Answered step by step

Verified Expert Solution

Question

1 Approved Answer

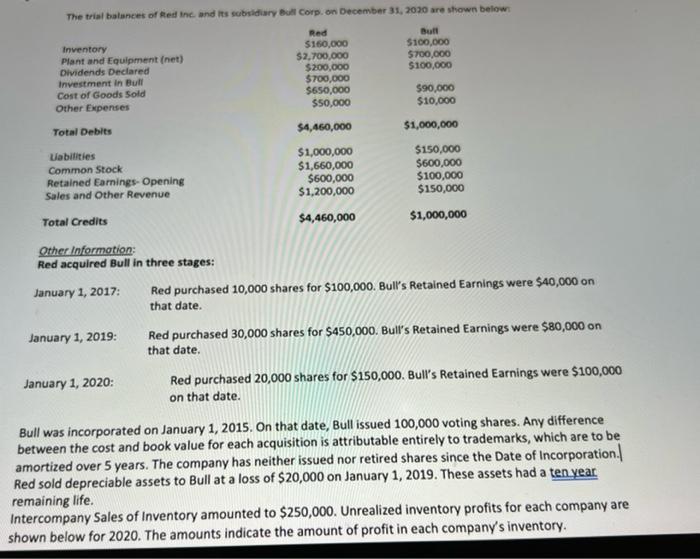

The trial balances of Red Inc. and its subsidiary Bull Corp. on December 31, 2020 are shown below: Red $160,000 $2,700,000 $200,000 $700,000 $650,000

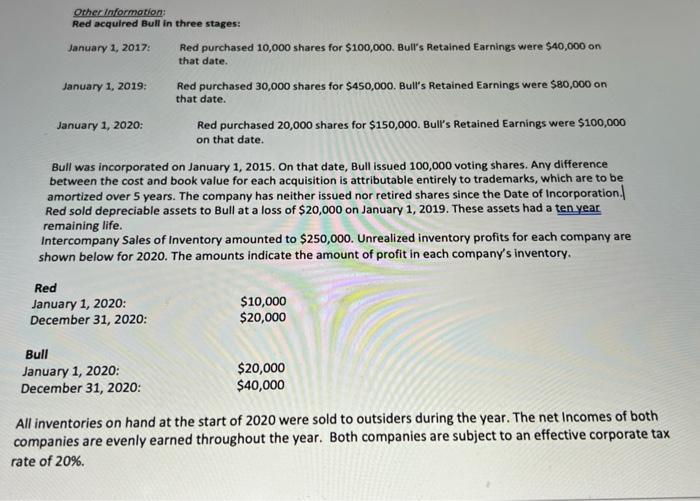

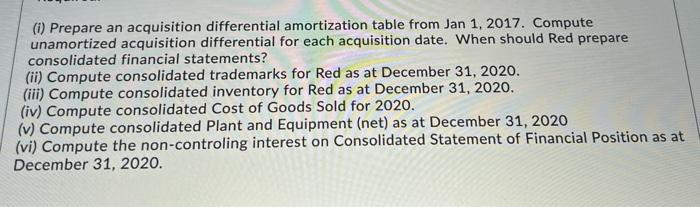

The trial balances of Red Inc. and its subsidiary Bull Corp. on December 31, 2020 are shown below: Red $160,000 $2,700,000 $200,000 $700,000 $650,000 $50,000 $4,460,000 $1,000,000 $1,660,000 $600,000 $1,200,000 $4,460,000 Inventory Plant and Equipment (net) Dividends Declared Investment in Bull Cost of Goods Sold Other Expenses Total Debits Liabilities Common Stock Retained Earnings-Opening Sales and Other Revenue Total Credits Other Information: Red acquired Bull in three stages: January 1, 2017: January 1, 2019: January 1, 2020: Bull $100,000 $700,000 $100,000 $90,000 $10,000 $1,000,000 $150,000 $600,000 $100,000 $150,000 $1,000,000 Red purchased 10,000 shares for $100,000. Bull's Retained Earnings were $40,000 on that date. Red purchased 30,000 shares for $450,000. Bull's Retained Earnings were $80,000 on that date. Red purchased 20,000 shares for $150,000. Bull's Retained Earnings were $100,000 on that date. Bull was incorporated on January 1, 2015. On that date, Bull issued 100,000 voting shares. Any difference to be between the cost and book value for each acquisition is attributable entirely to trademarks, which amortized over 5 years. The company has neither issued nor retired shares since the Date of Incorporation. Red sold depreciable assets to Bull at a loss of $20,000 on January 1, 2019. These assets had a ten year remaining life. Intercompany Sales of Inventory amounted to $250,000. Unrealized inventory profits for each company are shown below for 2020. The amounts indicate the amount of profit in each company's inventory. Other Information: Red acquired Bull in three stages: January 1, 2017: January 1, 2019: January 1, 2020: Red purchased 10,000 shares for $100,000. Bull's Retained Earnings were $40,000 on that date. Red January 1, 2020: December 31, 2020: Red purchased 30,000 shares for $450,000. Bull's Retained Earnings were $80,000 on that date. Bull was incorporated on January 1, 2015. On that date, Bull issued 100,000 voting shares. Any difference between the cost and book value for each acquisition is attributable entirely to trademarks, which are to be amortized over 5 years. The company has neither issued nor retired shares since the Date of Incorporation. Red sold depreciable assets to Bull at a loss of $20,000 on January 1, 2019. These assets had a ten year remaining life. Bull January 1, 2020: December 31, 2020: Red purchased 20,000 shares for $150,000. Bull's Retained Earnings were $100,000 on that date. Intercompany Sales of Inventory amounted to $250,000. Unrealized inventory profits for each company are shown below for 2020. The amounts indicate the amount of profit in each company's inventory. $10,000 $20,000 $20,000 $40,000 All inventories on hand at the start of 2020 were sold to outsiders during the year. The net Incomes of both companies are evenly earned throughout the year. Both companies are subject to an effective corporate tax rate of 20%. (i) Prepare an acquisition differential amortization table from Jan 1, 2017. Compute unamortized acquisition differential for each acquisition date. When should Red prepare consolidated financial statements? (ii) Compute consolidated trademarks for Red as at December 31, 2020. (iii) Compute consolidated inventory for Red as at December 31, 2020. (iv) Compute consolidated Cost of Goods Sold for 2020. (v) Compute consolidated Plant and Equipment (net) as at December 31, 2020 (vi) Compute the non-controling interest on Consolidated Statement of Financial Position as at December 31, 2020.

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

i Acquisition Differential Amortization Table Acquisition Date Acquisition Cost Bulls Retained Earni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started