Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The value of ratio analysis is that it enables a financial analyst to evaluate past performance, assess the current financial position of the company, and

The value of ratio analysis is that it enables a financial analyst to evaluate past performance, assess the current financial position of the company, and gain insights useful for projecting future results.

a.

False

b.

True

Clear my choice

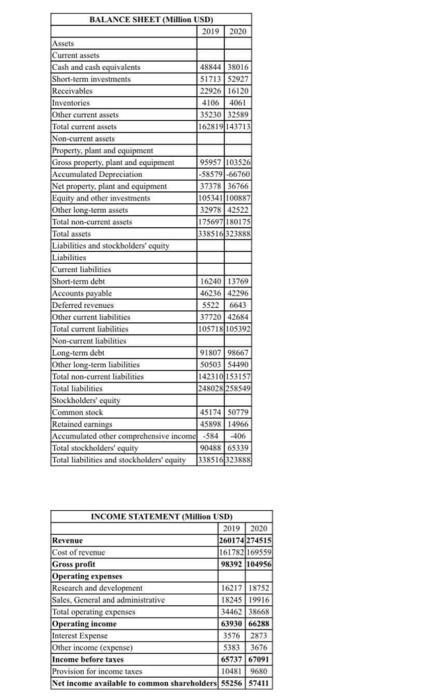

Given the attached balance sheet and income statement, calculate the Working capital turnover for 2020?

a.

None of the above

b.

5.8

c.

7.3

d.

8.2

e.

12.6

Given the attached balance sheet and income statement, calculate the quick ratio for 20208 a 1.17 b None of the above e 0.77

BALANCE SHEET (Million USD) 2019 2020 Assets Current assets Cash and cash equivalents 48844 38016 Short-term investments 51713 52927 Receivables 22926 16120 Inventories 4106 4061 Other current assets 35230 32589 Total current assets 162819 143713 Non-current assets Property, plant and equipment 95957 103526 Gross property, plant and equipment Accumulated Depreciation -58579-66760 Net property, plant and equipment 37378 36766 Equity and other investments 105341 100887 Other long-term assets 32978 42522 Total non-current assets 175697 180175 Total assets 338516323888 Liabilities and stockholders' equity Liabilities Current liabilities Short-term debt 16240 13769 Accounts payable 46236 42296 Deferred revenues 5522 6643 Other current liabilities 37720 42684 Total current liabilities 105718 105392 Non-current liabilities Long-term debt 91807 98667 Other long-term liabilities 50503 54490 Total non-current liabilities 142310 153157 Total liabilities 248028 258549 Stockholders' equity Common stock 4517450779 Retained earnings 45898 14966 Accumulated other comprehensive income -584-406 Total stockholders' equity 90488 65339 Total liabilities and stockholders' equity 338516323888 INCOME STATEMENT (Million USD) 2019 2020 Revenue 260174 274515 Cost of revenue 161782 169559 Gross profit 98392 104956 Operating expenses Research and development 1621718752 Sales, General and administrative 18245 19916 34462 38668 Total operating expenses Operating income 63930 66288 Interest Expense 3576 2873 Other income (expense) 5383 3676 Income before taxes 65737 67091 Provision for income taxes 10481 9680 Net income available to common shareholders 55256 57411

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer i 1 Option B is correct True Justification Ratio Analysis is used to know the Efficency Solve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started