Answered step by step

Verified Expert Solution

Question

1 Approved Answer

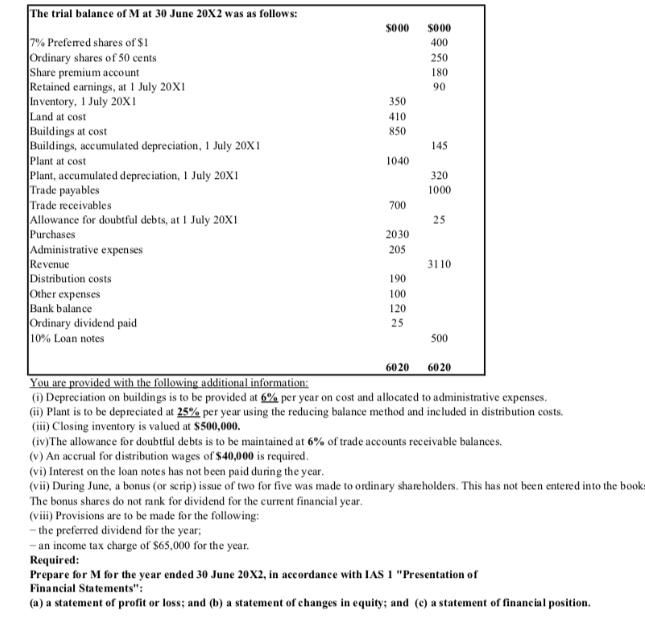

The trial balance of M at 30 June 20X2 was as follows: 7% Preferred shares of $1 Ordinary shares of 50 cents Share premium

The trial balance of M at 30 June 20X2 was as follows: 7% Preferred shares of $1 Ordinary shares of 50 cents Share premium account Retained earnings, at 1 July 20X1 Inventory, 1 July 20X1 Land at cost Buildings at cost Buildings, accumulated depreciation, 1 July 20X1 Plant at cost Plant, accumulated depreciation, 1 July 20X1 Trade payables Trade receivables Allowance for doubtful debts, at 1 July 20X1 Purchases Administrative expenses Revenue Distribution costs Other expenses Bank balance Ordinary dividend paid 10% Loan notes $000 350 410 850 1040 (viii) Provisions are to be made for the following: -the preferred dividend for the year; - an income tax charge of $65,000 for the year. 700 2030 205 190 100 120 25 6020 5000 400 250 180 90 145 320 1000 25 3110 500 6020 You are provided with the following additional information: (i) Depreciation on buildings is to be provided at 6% per year on cost and allocated to administrative expenses. (ii) Plant is to be depreciated at 25% per year using the reducing balance method and included in distribution costs. (iii) Closing inventory is valued at $500,000. (iv) The allowance for doubtful debts is to be maintained at 6% of trade accounts receivable balances. (v) An accrual for distribution wages of $40,000 is required. (vi) Interest on the loan notes has not been paid during the year. (vii) During June, a bonus (or scrip) issue of two for five was made to ordinary shareholders. This has not been entered into the books The bonus shares do not rank for dividend for the current financial year. Required: Prepare for M for the year ended 30 June 20X2, in accordance with IAS 1 "Presentation of Financial Statements": (a) a statement of profit or loss; and (b) a statement of changes in equity; and (c) a statement of financial position.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

First we have to record the journal entries and post them to the trial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started