The production and CAPEX spent for Sepat Oil Field development are shown in TABLE Q1a. The company projected that the OPEX will be constantly at

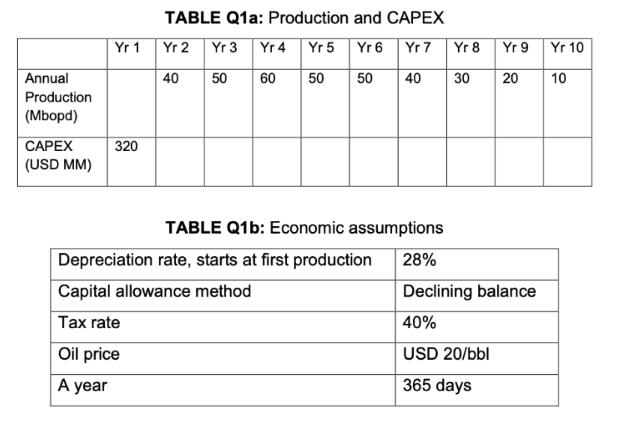

The production and CAPEX spent for Sepat Oil Field development are shown in TABLE Q1a. The company projected that the OPEX will be constantly at USD 20 MM per year starting when the first production occur. The capital allowance is to be claimed in full amount in the last production year. Compute the before tax net cash flow (BTNCF) and the after tax net cash flow (ATNCF). TABLE Q1b shows the assumptions that the company use for the cashflow analysis.

Annual Production (Mbopd) CAPEX (USD MM) Yr 1 320 TABLE Q1a: Production and CAPEX Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 40 50 60 50 50 40 TABLE Q1b: Economic assumptions Depreciation rate, starts at first production Capital allowance method Tax rate Oil price A year Yr 8 30 Yr 9 20 28% Declining balance 40% USD 20/bbl 365 days Yr 10 10

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To compute the beforetax net cash flow BTNCF and the aftertax net cash flow ATNCF we need to conside...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started