Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The National Bank has just granted you a loan with the following conditions Currency: soles Loan amount: S/. 100000 Loan interest rate: 12% annual

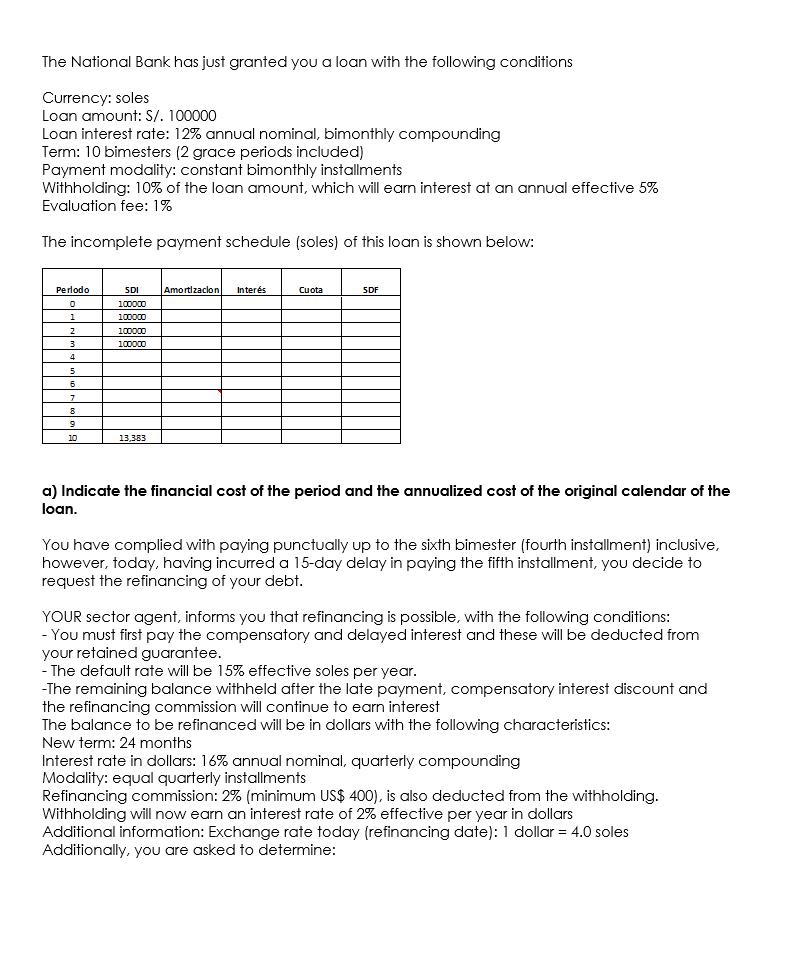

The National Bank has just granted you a loan with the following conditions Currency: soles Loan amount: S/. 100000 Loan interest rate: 12% annual nominal, bimonthly compounding Term: 10 bimesters (2 grace periods included) Payment modality: constant bimonthly installments Withholding: 10% of the loan amount, which will earn interest at an annual effective 5% Evaluation fee: 1% The incomplete payment schedule (soles) of this loan is shown below: Periodo 0 SDI 100000 Amortizacion Inters Cuota SDF 1 100000 2 100000 3 100000 4 5 6 7 8 9 10 13,383 a) Indicate the financial cost of the period and the annualized cost of the original calendar of the loan. You have complied with paying punctually up to the sixth bimester (fourth installment) inclusive, however, today, having incurred a 15-day delay in paying the fifth installment, you decide to request the refinancing of your debt. YOUR sector agent, informs you that refinancing is possible, with the following conditions: - You must first pay the compensatory and delayed interest and these will be deducted from your retained guarantee. -The default rate will be 15% effective soles per year. -The remaining balance withheld after the late payment, compensatory interest discount and the refinancing commission will continue to earn interest The balance to be refinanced will be in dollars with the following characteristics: New term: 24 months Interest rate in dollars: 16% annual nominal, quarterly compounding Modality: equal quarterly installments Refinancing commission: 2% (minimum US$ 400), is also deducted from the withholding. Withholding will now earn an interest rate of 2% effective per year in dollars Additional information: Exchange rate today (refinancing date): 1 dollar = 4.0 soles Additionally, you are asked to determine:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started