Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the questions with their answer sheets MODULE 4 - SHORT TERM BUSINESS DECISIONS. QUESTION 1 - MAKE OR BUY DECISION Gibbs Company purchases sails and

the questions with their answer sheets

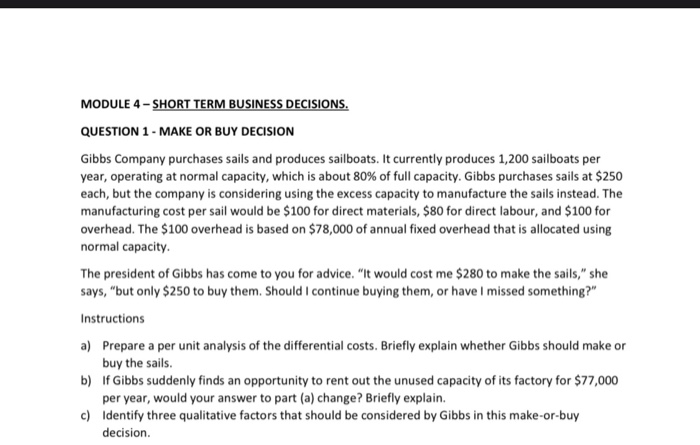

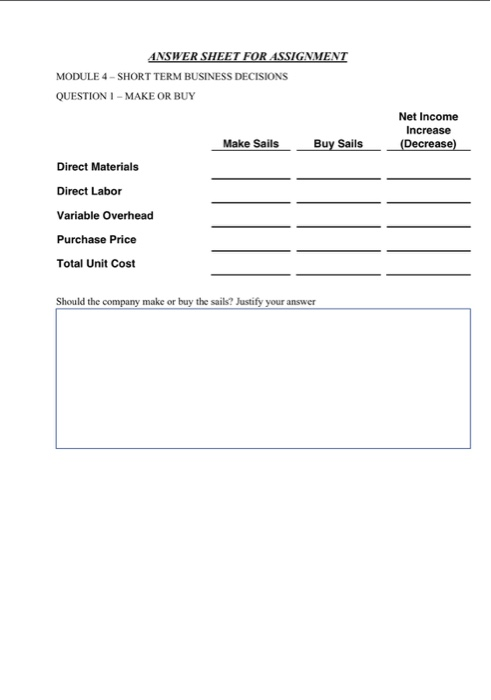

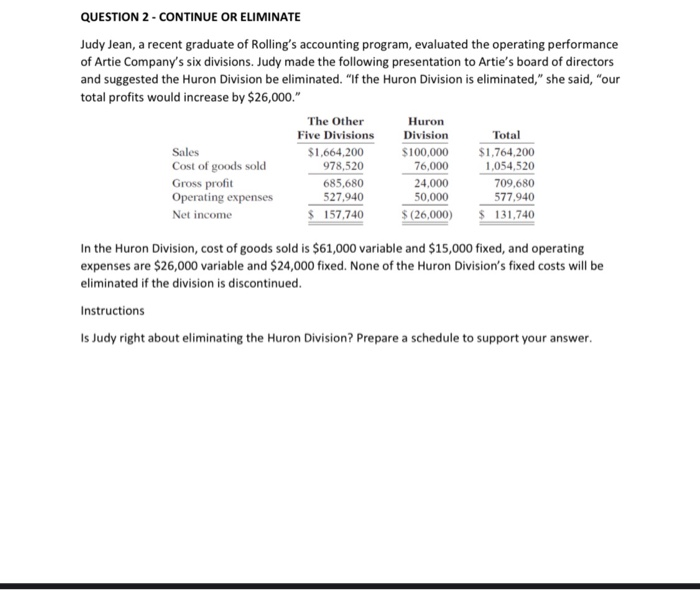

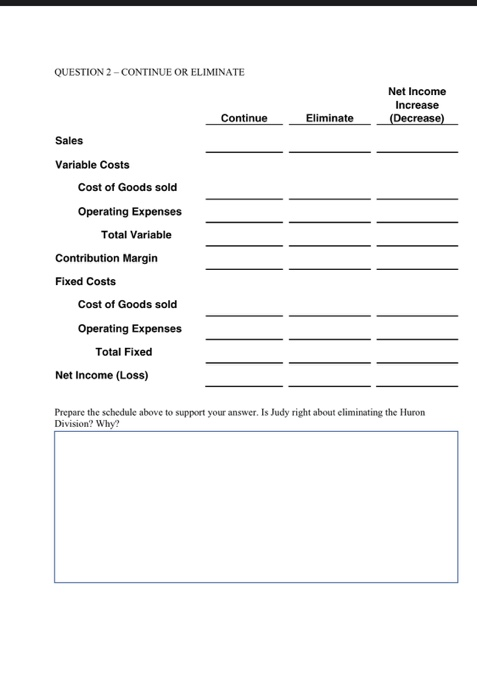

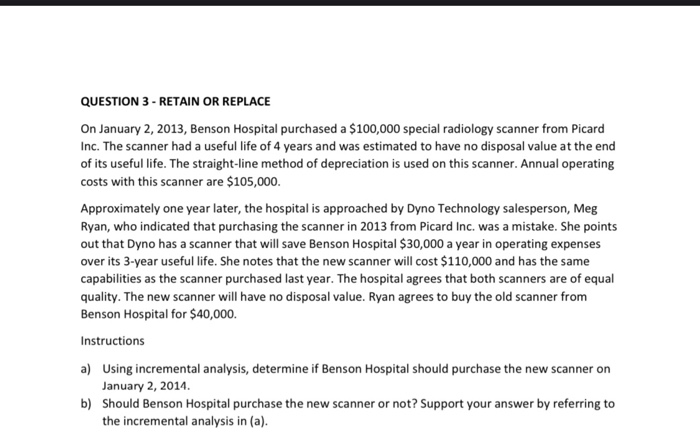

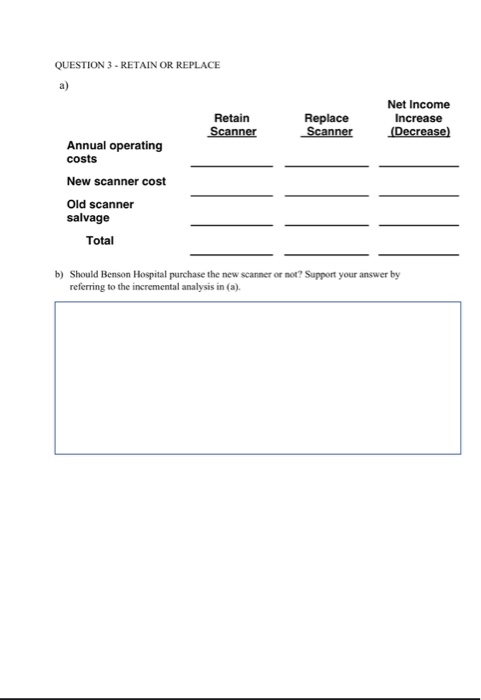

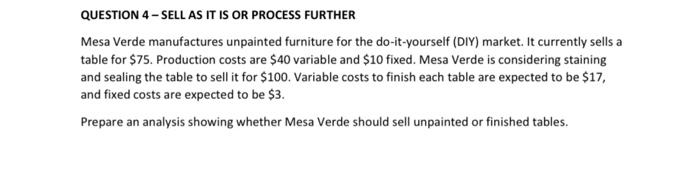

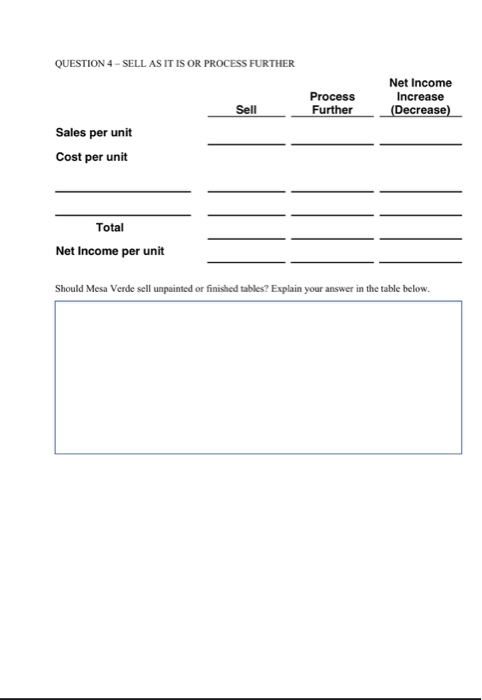

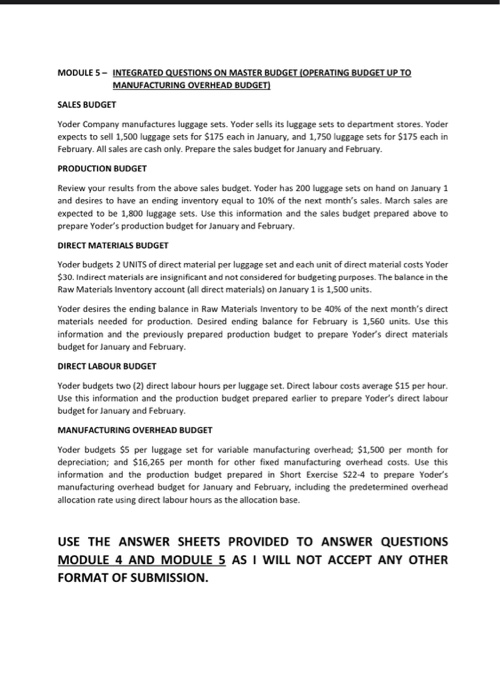

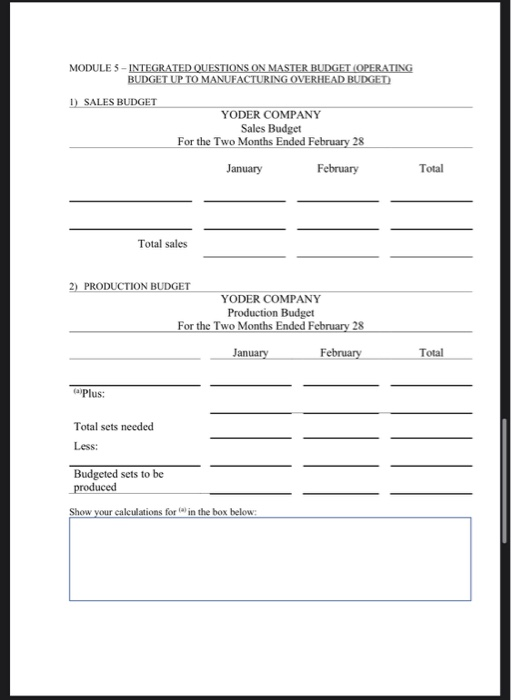

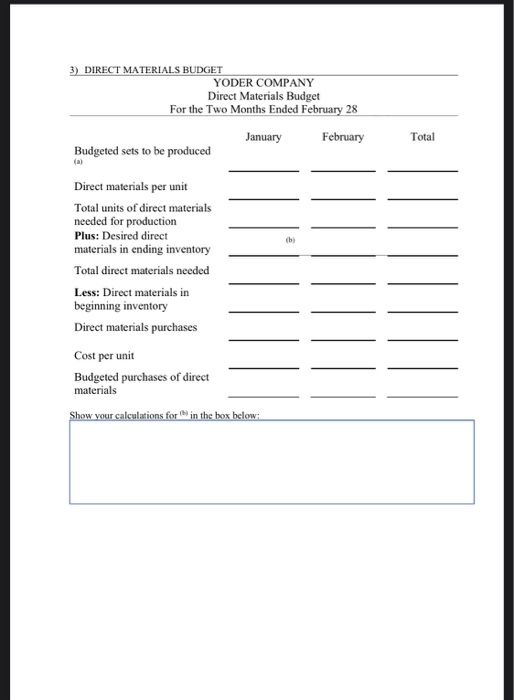

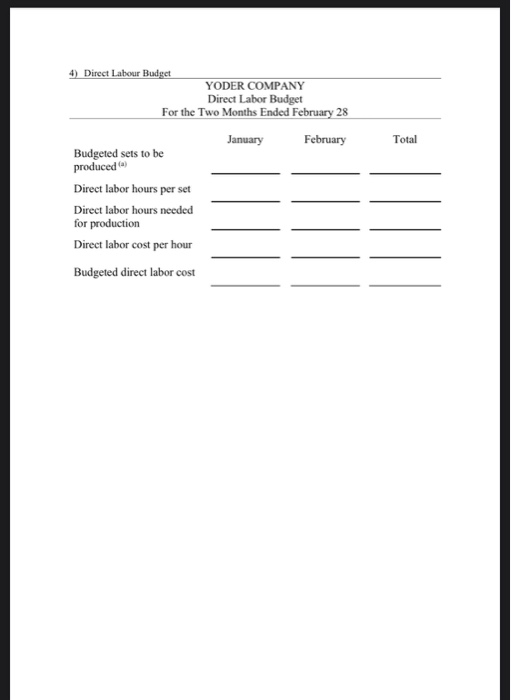

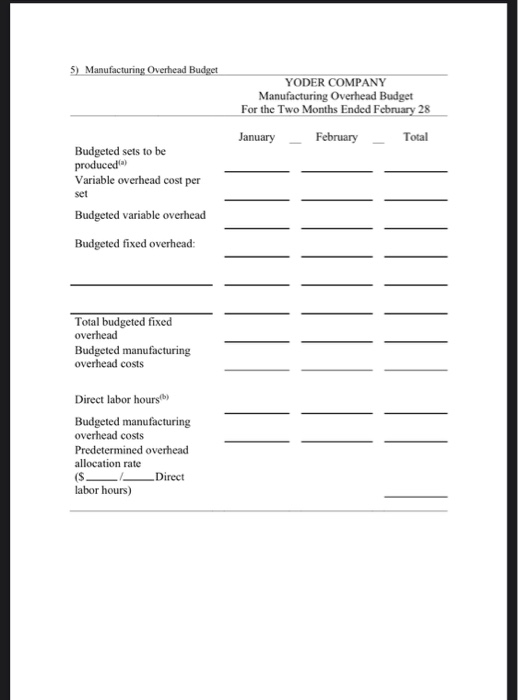

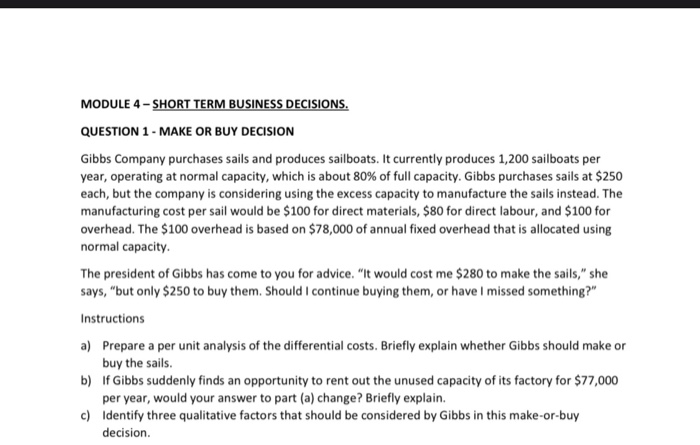

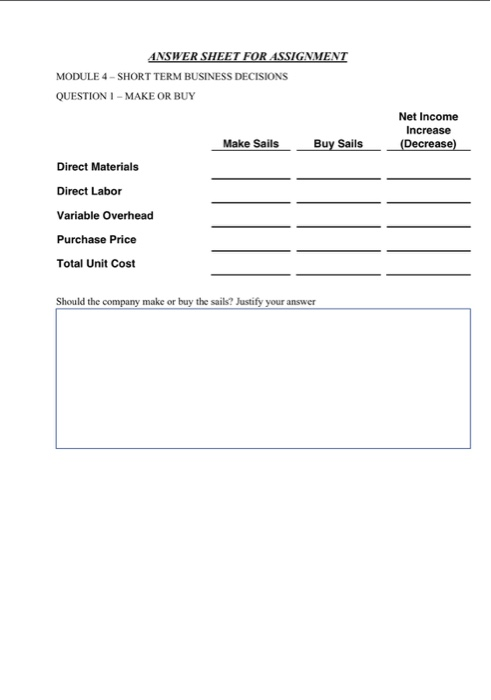

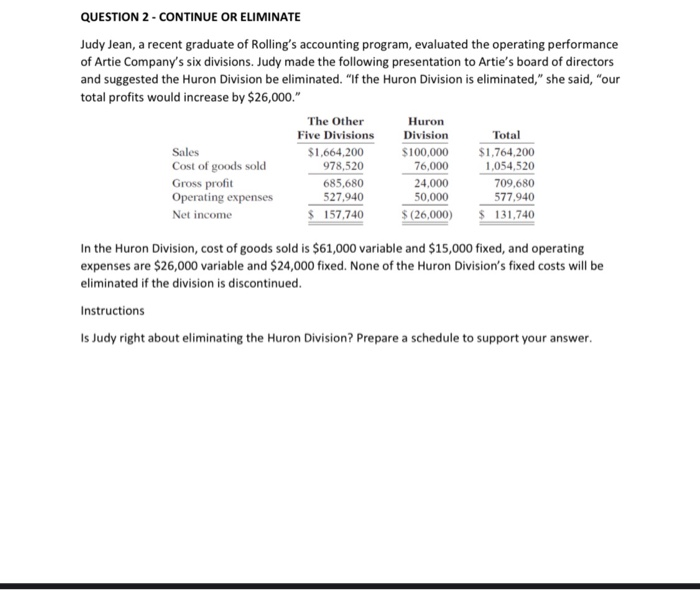

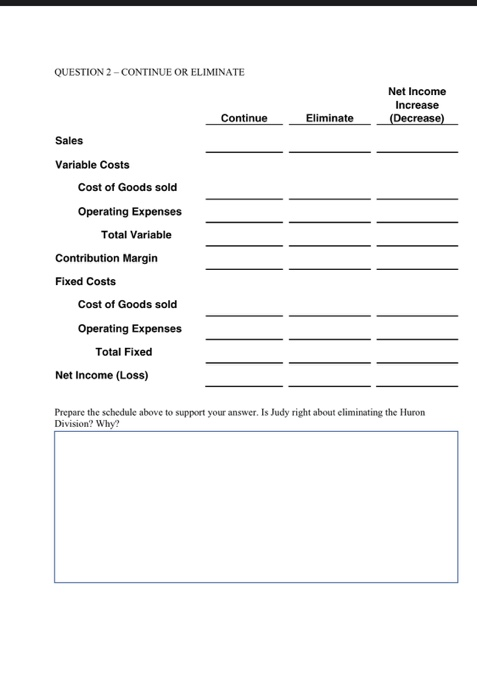

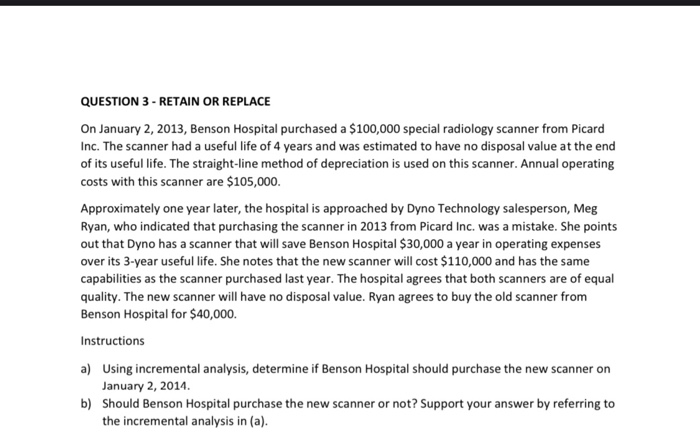

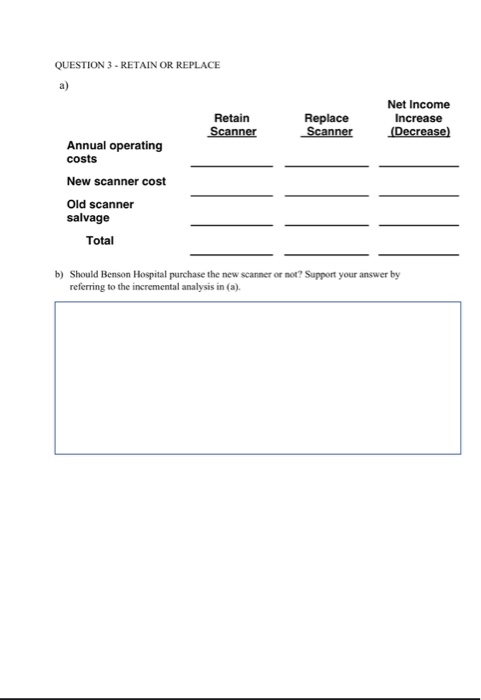

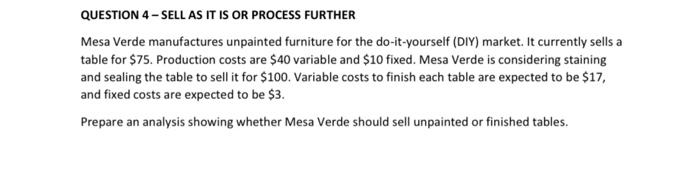

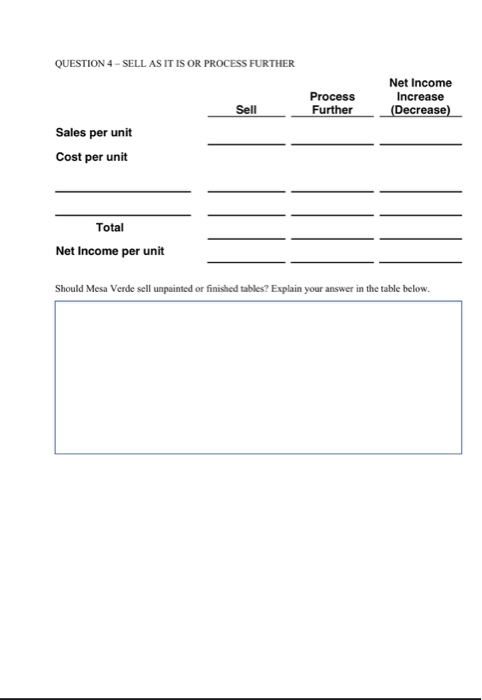

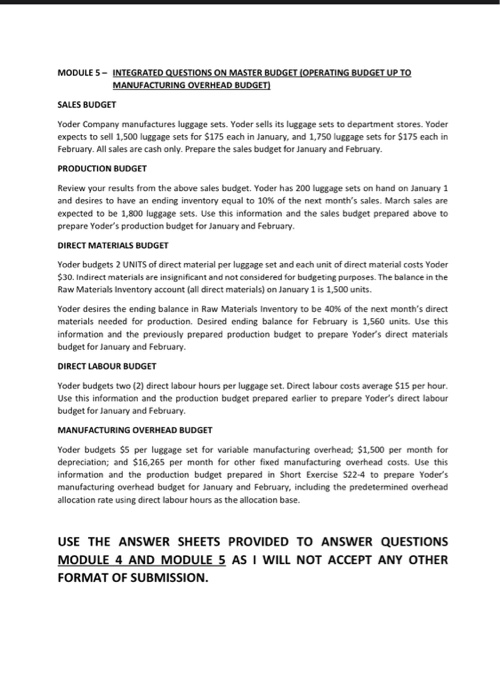

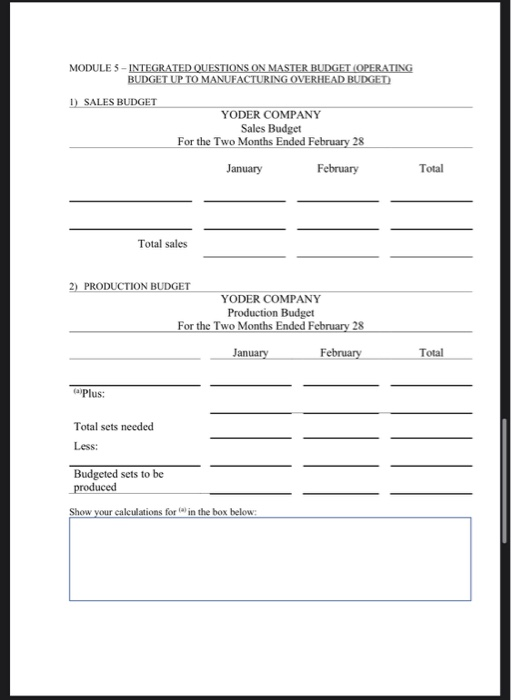

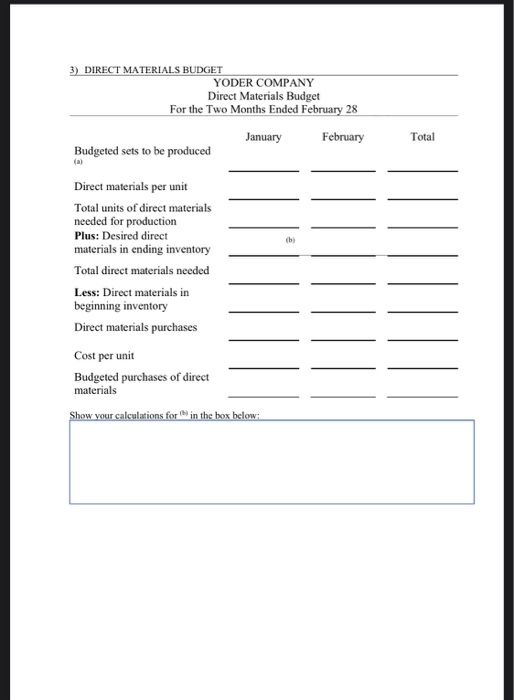

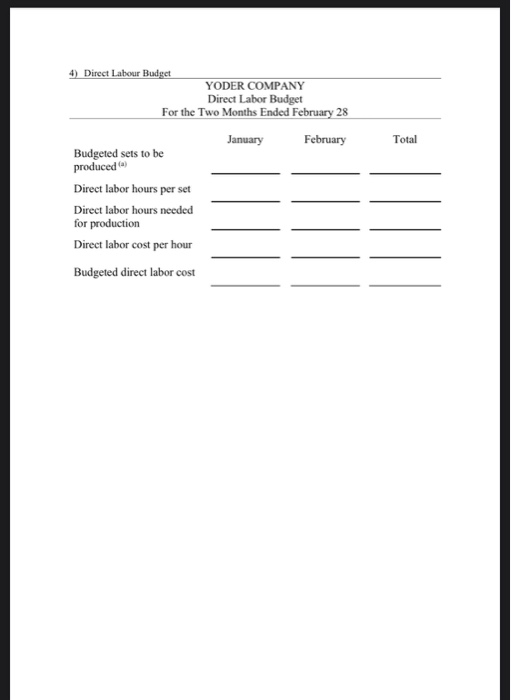

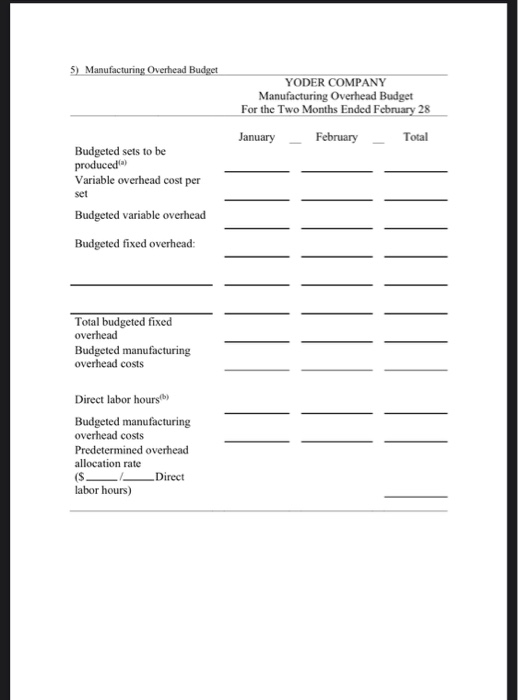

MODULE 4 - SHORT TERM BUSINESS DECISIONS. QUESTION 1 - MAKE OR BUY DECISION Gibbs Company purchases sails and produces sailboats. It currently produces 1,200 sailboats per year, operating at normal capacity, which is about 80% of full capacity. Gibbs purchases sails at $250 each, but the company is considering using the excess capacity to manufacture the sails instead. The manufacturing cost per sail would be $100 for direct materials, $80 for direct labour, and $100 for overhead. The $100 overhead is based on $78,000 of annual fixed overhead that is allocated using normal capacity The president of Gibbs has come to you for advice. "It would cost me $280 to make the sails," she says, "but only $250 to buy them. Should I continue buying them, or have I missed something?" Instructions a) Prepare a per unit analysis of the differential costs. Briefly explain whether Gibbs should make or buy the sails. b) If Gibbs suddenly finds an opportunity to rent out the unused capacity of its factory for $77,000 per year, would your answer to part (a) change? Briefly explain. c) Identify three qualitative factors that should be considered by Gibbs in this make-or-buy decision. ANSWER SHEET FOR ASSIGNMENT MODULE 4 - SHORT TERM BUSINESS DECISIONS QUESTIONI - MAKE OR BUY Net Income Increase (Decrease) Make Sails Buy Sails Direct Materials Direct Labor Variable Overhead Purchase Price Total Unit Cost Should the company make or buy the sails? Justify your answer QUESTION 2 - CONTINUE OR ELIMINATE Judy Jean, a recent graduate of Rolling's accounting program, evaluated the operating performance of Artie Company's six divisions. Judy made the following presentation to Artie's board of directors and suggested the Huron Division be eliminated. "If the Huron Division is eliminated," she said, "our total profits would increase by $26,000." Sales Cost of goods sold Gross profit Operating expenses Net income The Other Five Divisions $1,664,200 978,520 685,680 527,940 $ 157,740 Huron Division $100,000 76.000 24,000 50,000 $(26,000) Total $1,764,200 1,054,520 709,680 577,940 $ 131,740 In the Huron Division, cost of goods sold is $61,000 variable and $15,000 fixed, and operating expenses are $26,000 variable and $24,000 fixed. None of the Huron Division's fixed costs will be eliminated if the division is discontinued. Instructions Is Judy right about eliminating the Huron Division? Prepare a schedule to support your answer. QUESTION 2 - CONTINUE OR ELIMINATE Net Income Increase (Decrease) Continue Eliminate Sales Variable Costs Cost of Goods sold Operating Expenses Total Variable Contribution Margin Fixed Costs Cost of Goods sold Operating Expenses Total Fixed Net Income (Loss) Prepare the schedule above to support your answer. Is Judy right about eliminating the Huron Division? Why? QUESTION 3 - RETAIN OR REPLACE On January 2, 2013, Benson Hospital purchased a $100,000 special radiology scanner from Picard Inc. The scanner had a useful life of 4 years and was estimated to have no disposal value at the end of its useful life. The straight-line method of depreciation is used on this scanner. Annual operating costs with this scanner are $105,000. Approximately one year later, the hospital is approached by Dyno Technology salesperson, Meg Ryan, who indicated that purchasing the scanner in 2013 from Picard Inc. was a mistake. She points out that Dyno has a scanner that will save Benson Hospital $30,000 a year in operating expenses over its 3-year useful life. She notes that the new scanner will cost $110,000 and has the same capabilities as the scanner purchased last year. The hospital agrees that both scanners are of equal quality. The new scanner will have no disposal value. Ryan agrees to buy the old scanner from Benson Hospital for $40,000. Instructions a) Using incremental analysis, determine if Benson Hospital should purchase the new scanner on January 2, 2014 b) Should Benson Hospital purchase the new scanner or not? Support your answer by referring to the incremental analysis in (a). QUESTION 3 - RETAIN OR REPLACE Retain Scanner Replace Scanner Net Income Increase (Decrease) Annual operating costs New scanner cost Old scanner salvage Total b) Should Benson Hospital purchase the new scanner or not? Support your answer by referring to the incremental analysis in (a). QUESTION 4 -SELL AS IT IS OR PROCESS FURTHER Mesa Verde manufactures unpainted furniture for the do-it-yourself (DIY) market. It currently sells a table for $75. Production costs are $40 variable and $10 fixed. Mesa Verde is considering staining and sealing the table to sell it for $100. Variable costs to finish each table are expected to be $17, and fixed costs are expected to be $3. Prepare an analysis showing whether Mesa Verde should sell unpainted or finished tables. QUESTION 4-SELL AS IT IS OR PROCESS FURTHER Process Further Net Income Increase (Decrease) Sell Sales per unit Cost per unit Total Net Income per unit Should Mesa Verde sell unpainted or finished tables? Explain your answer in the table below. MODULE 5 - INTEGRATED QUESTIONS ON MASTER BUDGET (OPERATING BUDGET UP TO MANUFACTURING OVERHEAD BUDGET SALES BUDGET Yoder Company manufactures luggage sets. Yoder sells its luggage sets to department stores. Yoder expects to sell 1,500 luegage sets for $175 each in January, and 1,750 luggage sets for $175 each in February. All sales are cash only. Prepare the sales budget for January and February PRODUCTION BUDGET Review your results from the above sales budget. Yoder has 200 luggage sets on hand on January 1 and desires to have an ending inventory equal to 10% of the next month's sales. March sales are expected to be 1.800 luggage sets. Use this information and the sales budget prepared above to prepare Yoder's production budget for January and February DIRECT MATERIALS BUDGET Yoder budgets 2 UNITS of direct material per luggage set and each unit of direct material costs Yoder $30. Indirect materials are insignificant and not considered for budgeting purposes. The balance in the Raw Materials Inventory account (all direct materials) on January 1 is 1,500 units. Yoder desires the ending balance in Raw Materials Inventory to be 40% of the next month's direct materials needed for production. Desired ending balance for February is 1,560 units. Use this information and the previously prepared production budget to prepare Yoder's direct materials budget for January and February. DIRECT LABOUR BUDGET Yoder budgets two (2) direct labour hours per luggage set. Direct labour costs average $15 per hour Use this information and the production budget prepared earlier to prepare Yoder's direct labour budget for January and February MANUFACTURING OVERHEAD BUDGET Yoder budgets $5 per luggage set for variable manufacturing overhead: $1,500 per month for depreciation, and $16,265 per month for other fixed manufacturing overhead costs. Use this information and the production budget prepared in Short Exercise S22-4 to prepare Yoder's manufacturing overhead budget for January and February, including the predetermined overhead allocation rate using direct labour hours as the allocation base. USE THE ANSWER SHEETS PROVIDED TO ANSWER QUESTIONS MODULE 4 AND MODULE 5 AS I WILL NOT ACCEPT ANY OTHER FORMAT OF SUBMISSION. MODULE 5 - INTEGRATED QUESTIONS ON MASTER BUDGET OPERATING BUDGET UP TO MANUFACTURING OVERHEAD BUDGET 1) SALES BUDGET YODER COMPANY Sales Budget For the Two Months Ended February 28 January February Total Total sales 2) PRODUCTION BUDGET YODER COMPANY Production Budget For the Two Months Ended February 28 January February Total Plus: Total sets needed Less: Budgeted sets to be produced Show your calculations for in the box below: 3) DIRECT MATERIALS BUDGET YODER COMPANY Direct Materials Budget For the Two Months Ended February 28 January February Total Budgeted sets to be produced Direct materials per unit Total units of direct materials needed for production Plus: Desired direct materials in ending inventory Total direct materials needed Less: Direct materials in beginning inventory Direct materials purchases Cost per unit Budgeted purchases of direct materials Show your calculations for in the box below: 4) Direct Labour Budget YODER COMPANY Direct Labor Budget For the Two Months Ended February 28 January February Total Budgeted sets to be produced Direct labor hours per set Direct labor hours needed for production Direct labor cost per hour Budgeted direct labor cost 5) Manufacturing Overhead Budget YODER COMPANY Manufacturing Overhead Budget For the Two Months Ended February 28 January February Total Budgeted sets to be produced Variable overhead cost per set Budgeted variable overhead Budgeted fixed overhead: Total budgeted fixed overhead Budgeted manufacturing overhead costs Direct labor hours) Budgeted manufacturing overhead costs Predetermined overhead allocation rate Direct labor hours)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started