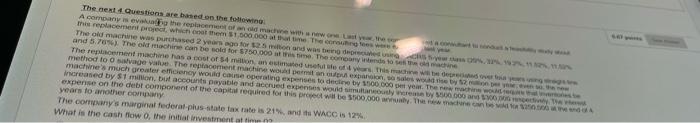

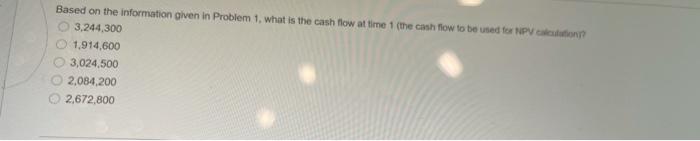

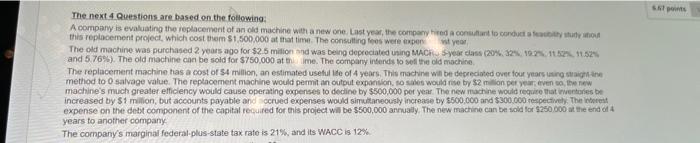

The next Questions are based on the following A company the replace and made with new the the replacement part which colmom 1.000.000 time. There The old mache was purchased 2 years ago for 25 ton and was being de and 570%). The old machine can be sold for 5750.000 at time. The comany Wed to The replacement machine has a coor 4 min med et of Thische were method to Osage The replacement machine was permitan exposals we by machine's much greater efficiency would cause operating expenses to decine by 15000 year. There machine increased by Simon, but accounts payable and accrued experts would not very 00000 expense on the debt component of the capire cuired for this pret wel 500.000 y. The man years to another company The company's marginal federal-plus-state tax rate is 21 and its WACC IS 12% What is the cash flow the initial inwestment Based on the information given in Problem 1. what is the cash flow at time 1 (the cash flow to be used for NPV in 3,244,300 1.914,600 3,024,500 2,084,200 2,672.800 ST The next 4 Questions are based on the following: A company is evaluating the replacement of an old machine with a new one. Last year, the company had a constant to conducts to this replacement project, which cost them $1,500,000 at that time. The consulting fees were per ty The old machine was purchased 2 years ago for $2.5 million and was being depreciated using MAC your class (20% 32,192 1152 and 5.76%). The old machine can be sold for $750,000 at the time. The company intends to set the old machine The replacement machine has a cost of S4 million, an estimated useful life of 4 years. This machine will be depreciated over four years singin method to Osalvage value. The replacement machine would permitan output expansion, so would rise by $2 million per year event machine's much greater elficiency would cause operating expenses to decline by $500,000 per year. The new machine would require that inventores e increased by $1 million, but accounts payable and ccrued expenses would simultaneously increase by $500,000 and $300.000 respectively. The hot expense on the debt component of the capital required for this project will be $500,000 annually. The new machine can be sold for $250.000 at the end of 4 years to another company The company's marginal federal-plus-state tax rate is 21%, and its WACC is 12%