Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question is from international financial market **PLEASE ANSWER WITHIN 1 HOUR** this is a single questions with A,B,C,D,E... so I can't make it pieces

The question is from international financial market **PLEASE ANSWER WITHIN 1 HOUR**

this is a single questions with A,B,C,D,E... so I can't make it pieces

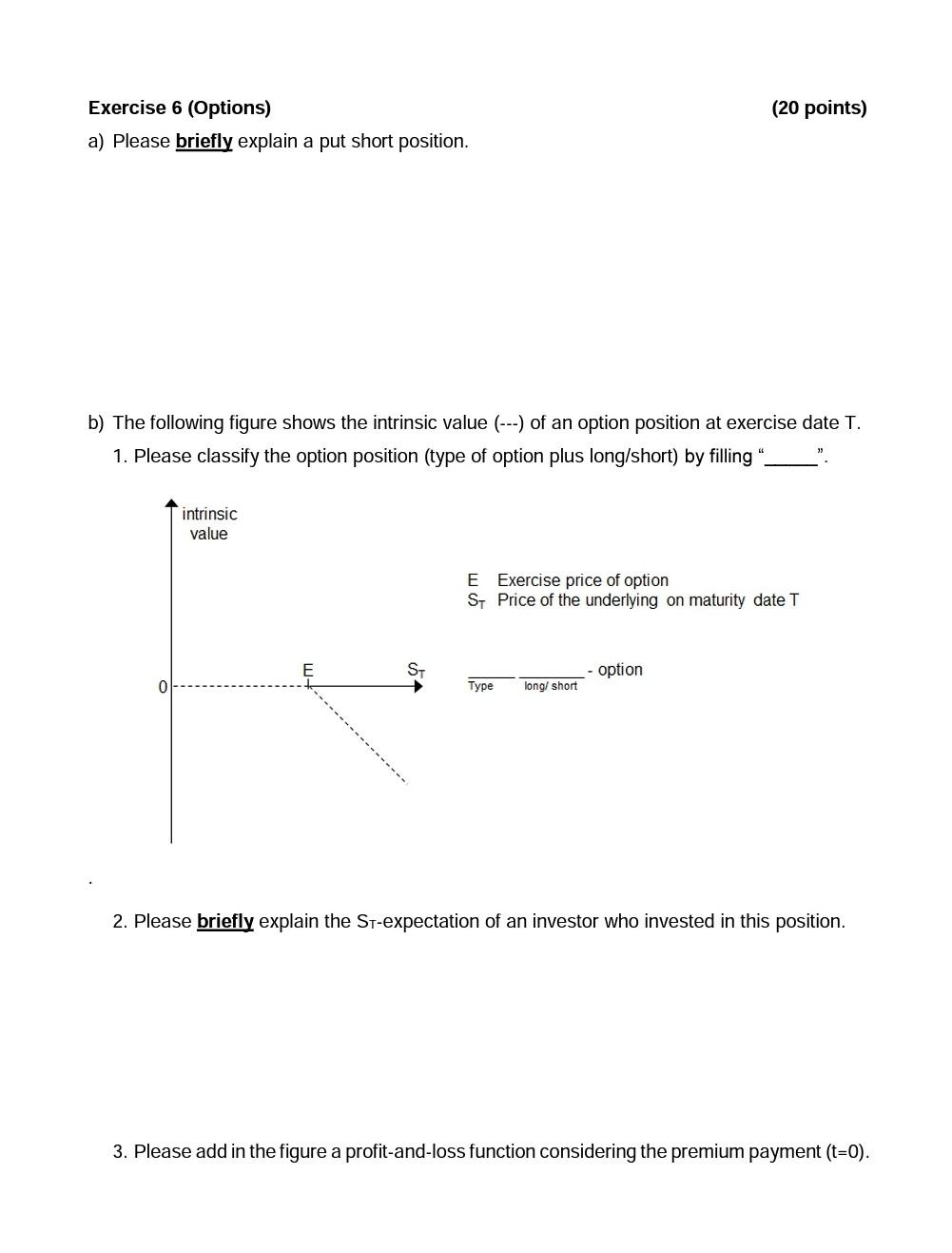

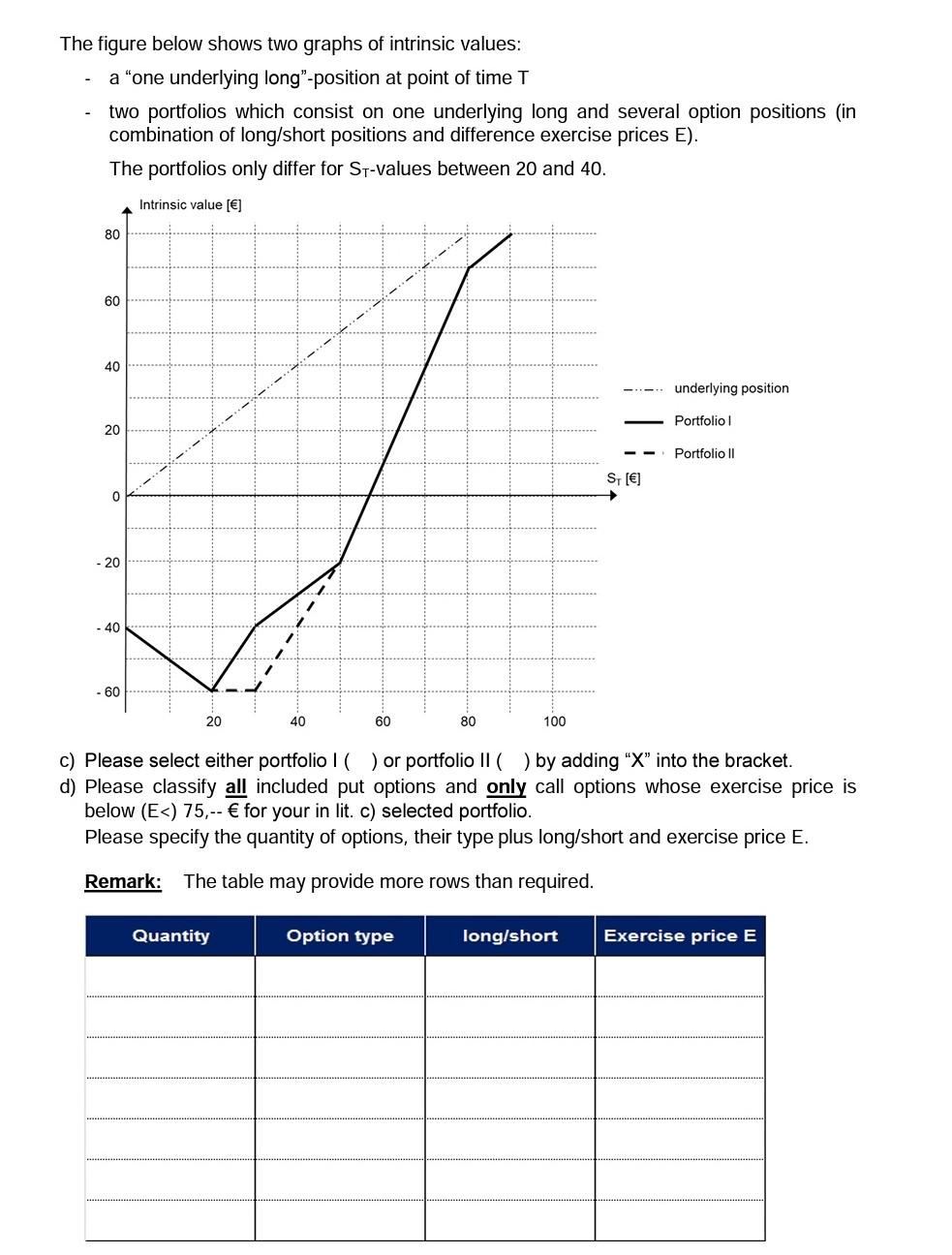

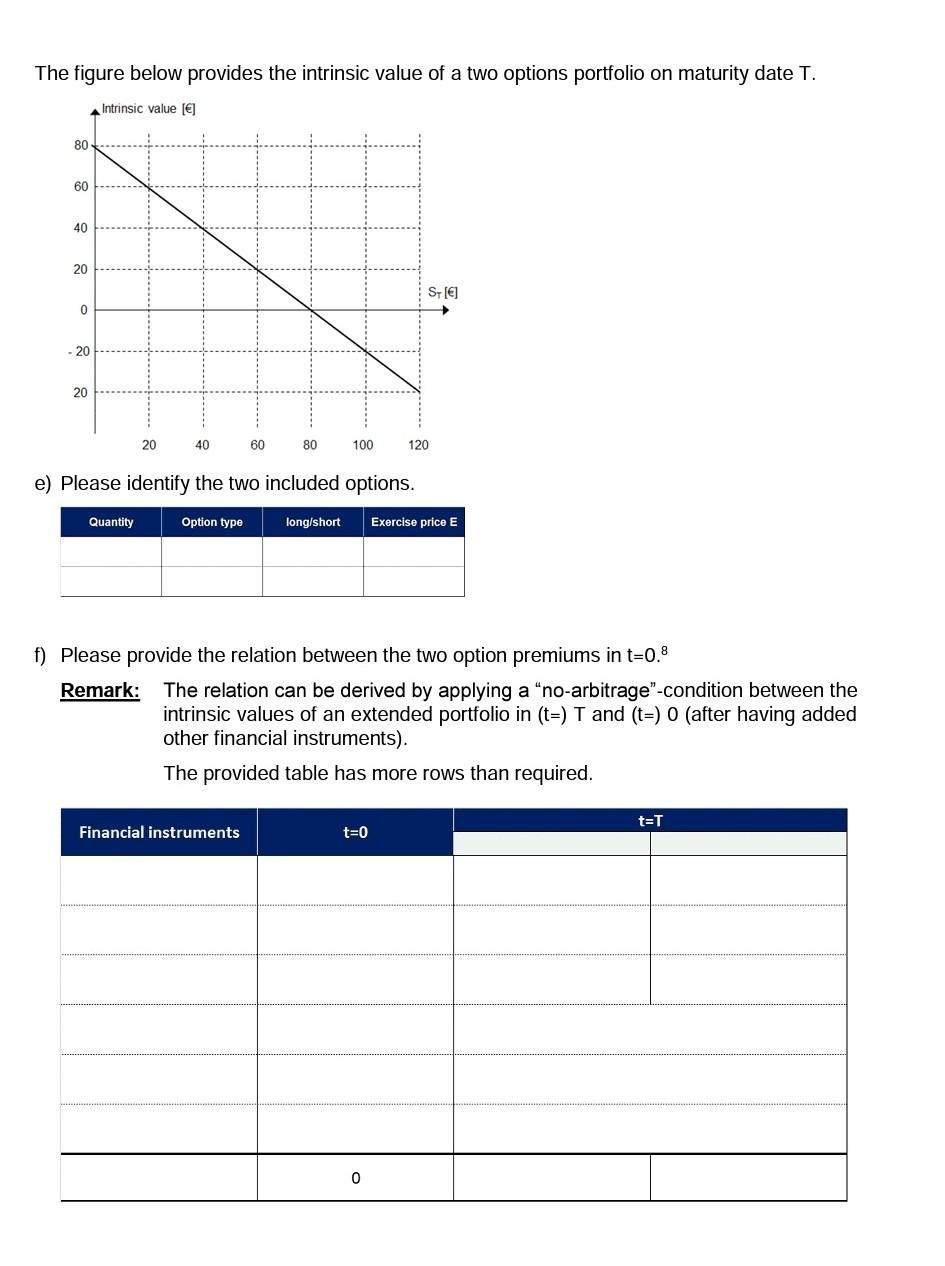

(20 points) Exercise 6 (Options) a) Please briefly explain a put short position. b) The following figure shows the intrinsic value (---) of an option position at exercise date T. 1. Please classify the option position (type of option plus long/short) by filling intrinsic value E Exercise price of option ST Price of the underlying on maturity date T ST option 0 Type long/ short 2. Please briefly explain the St-expectation of an investor who invested in this position. 3. Please add in the figure a profit-and-loss function considering the premium payment (t=0). The figure below shows two graphs of intrinsic values: a "one underlying long"-position at point of time T two portfolios which consist on one underlying long and several option positions in combination of long/short positions and difference exercise prices E). The portfolios only differ for St-values between 20 and 40. Intrinsic value [] 80 60 40 underlying position Portfolio 20 Portfolio II ST[] 0 - 20 40 - 60 20 40 60 80 100 c) Please select either portfolio I ( ) or portfolio II ( ) by adding X into the bracket. d) Please classify all included put options and only call options whose exercise price is below (EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started