Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The product development department of Anfield Limited is contemplating renting a factory building on a four-year lease from the 1 April 2021, and investing

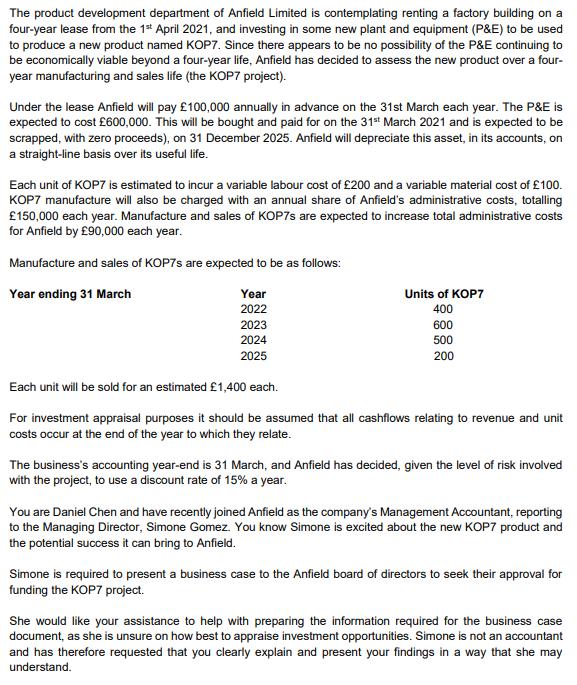

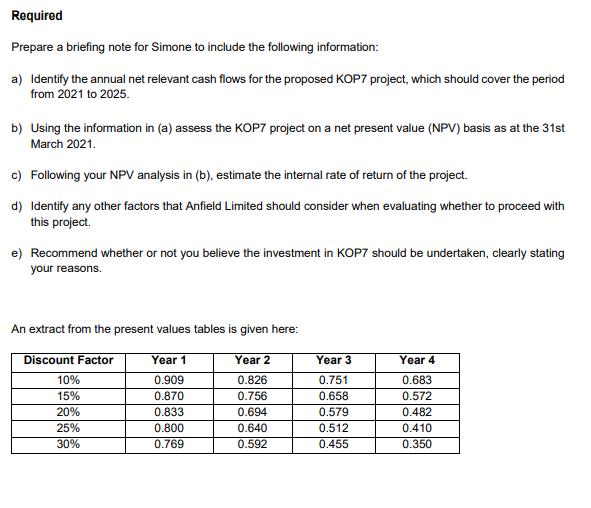

The product development department of Anfield Limited is contemplating renting a factory building on a four-year lease from the 1 April 2021, and investing in some new plant and equipment (P&E) to be used to produce a new product named KOP7. Since there appears to be no possibility of the P&E continuing to be economically viable beyond a four-year life, Anfield has decided to assess the new product over a four- year manufacturing and sales life (the KOP7 project). Under the lease Anfield will pay 100,000 annually in advance on the 31st March each year. The P&E is expected to cost 600,000. This will be bought and paid for on the 31t March 2021 and is expected to be scrapped, with zero proceeds), on 31 December 2025. Anfield will depreciate this asset, in its accounts, on a straight-line basis over its useful life. Each unit of KOP7 is estimated to incur a variable labour cost of 200 and a variable material cost of 100. KOP7 manufacture will also be charged with an annual share of Anfield's administrative costs, totalling 150,000 each year. Manufacture and sales of KOP7S are expected to increase total administrative costs for Anfield by 90,000 each year. Manufacture and sales of KOP7S are expected to be as follows: Year ending 31 March Year Units of KOP7 2022 400 2023 600 2024 500 2025 200 Each unit will be sold for an estimated 1,400 each. For investment appraisal purposes it should be assumed that all cashflows relating to revenue and unit costs occur at the end of the year to which they relate. The business's accounting year-end is 31 March, and Anfield has decided, given the level of risk involved with the project, to use a discount rate of 15% a year. You are Daniel Chen and have recently joined Anfield as the company's Management Accountant, reporting to the Managing Director, Simone Gomez. You know Simone is excited about the new KOP7 product and the potential success it can bring to Anfield. Simone is required to present a business case to the Anfield board of directors to seek their approval for funding the KOP7 project. She would like your assistance to help with preparing the information required for the business case document, as she is unsure on how best to appraise investment opportunities. Simone is not an accountant and has therefore requested that you clearly explain and present your findings in a way that she may understand. Required Prepare a briefing note for Simone to include the following information: a) Identify the annual net relevant cash flows for the proposed KOP7 project, which should cover the period from 2021 to 2025. b) Using the information in (a) assess the KOP7 project on a net present value (NPV) basis as at the 31st March 2021. c) Following your NPV analysis in (b), estimate the internal rate of return of the project. d) Identify any other factors that Anfield Limited should consider when evaluating whether to proceed with this project. e) Recommend whether or not you believe the investment in KOP7 should be undertaken, clearly stating your reasons. An extract from the present values tables is given here: Discount Factor Year 1 Year 2 Year 3 Year 4 10% 0.909 0.826 0.751 0.683 15% 0.870 0.756 0.658 0.572 20% 0.833 0.694 0.579 0.482 25% 0.800 0.640 0.512 0.410 30% 0.769 0.592 0.455 0.350

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Dalglish Plc Investment Apprisal We are not considering part of the allocation of share of Buisness ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started