Answered step by step

Verified Expert Solution

Question

1 Approved Answer

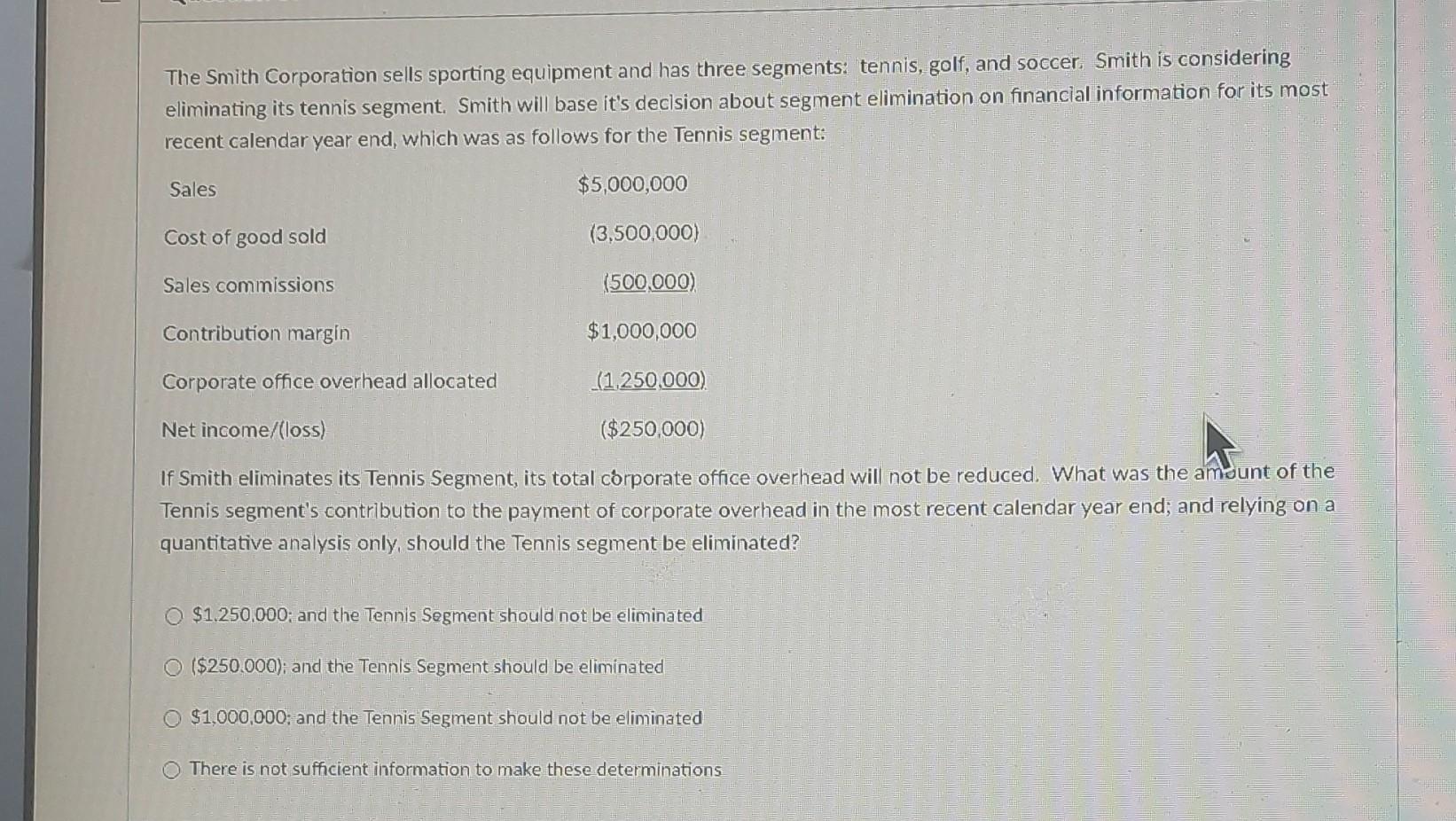

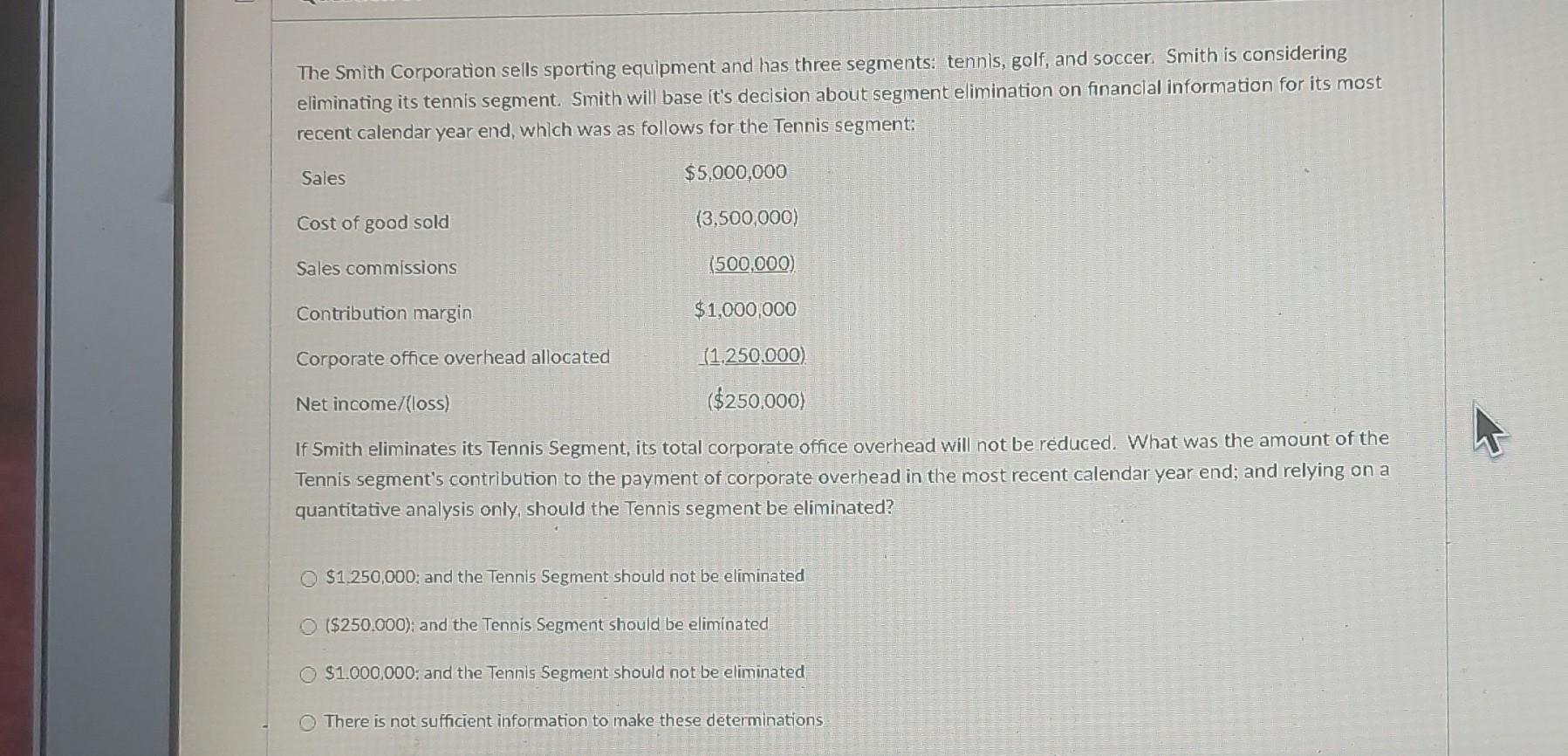

The Smith Corporation sells sporting equipment and has three segments: tennis, golf, and soccer. Smith is considering eliminating its tennis segment. Smith will base it's

The Smith Corporation sells sporting equipment and has three segments: tennis, golf, and soccer. Smith is considering eliminating its tennis segment. Smith will base it's decision about segment elimination on financial information for its most recent calendar year end, which was as follows for the Tennis segment: If Smith eliminates its Tennis Segment, its total corporate office overhead will not be reduced. What was the amount of the Tennis segment's contribution to the payment of corporate overhead in the most recent calendar year end; and relying on a quantitative analysis only, should the Tennis segment be eliminated? $1.250.000; and the Tennis Segment should not be eliminated ($250.000); and the Tennis Segment should be eliminated $1,000,000 : and the Tennis Segment should not be eliminated There is not sufficient information to make these determinations The Smith Corporation sells sporting equipment and has three segments: tennis, golf, and soccer. Smith is considering eliminating its tennis segment. Smith will base it's decision about segment elimination on financlal information for its most recent calendar year end, which was as follows for the Tennis segment: If Smith eliminates its Tennis Segment, its total corporate office overhead will not be reduced. What was the amount of the Tennis segment's contribution to the payment of corporate overhead in the most recent calendar year end; and relying on a quantitative analysis only, should the Tennis segment be eliminated? \$1,250,000; and the Tennis Segment should not be eliminated ($250.000) : and the Tennis Segment should be eliminated $1.000,000 : and the Tennis Segment should not be eliminated There is not sufficient information to make these determinations The Smith Corporation sells sporting equipment and has three segments: tennis, golf, and soccer. Smith is considering eliminating its tennis segment. Smith will base it's decision about segment elimination on financial information for its most recent calendar year end, which was as follows for the Tennis segment: If Smith eliminates its Tennis Segment, its total corporate office overhead will not be reduced. What was the amount of the Tennis segment's contribution to the payment of corporate overhead in the most recent calendar year end; and relying on a quantitative analysis only, should the Tennis segment be eliminated? $1.250.000; and the Tennis Segment should not be eliminated ($250.000); and the Tennis Segment should be eliminated $1,000,000 : and the Tennis Segment should not be eliminated There is not sufficient information to make these determinations The Smith Corporation sells sporting equipment and has three segments: tennis, golf, and soccer. Smith is considering eliminating its tennis segment. Smith will base it's decision about segment elimination on financlal information for its most recent calendar year end, which was as follows for the Tennis segment: If Smith eliminates its Tennis Segment, its total corporate office overhead will not be reduced. What was the amount of the Tennis segment's contribution to the payment of corporate overhead in the most recent calendar year end; and relying on a quantitative analysis only, should the Tennis segment be eliminated? \$1,250,000; and the Tennis Segment should not be eliminated ($250.000) : and the Tennis Segment should be eliminated $1.000,000 : and the Tennis Segment should not be eliminated There is not sufficient information to make these determinations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started