Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is alot but I cannot post it one by one since its all linked together. I appreciate your help. Thank you so much!

The question is alot but I cannot post it one by one since its all linked together.

I appreciate your help.

Thank you so much!

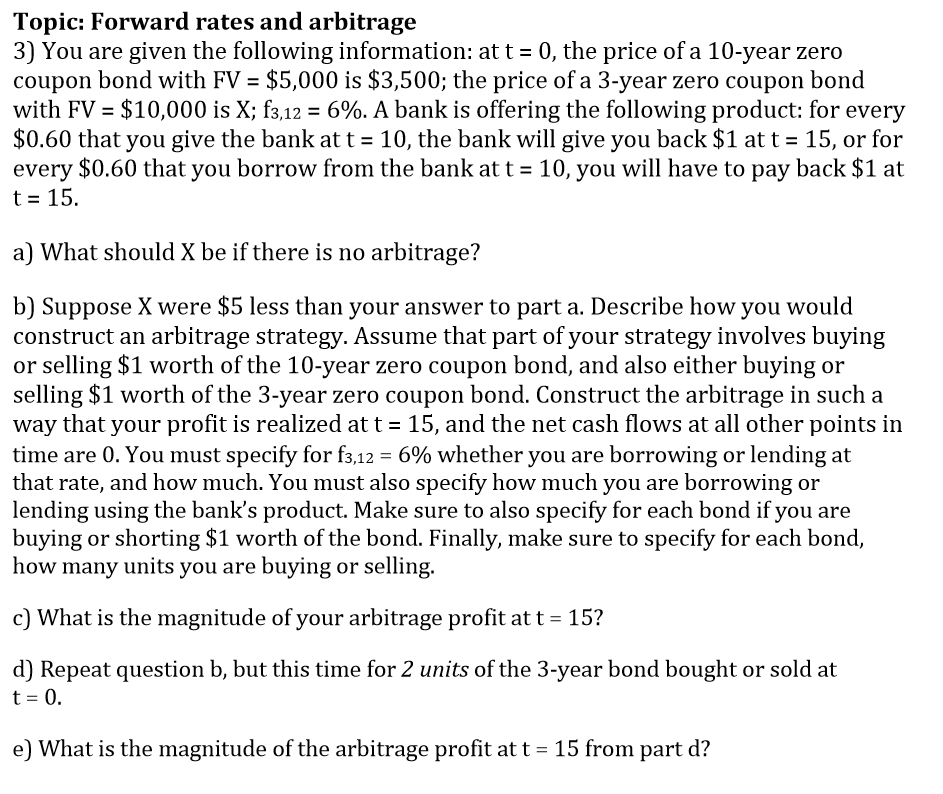

Topic: Forward rates and arbitrage 3 You are given the following information: att 0, the price of a 10-year zero coupon bond with FV $5,000 is $3,500; the price of a 3-year zero coupon bond with FV-$10,000 is X; f3,12 6%. A bank is offering the following product: for every $0.60 that you give the bank at t 10, the bank will give you back $1 at t 15, or for every $0.60 that you borrow from the bank at t 10, you will have to pay back $1 at a) What should X be if there is no arbitrage? b) Suppose X were $5 less than your answer to part a. Describe how you would construct an arbitrage strategy. Assume that part of your strategy involves buying or selling $1 worth of the 10-year zero coupon bond, and also either buying or selling $1 worth of the 3-year zero coupon bond. Construct the arbitrage in such a way that your profit is realized at t 15, and the net cash flows at all other points in time are 0. You must specify for f3,12 6% whether you are borrowing or lending at that rate, and how much. You must also specify how much you are borrowing or lending using the bank's product. Make sure to also specify for each bond if you are buying or shorting $1 worth of the bond. Finally, make sure to specify for each bond how many units you are buying or selling. c) What is the magnitude of your arbitrage profit att 15? d) Repeat question b, but this time for 2 units of the 3-year bond bought or sold at e) What is the magnitude of the arbitrage profit at t 15 from part d? Topic: Forward rates and arbitrage 3 You are given the following information: att 0, the price of a 10-year zero coupon bond with FV $5,000 is $3,500; the price of a 3-year zero coupon bond with FV-$10,000 is X; f3,12 6%. A bank is offering the following product: for every $0.60 that you give the bank at t 10, the bank will give you back $1 at t 15, or for every $0.60 that you borrow from the bank at t 10, you will have to pay back $1 at a) What should X be if there is no arbitrage? b) Suppose X were $5 less than your answer to part a. Describe how you would construct an arbitrage strategy. Assume that part of your strategy involves buying or selling $1 worth of the 10-year zero coupon bond, and also either buying or selling $1 worth of the 3-year zero coupon bond. Construct the arbitrage in such a way that your profit is realized at t 15, and the net cash flows at all other points in time are 0. You must specify for f3,12 6% whether you are borrowing or lending at that rate, and how much. You must also specify how much you are borrowing or lending using the bank's product. Make sure to also specify for each bond if you are buying or shorting $1 worth of the bond. Finally, make sure to specify for each bond how many units you are buying or selling. c) What is the magnitude of your arbitrage profit att 15? d) Repeat question b, but this time for 2 units of the 3-year bond bought or sold at e) What is the magnitude of the arbitrage profit at t 15 from part dStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started