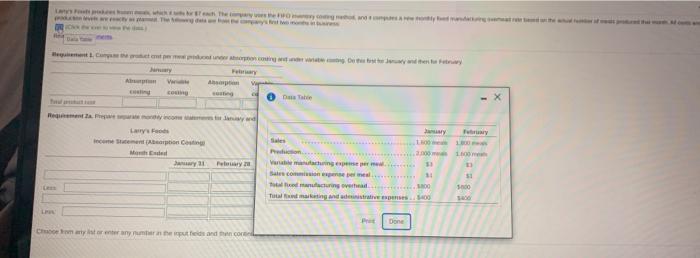

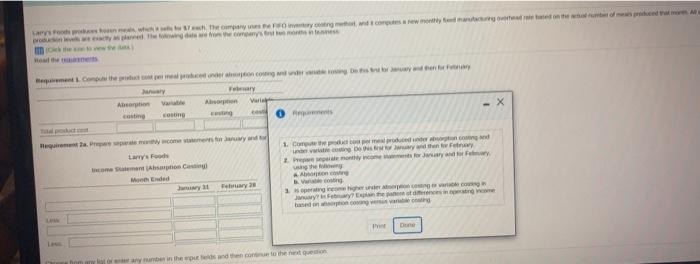

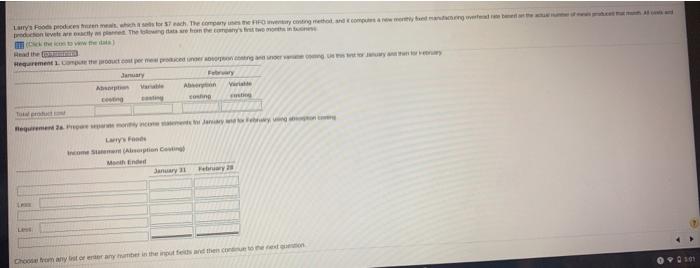

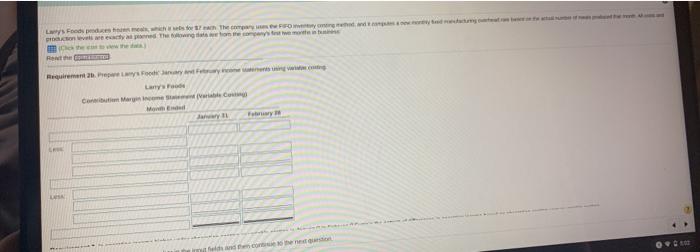

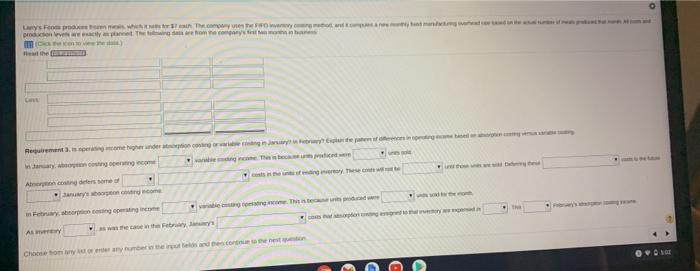

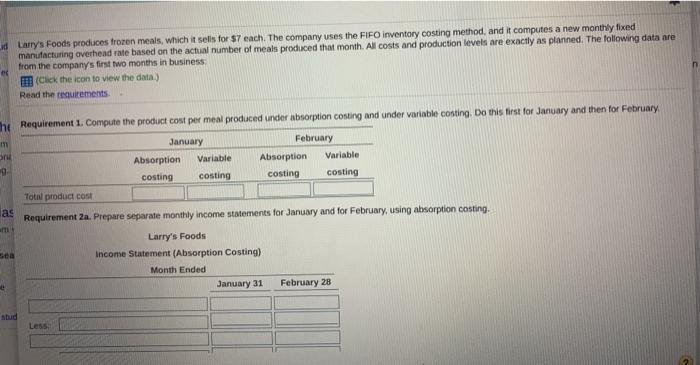

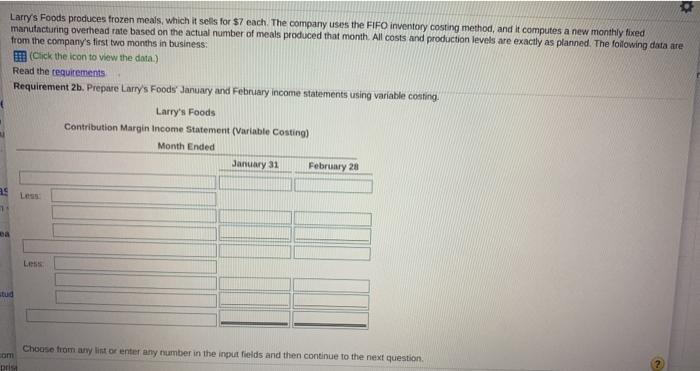

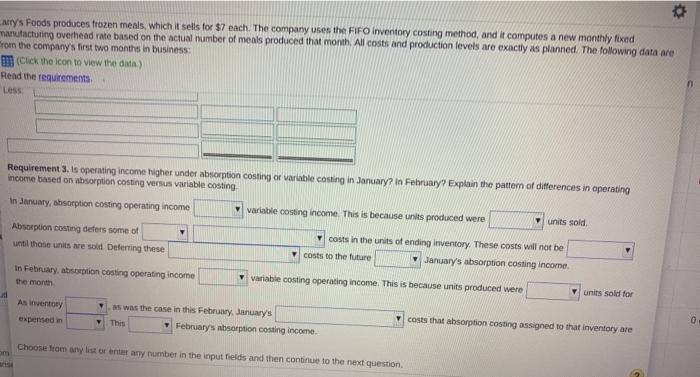

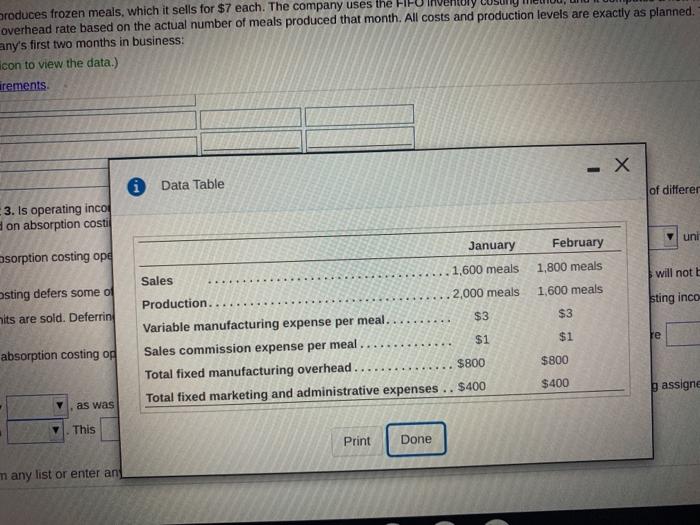

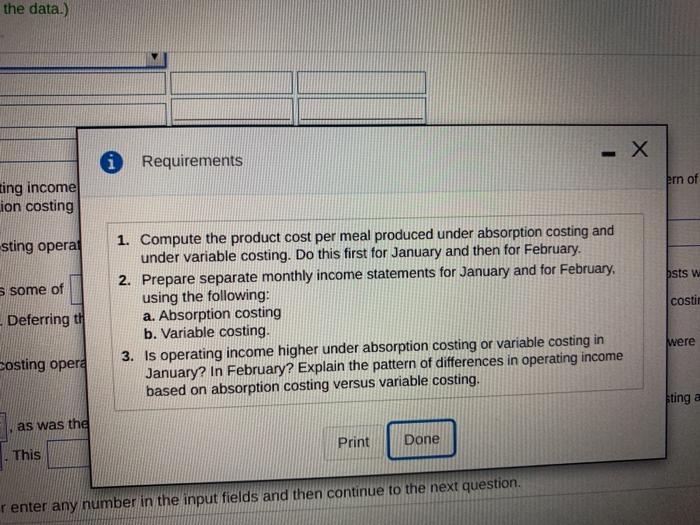

- The Pary co 0 Date La Fe comment Month wy Sales Pion Wenger 1 31 Targova 51 1000 Done Charly any need and encore Landwich the many rynd commentform vous men i themelor way Vary Os Remmen 1. Comprend Lay's w stron www Alpin remont colorowy Ended An Fery ng mga Feminine based once D way the sad to the que La procesor ach the company recomwa rechenlevet the bottom stoww the Heurement. The outcome precedeng way January AD Tone me why Layo Stationen ME January Chromater aber in the route encontro 00101 Law Foods podem Thema For vya Theme Reg. For Las Cut Mrs (ate 0 O Laws op Themes propostes Dow) Le . Buyong come my son congerige ASY Chocomary medence INDO id Larry's Foods produces frozen meals, which it sells for $7 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business (Click the icon to view the data) Read the requirements the Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing Do this first for January and then for February m January February Absorption Variable Absorption Variable 9 costing costing costing costing Total product cost as Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing. Larry's Foods Income Statement (Absorption Costing) Month Ended January 31 February 28 Less Larry's Foods produces frozen meals, which it sells for $7 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business (Click the icon to view the data) Read the requirements Requirement 2b. Prepare Larry's Foods January and February income statements using variable costing Larry's Foods Contribution Margin Income Statement (Variable Costing) Month Ended January 31 February 28 as Les Choose from a list or enter any number in the input fields and then continue to the next question Com pris Mry's Foods produces frozen meals, which it sells for $7 each. The company uses the FIFO Inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are From the company's first two months in business m (Click the icon to view the data) Read the requirements Less Requirement 3. is operating income higher under absorption costing or variable costing in January? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing variable costing income. This is because units produced were In January, absorption costing operating income Absorption costing deters some of until those units we sold Deferring these units sold costs in the units of ending inventory. These costs will not be costs to the future January's absorption costing income In February, absorption costing operating income the month variable costing operating income. This is because units produced were units sold for As they as was the case in this February, January's This February's absorption costing income costs that absorption costing assigned to that inventory are 0 Choose from any list or enter any number in the input fields and then continue to the next question Oroduces frozen meals, which it sells for $7 each. The company uses the FL overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. any's first two months in business: icon to view the data.) irements - X * Data Table of differer 3. Is operating inco on absorption costi uni February sorption costing op will not 1,800 meals 1,600 meals osting defers some of sting inco $3 nits are sold. Deferrin January Sales 1,600 meals Production.. 2,000 meals Variable manufacturing expense per meal. $3 Sales commission expense per meal. $1 Total fixed manufacturing overhead. $800 Total fixed marketing and administrative expenses .. $400 $1 absorption costing og $800 $400 assigne as was This Print Done many list or enter an the data.) - X Requirements ern of ting income Lion costing sting operat bsts w s some of costir -Deferring the 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February 2. Prepare separate monthly income statements for January and for February using the following: a. Absorption costing b. Variable costing. 3. Is operating income higher under absorption costing or variable costing in January? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing. were Sosting opera sting a as was the Print Done This renter any number in the input fields and then continue to the next