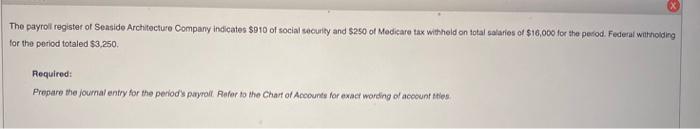

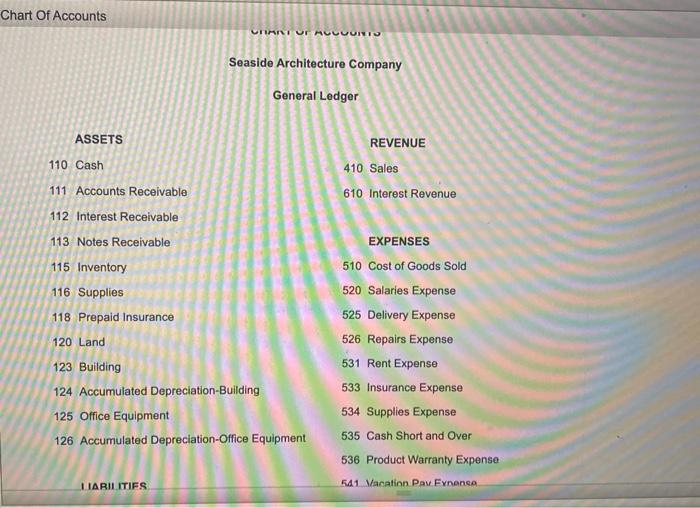

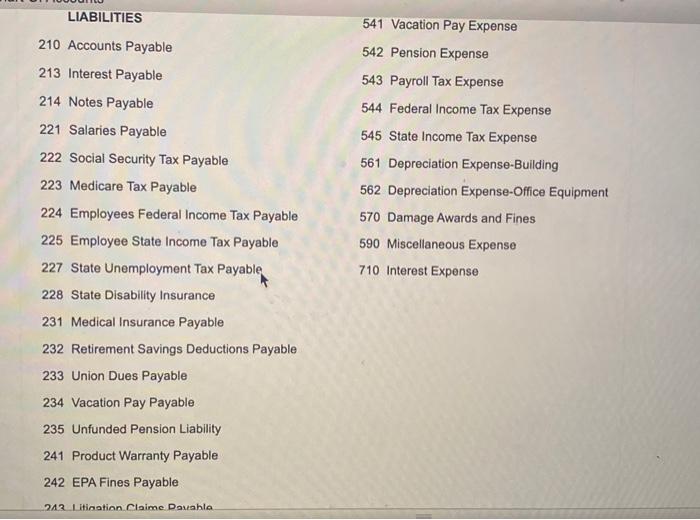

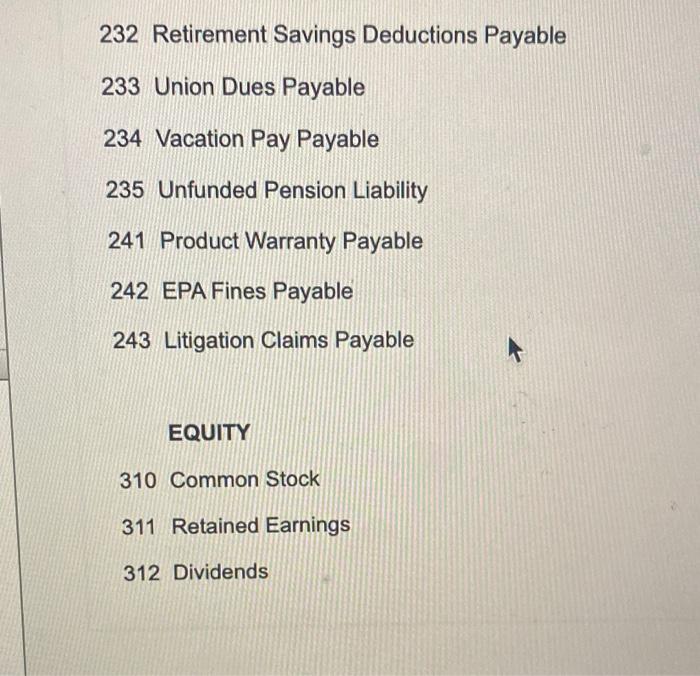

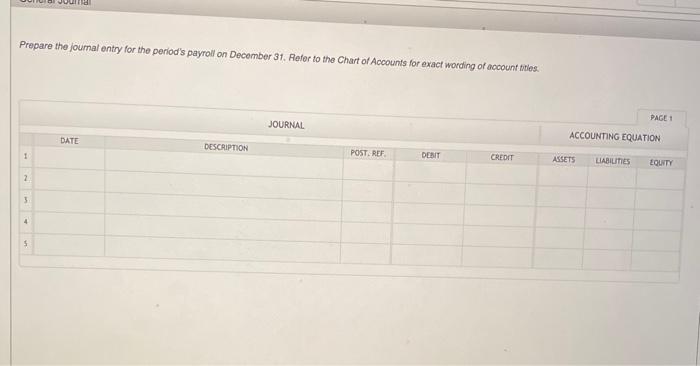

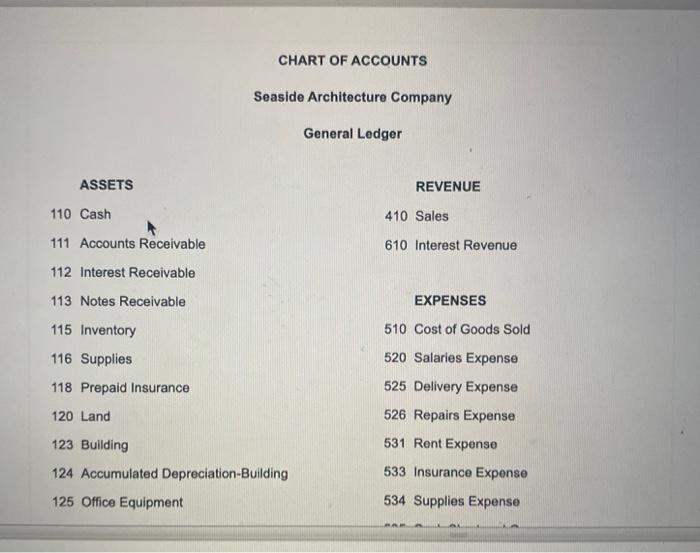

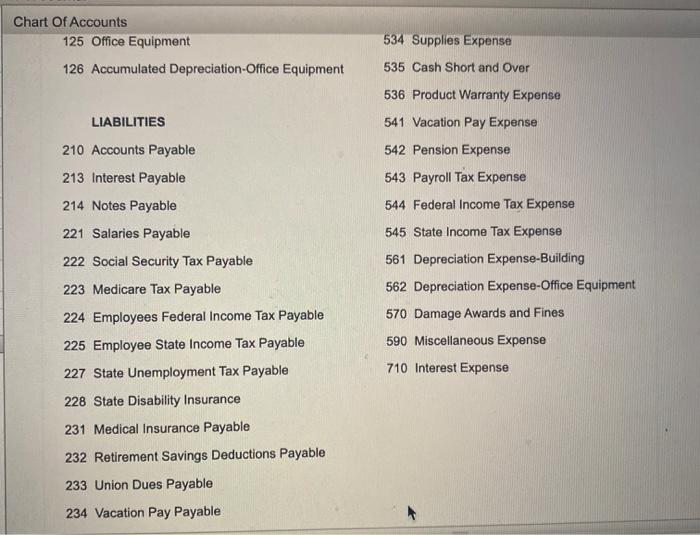

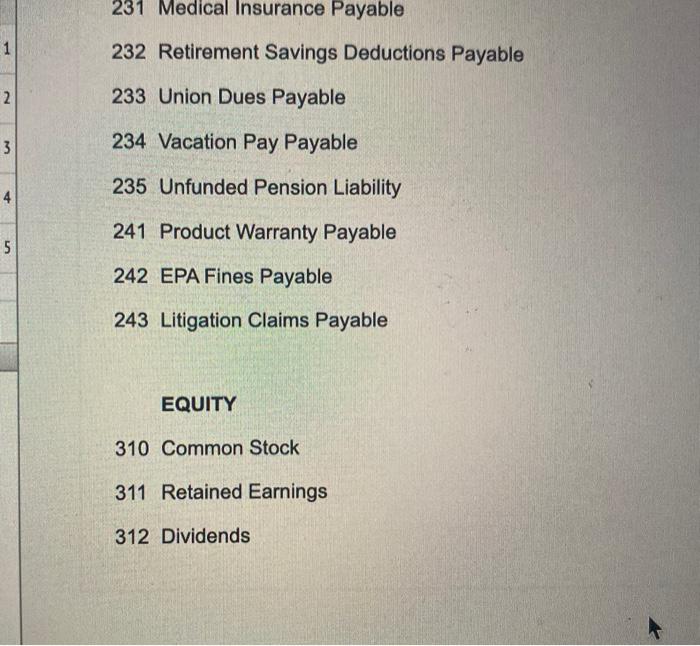

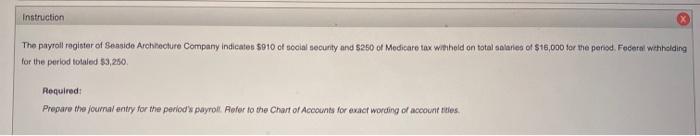

The payroll register of Seaside Architecture Company indicates $0 10 of social security and $250 of Medicare tax withheld on total salaries of $16,000 for the period. Federal witholding for the period totaled $3,250 Required: Prepare the journal entry for the period's payroll Refer to the Chart of Accounts for exact wording of accounts Chart Of Accounts VINNUT RUUUURI Seaside Architecture Company General Ledger ASSETS 110 Cash 111 Accounts Receivable 112 Interest Receivable 113 Notes Receivable 115 Inventory REVENUE 410 Sales 610 Interest Revenue 116 Supplies 118 Prepaid Insurance EXPENSES 510 Cost of Goods Sold 520 Salaries Expense 525 Delivery Expense 526 Repairs Expense 531 Rent Expense 533 Insurance Expense 534 Supplies Expense 120 Land 123 Building 124 Accumulated Depreciation Building 125 Office Equipment 126 Accumulated Depreciation Office Equipment 535 Cash Short and Over 536 Product Warranty Expense LIABILITIES 541 Vacation Pay Fynens LIABILITIES 541 Vacation Pay Expense 542 Pension Expense 543 Payroll Tax Expense 544 Federal Income Tax Expense 210 Accounts Payable 213 Interest Payable 214 Notes Payable 221 Salaries Payable 222 Social Security Tax Payable 223 Medicare Tax Payable 224 Employees Federal Income Tax Payable 225 Employee State Income Tax Payable 227 State Unemployment Tax Payable 228 State Disability Insurance 231 Medical Insurance Payable 232 Retirement Savings Deductions Payable 233 Union Dues Payable 545 State Income Tax Expense 561 Depreciation Expense-Building 562 Depreciation Expense-Office Equipment 570 Damage Awards and Fines 590 Miscellaneous Expense 710 Interest Expense 234 Vacation Pay Payable 235 Unfunded Pension Liability 241 Product Warranty Payable 242 EPA Fines Payable 242 Litination Claime Douabla 232 Retirement Savings Deductions Payable 233 Union Dues Payable 234 Vacation Pay Payable 235 Unfunded Pension Liability 241 Product Warranty Payable 242 EPA Fines Payable 243 Litigation Claims Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Prepare the journal entry for the period's payroll on December 31. Refer to the Chart of Accounts for exact wording of account bles. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION 1 POST. REF DESIT CREDIT ASSETS LIABILITIES ZQUITY 2 3 4 5 CHART OF ACCOUNTS Seaside Architecture Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Accounts Receivable 610 Interest Revenue 112 Interest Receivable 113 Notes Receivable EXPENSES 510 Cost of Goods Sold 115 Inventory 116 Supplies 118 Prepaid Insurance 120 Land 520 Salaries Expense 525 Delivery Expense 526 Repairs Expense 531 Rent Expense 533 Insurance Expense 534 Supplies Expense 123 Building 124 Accumulated Depreciation-Building 125 Office Equipment Prepare the journal entry for the period's payroll on December 31. Refer to the Chart of Accounts for exact wording of account bles. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION 1 POST. REF DESIT CREDIT ASSETS LIABILITIES ZQUITY 2 3 4 5 231 Medical Insurance Payable 1 232 Retirement Savings Deductions Payable 2 233 Union Dues Payable 3 234 Vacation Pay Payable 235 Unfunded Pension Liability 4 241 Product Warranty Payable 5 242 EPA Fines Payable 243 Litigation Claims Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Instruction The payroll register of Seaside Architecture Company indicates $010 of social security and $250 of Medicare tax winhold on total salaries of $15,000 for me period. Federal whholding for the period totaled $3,250. Required: Prepare the journal entry for the period payrolRefer to the Chart of Accounts for exact wording of account titles