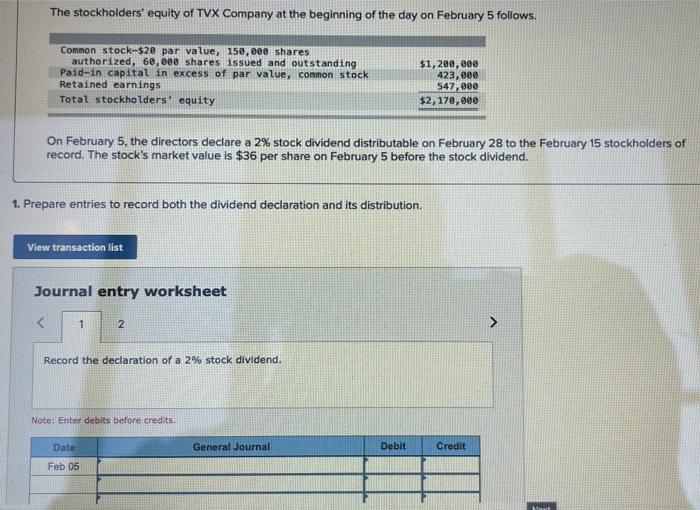

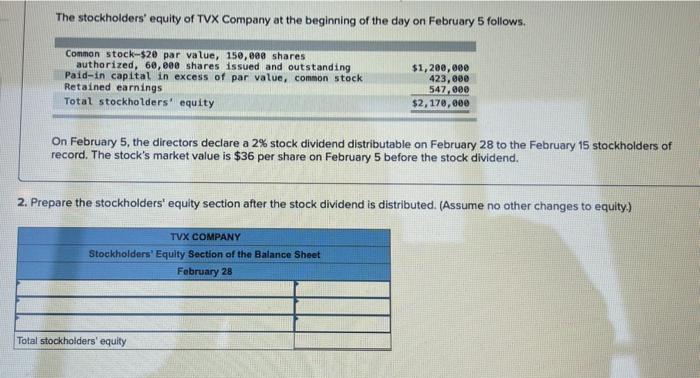

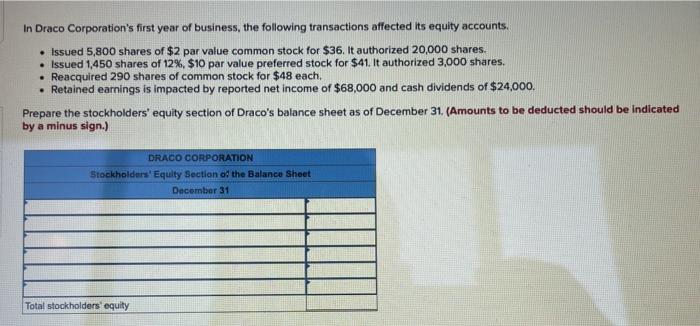

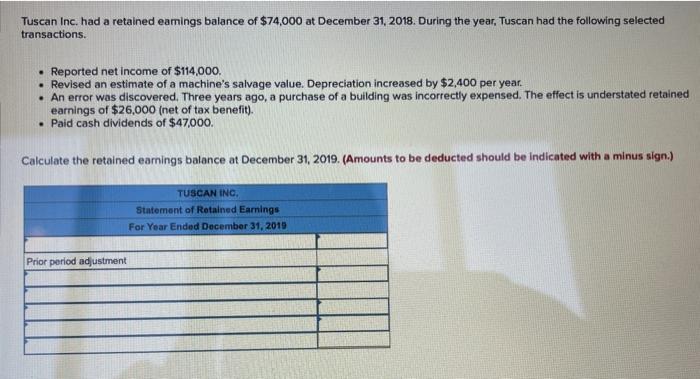

The stockholders' equity of TVX Company at the beginning of the day on February 5 follows. Common stock-$20 par value, 150,000 shares authorized, 68,888 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders equity $1,200,000 423,000 547,000 $2,170,000 On February 5, the directors declare a 2% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $36 per share on February 5 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. View transaction list Journal entry worksheet 1 2 Record the declaration of a 2% stock dividend. Note: Enter debits before credits. General Journal Debit Credit Date Feb 05 The stockholders' equity of TVX Company at the beginning of the day on February 5 follows. Common Stock-$20 par value, 150,000 shares authorized, 60,800 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,200,000 423,000 547 000 $2,170,000 On February 5, the directors declare a 2% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $36 per share on February 5 before the stock dividend. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) TVX COMPANY Stockholders' Equity Section of the Balance Sheet February 28 Total stockholders' equity In Draco Corporation's first year of business, the following transactions affected its equity accounts. Issued 5,800 shares of $2 par value common stock for $36. It authorized 20,000 shares. Issued 1,450 shares of 12%, $10 par value preferred stock for $41. It authorized 3,000 shares. Reacquired 290 shares of common stock for $48 each, Retained earnings is impacted by reported net income of $68,000 and cash dividends of $24,000. Prepare the stockholders' equity section of Draco's balance sheet as of December 31. (Amounts to be deducted should be indicated by a minus sign.) DRACO CORPORATION Stockholders' Equity Section or the Balance Sheet December 31 Total stockholders' equity Tuscan Inc. had a retained earings balance of $74,000 at December 31, 2018. During the year. Tuscan had the following selected transactions. Reported net income of $114,000. Revised an estimate of a machine's salvage value. Depreciation increased by $2,400 per year. An error was discovered. Three years ago, a purchase of a building was incorrectly expensed. The effect is understated retained earnings of $26,000 (net of tax benefit). Paid cash dividends of $47,000. Calculate the retained earnings balance at December 31, 2019. (Amounts to be deducted should be indicated with a minus sign.) TUSCAN INC. Statement of Retained Earnings For Year Ended December 31, 2019 Prior period adjustment