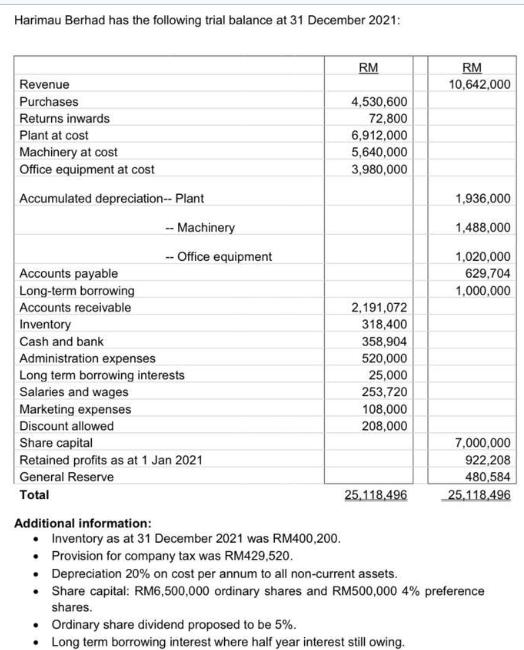

Harimau Berhad has the following trial balance at 31 December 2021: Revenue Purchases Returns inwards Plant at cost Machinery at cost Office equipment at

Harimau Berhad has the following trial balance at 31 December 2021: Revenue Purchases Returns inwards Plant at cost Machinery at cost Office equipment at cost Accumulated depreciation-- Plant Accounts payable Long-term borrowing Accounts receivable Inventory Cash and bank Administration expenses Long term borrowing interests Salaries and wages Marketing expenses Discount allowed -- Machinery -- Office equipment Share capital Retained profits as at 1 Jan 2021 General Reserve Total Additional information: RM 4,530,600 72,800 6,912,000 5,640,000 3,980,000 2,191,072 318,400 358,904 520,000 25,000 253,720 108,000 208,000 25.118.496 RM 10,642,000 1,936,000 1,488,000 1,020,000 629,704 1,000,000 7,000,000 922,208 480,584 25.118,496 Inventory as at 31 December 2021 was RM400,200. Provision for company tax was RM429,520. Depreciation 20% on cost per annum to all non-current assets. Share capital: RM6,500,000 ordinary shares and RM500,000 4% preference shares. Ordinary share dividend proposed to be 5%. Long term borrowing interest where half year interest still owing. Required: Prepare Statement of Comprehensive Income and Statement of Financial Position as at 31 Dec 2021. (40 marks)

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Comprehensive Income Revenue 10642000 Cost of Sales 4776200 Gross Profit 5865800 Operating Expenses Administration expenses 520000 Depreciation 889800 Salaries and wages 253720 Marketing ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started