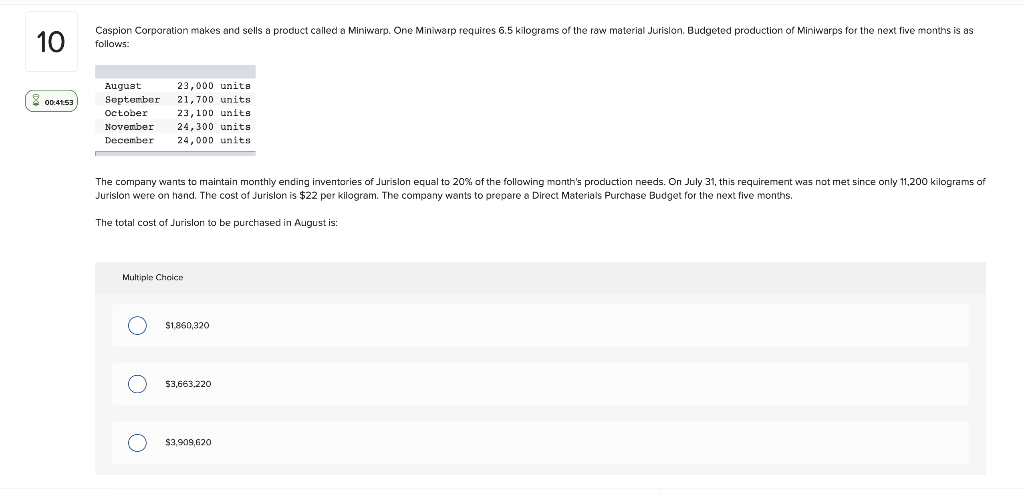

The manufacturing overhead budget at Polich Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 9,000 direct labor-hours will be required in February. The variable overhead rate is $8.90 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $116,100 per month, which includes depreciation of $18,260. All other fixed manufacturing overhead costs represent current cash flows. The company recomputes its predetermined overhead rate every month. The predetermined overhead rate for February should be: Multiple Choice $12.90 per direct labor-hour O $19.50 per direct labor hour O $8.90 per direct labor hour $21.80 per direct labor-hour 5 The Puyer Corporation makes and sells only one product called a Deb. The company is in the process of preparing its Selling and Administrative Expense Budget for next year. The following budget data are available: 00:42:18 Monthly Fixed Cost Variable Cost Per Deb Sold $0.92 $1.42 $0.22 Sales commissions Shipping Advertising Executive salaries Depreciation on office equipment Other $50,200 $ 60,200 $20,200 $40,200 All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the company has budgeted to sell 15,200 Debs in February, then the total budgeted fixed selling and administrative expenses for February is: Multiple Choice $120,600 $130,600 Paradise Corporation budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for next year. 6 Beginning Inventory 48,000 88,000 Ending Inventory 50,000 50,000 Raw material Finished goods 8 00:42:12 'Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 520,000 units during next year, the number of units it would have to manufacture during the year would be: Multiple Choice 490,000 units 472.000 units 520,000 units 550,000 units The following are budgeted data: 7 Sales in units Production in units January February March 16,800 23,600 19,800 19,800 20,800 19,700 8 00:42:05 One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for February would be budgeted to be: Multiple Choice 21,020 pounds 20,680 pounds O 20,580 pounds 18,220 pounds 8 Pooler Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.71 direct labor-hours. The direct labor rate is $10.00 per direct labor-hour. The production budget calls for producing 7,700 units in April and 7,500 units in May. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed paying its direct labor work force for at least 5,480 hours in total each month even if there is not enough work to keep them busy. What would be the total combined direct labor cost for the two months? 8 00:41:50 Multiple Choice $108,050.00 $107,920,00 $109,500.00 $128,250.00 10 Caspion Corporation makes and sells a product called a Miniwarp. One Miniwarp requires 6.5 kilograms of the raw material Jurislon. Budgeted production of Miniwarps for the next five months is as follows 8 00:4153 August September October November December 23,000 units 21.700 units 23, 100 units 24,300 units 24,000 units The company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 11,200 kilograms of Jurision were on hand. The cost of Jurision is $22 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months. The total cost of Jurision to be purchased in August is: Multiple Choice S1,860,320 53,663,220 $3,909,620