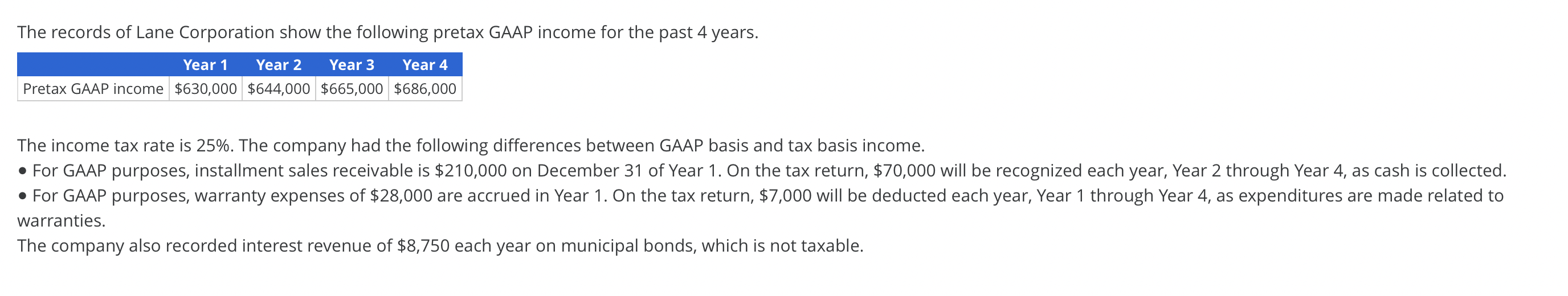

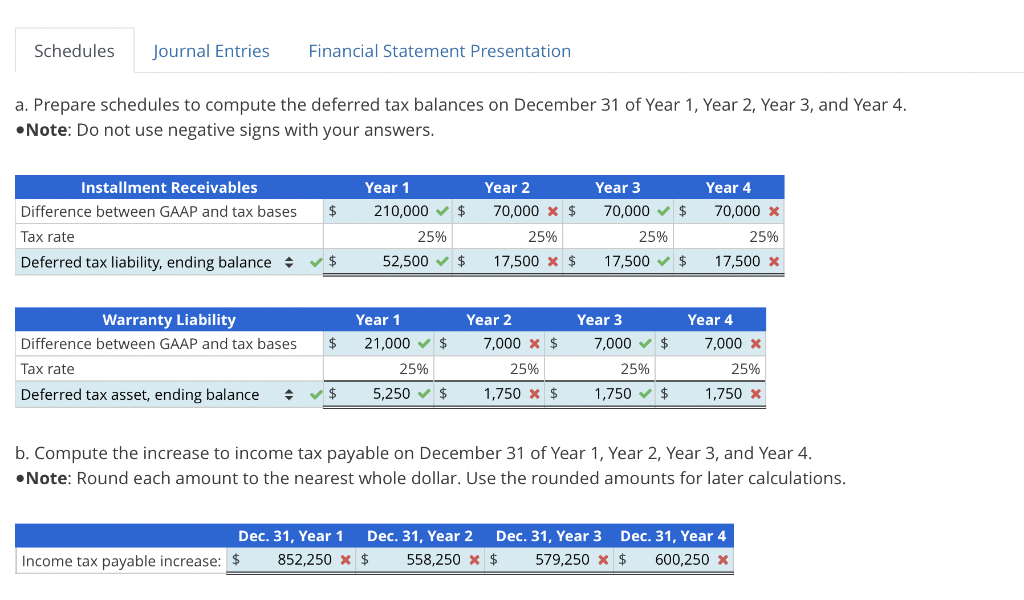

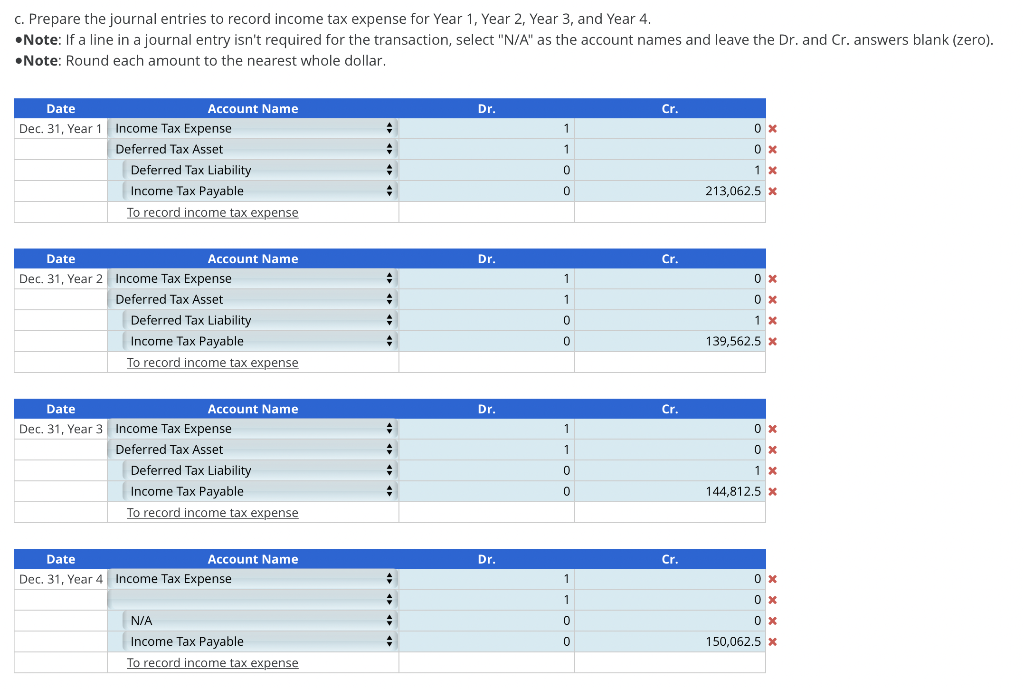

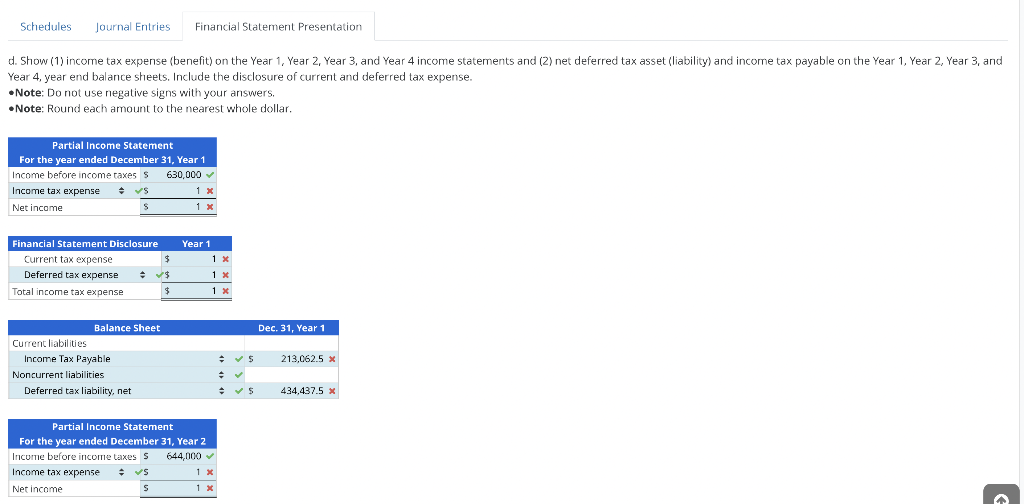

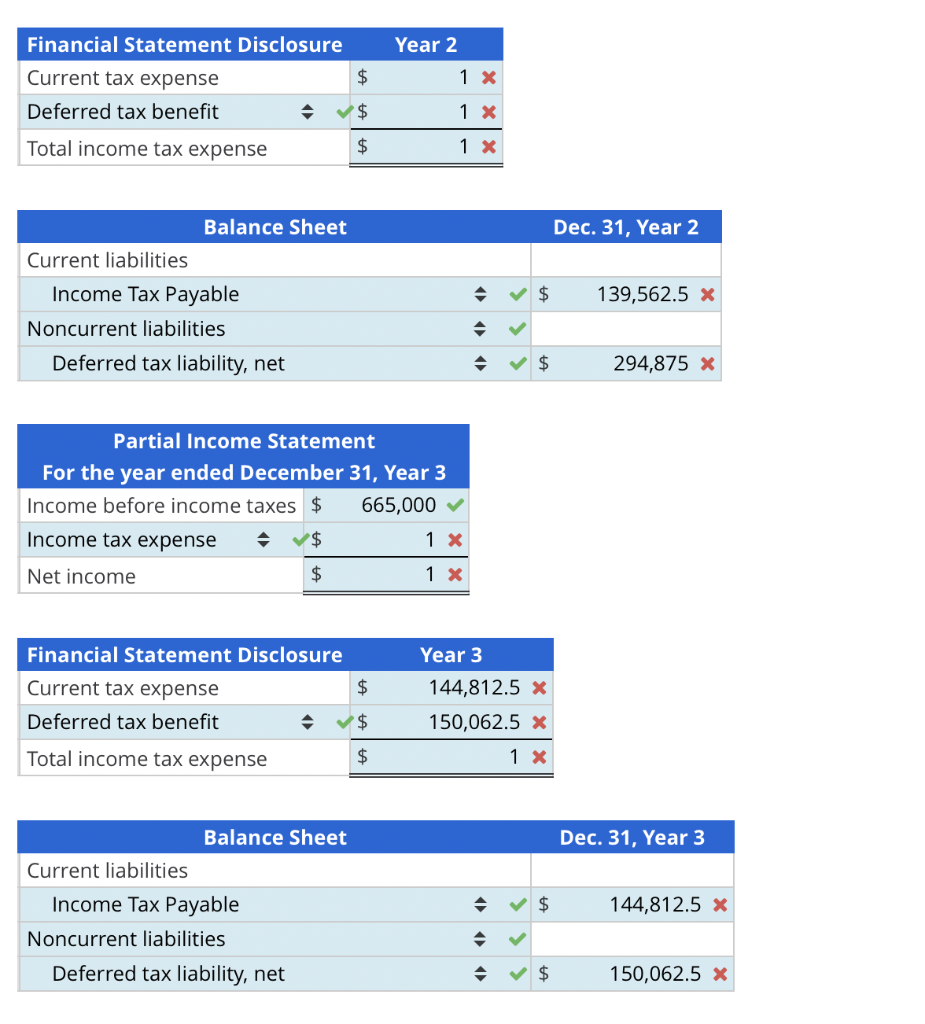

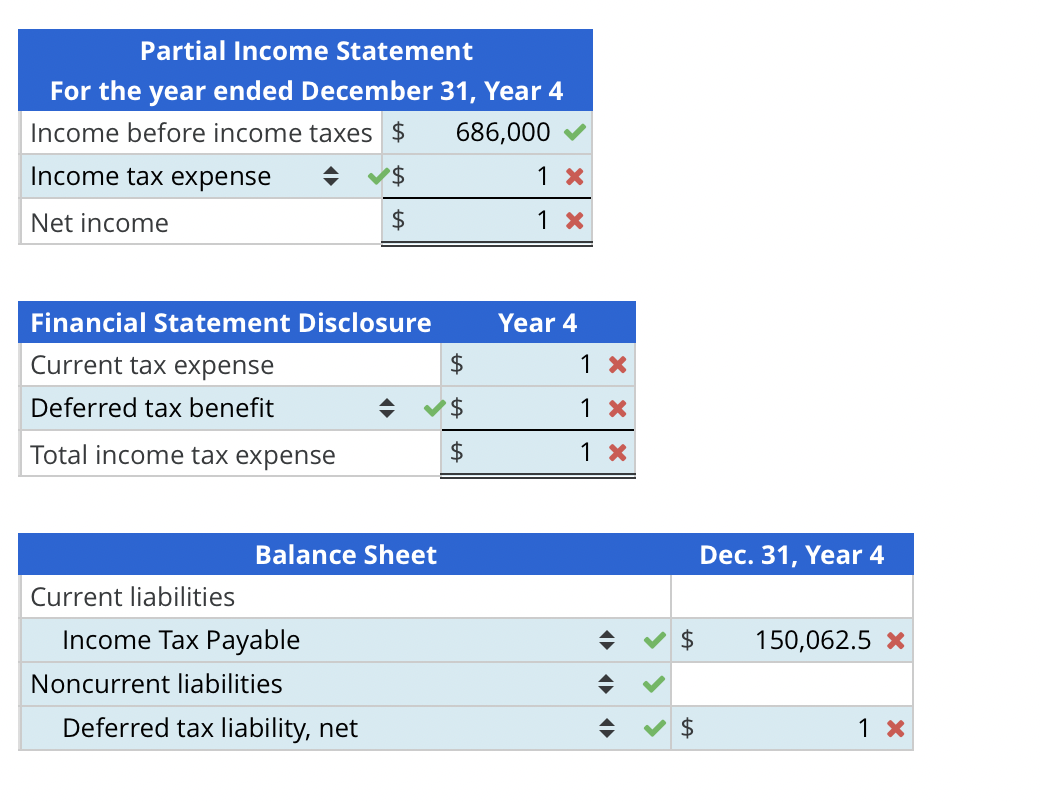

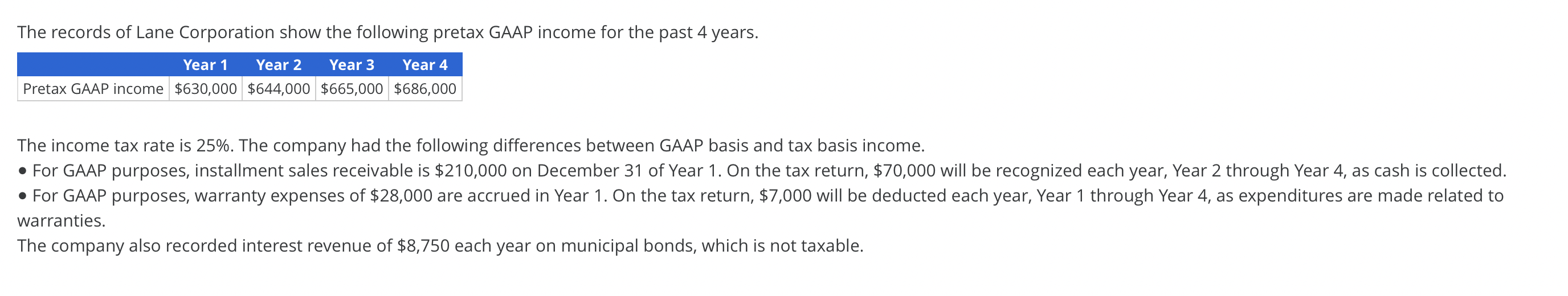

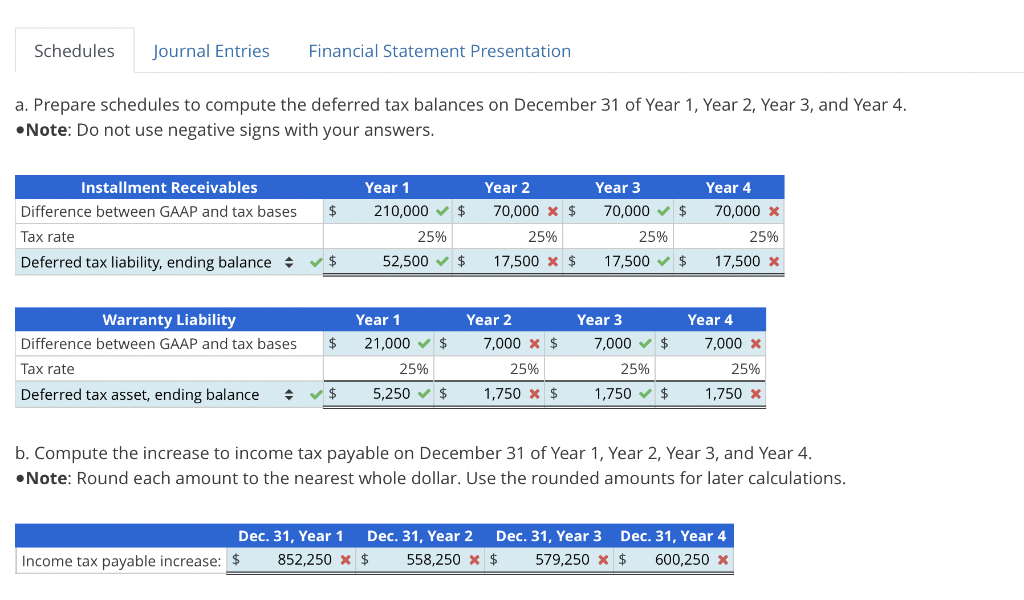

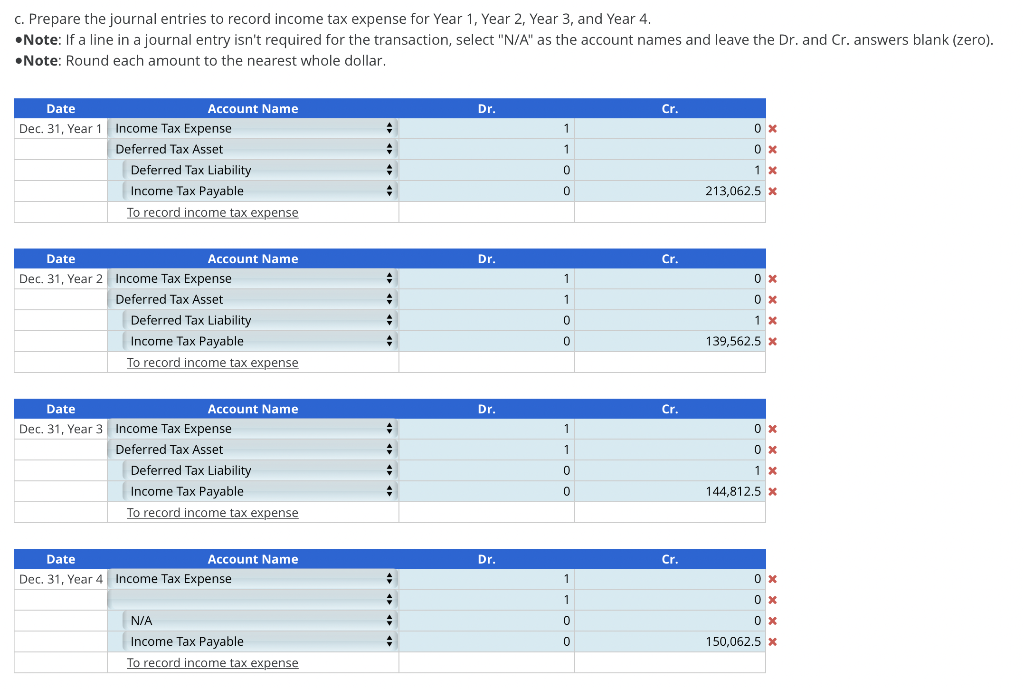

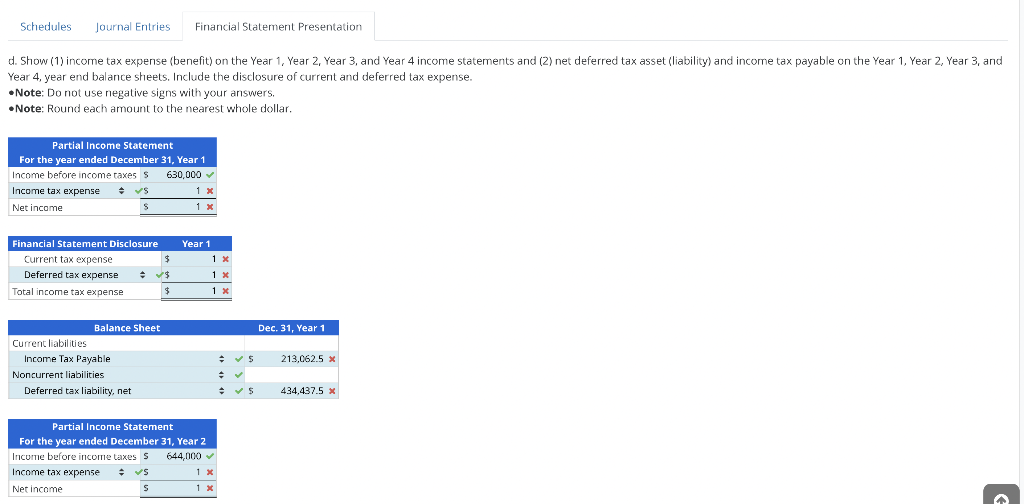

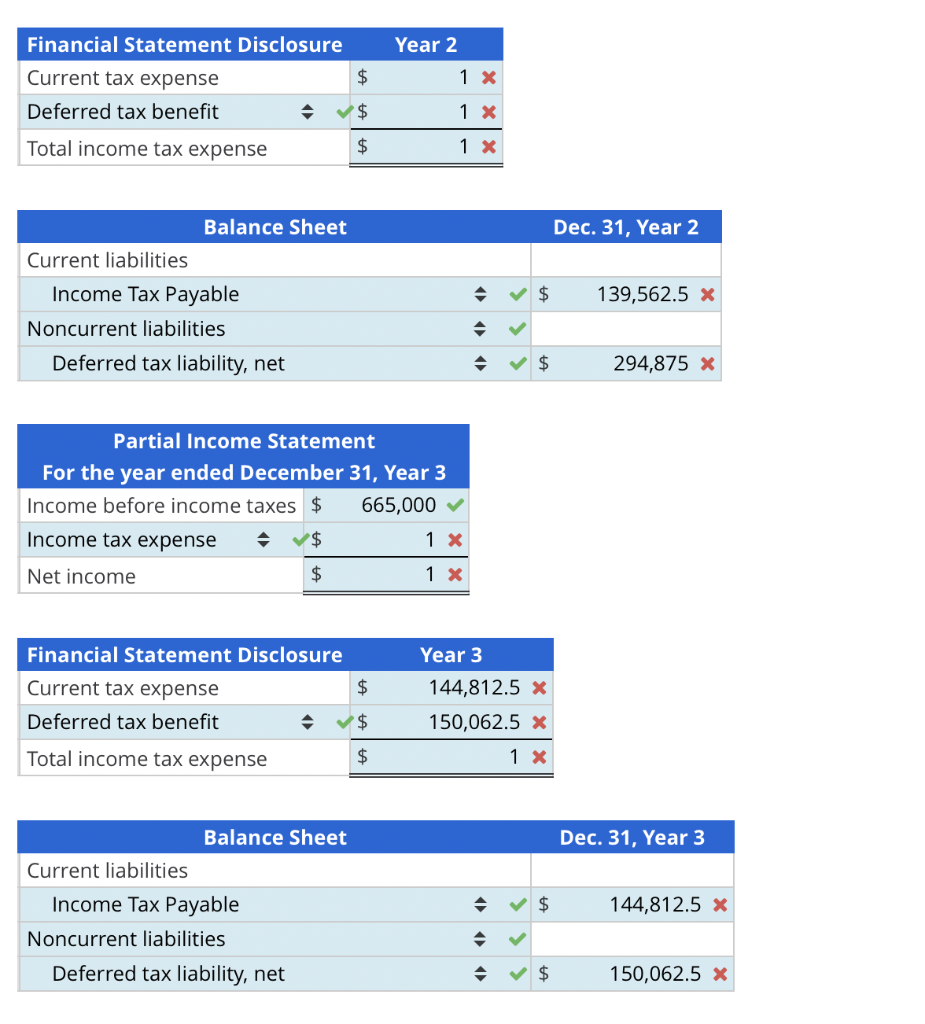

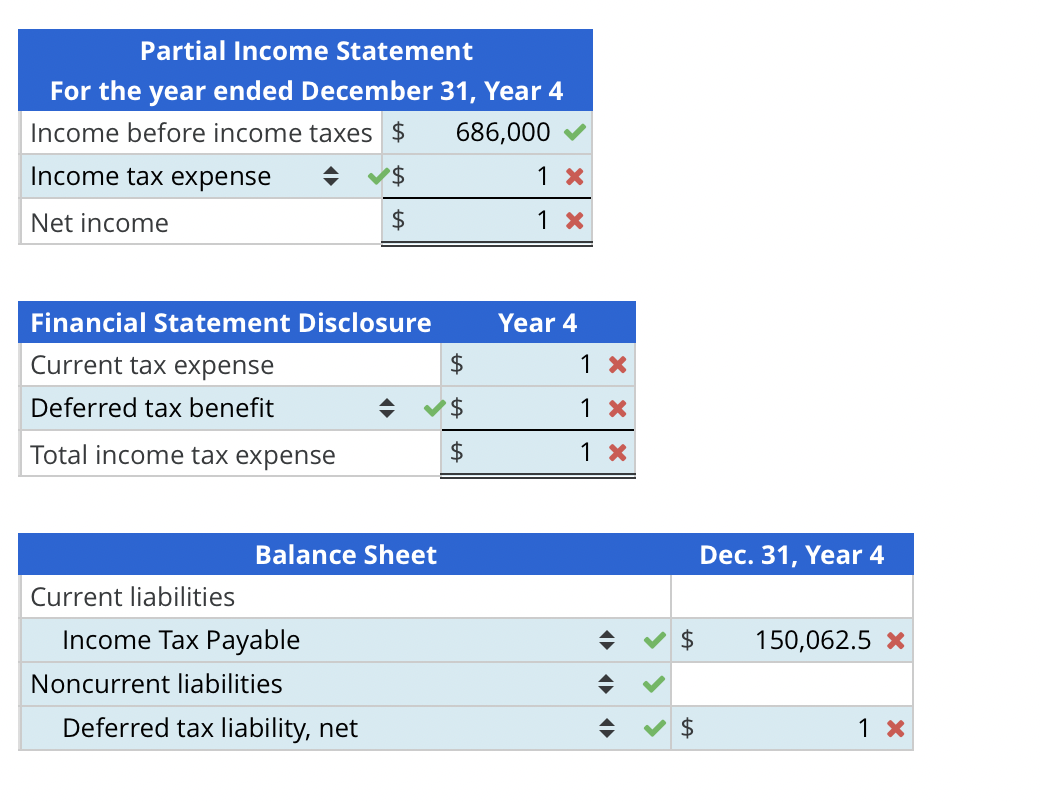

The records of Lane Corporation show the following pretax GAAP income for the past 4 years. The income tax rate is 25%. The company had the following differences between GAAP basis and tax basis income. warranties. The company also recorded interest revenue of $8,750 each year on municipal bonds, which is not taxable. a. Prepare schedules to compute the deferred tax balances on December 31 of Year 1 , Year 2 , Year 3 , and Year 4. - Note: Do not use negative signs with your answers. b. Compute the increase to income tax payable on December 31 of Year 1, Year 2, Year 3, and Year 4. - Note: Round each amount to the nearest whole dollar. Use the rounded amounts for later calculations. c. Prepare the journal entries to record income tax expense for Year 1, Year 2, Year 3, and Year 4. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). -Ninta. Doulnd a arh amniunt th tha naaract ishola dallar Year 4, year end balance sheets. Include the disclosure of current and deferred tax expense. - Note: Do not use negative signs with your answers. - Note: Round each amount to the nearest whole dollar. \begin{tabular}{|l|ll|} \hline Financial Statement Disclosure & \multicolumn{2}{|c|}{ Year 2} \\ \hline Current tax expense & $ & 1x \\ \hline Deferred tax benefit & $ & 1x \\ \hline Total income tax expense & $ & 1x \\ \hline \end{tabular} \begin{tabular}{|l|c|r|} \hline Financial Statement Disclosure & \multicolumn{2}{c|}{ Year 3} \\ \hline Current tax expense & $ & 144,812.5x \\ \hline Deferred tax benefit & $ & 150,062.5x \\ \hline Total income tax expense & $ & 1x \\ \hline \end{tabular} The records of Lane Corporation show the following pretax GAAP income for the past 4 years. The income tax rate is 25%. The company had the following differences between GAAP basis and tax basis income. warranties. The company also recorded interest revenue of $8,750 each year on municipal bonds, which is not taxable. a. Prepare schedules to compute the deferred tax balances on December 31 of Year 1 , Year 2 , Year 3 , and Year 4. - Note: Do not use negative signs with your answers. b. Compute the increase to income tax payable on December 31 of Year 1, Year 2, Year 3, and Year 4. - Note: Round each amount to the nearest whole dollar. Use the rounded amounts for later calculations. c. Prepare the journal entries to record income tax expense for Year 1, Year 2, Year 3, and Year 4. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). -Ninta. Doulnd a arh amniunt th tha naaract ishola dallar Year 4, year end balance sheets. Include the disclosure of current and deferred tax expense. - Note: Do not use negative signs with your answers. - Note: Round each amount to the nearest whole dollar. \begin{tabular}{|l|ll|} \hline Financial Statement Disclosure & \multicolumn{2}{|c|}{ Year 2} \\ \hline Current tax expense & $ & 1x \\ \hline Deferred tax benefit & $ & 1x \\ \hline Total income tax expense & $ & 1x \\ \hline \end{tabular} \begin{tabular}{|l|c|r|} \hline Financial Statement Disclosure & \multicolumn{2}{c|}{ Year 3} \\ \hline Current tax expense & $ & 144,812.5x \\ \hline Deferred tax benefit & $ & 150,062.5x \\ \hline Total income tax expense & $ & 1x \\ \hline \end{tabular}