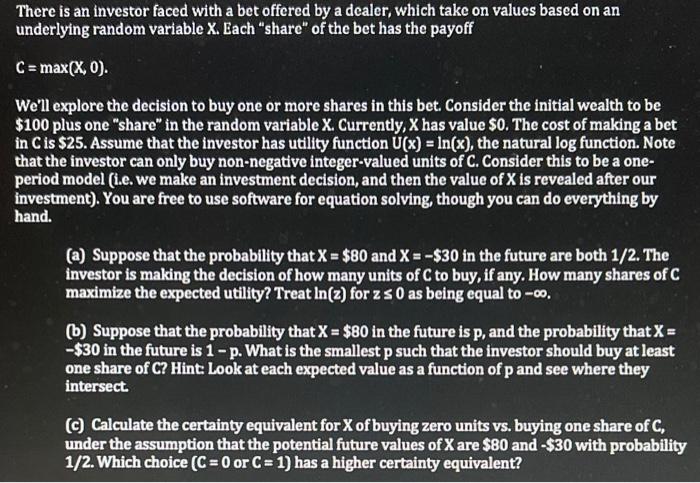

There is an investor faced with a bet offered by a dealer, which take on values based on an underlying random variable X. Each "share" of the bet has the payoff C= max(x, 0). We'll explore the decision to buy one or more shares in this bet. Consider the initial wealth to be $100 plus one "share" in the random variable X. Currently, X has value $0. The cost of making a bet in C is $25. Assume that the investor has utility function U(x) = ln(x), the natural log function. Note that the investor can only buy non-negative integer-valued units of C. Consider this to be a one- period model (i.e. we make an investment decision, and then the value of X is revealed after our investment). You are free to use software for equation solving, though you can do everything by hand. (a) Suppose that the probability that X = $80 and X = -$30 in the future are both 1/2. The investor is making the decision of how many units of C to buy, if any. How many shares of C maximize the expected utility? Treat In(z) for z s 0 as being equal to -60. (b) Suppose that the probability that X = $80 in the future is p, and the probability that X = -$30 in the future is 1 - p. What is the smallest p such that the investor should buy at least one share of C? Hint: Look at each expected value as a function of p and see where they intersect. c) Calculate the certainty equivalent for Xof buying zero units vs. buying one share of c, under the assumption that the potential future values of X are $80 and $30 with probability 1/2. Which choice (C = 0 or C = 1) has a higher certainty equivalent? There is an investor faced with a bet offered by a dealer, which take on values based on an underlying random variable X. Each "share" of the bet has the payoff C= max(x, 0). We'll explore the decision to buy one or more shares in this bet. Consider the initial wealth to be $100 plus one "share" in the random variable X. Currently, X has value $0. The cost of making a bet in C is $25. Assume that the investor has utility function U(x) = ln(x), the natural log function. Note that the investor can only buy non-negative integer-valued units of C. Consider this to be a one- period model (i.e. we make an investment decision, and then the value of X is revealed after our investment). You are free to use software for equation solving, though you can do everything by hand. (a) Suppose that the probability that X = $80 and X = -$30 in the future are both 1/2. The investor is making the decision of how many units of C to buy, if any. How many shares of C maximize the expected utility? Treat In(z) for z s 0 as being equal to -60. (b) Suppose that the probability that X = $80 in the future is p, and the probability that X = -$30 in the future is 1 - p. What is the smallest p such that the investor should buy at least one share of C? Hint: Look at each expected value as a function of p and see where they intersect. c) Calculate the certainty equivalent for Xof buying zero units vs. buying one share of c, under the assumption that the potential future values of X are $80 and $30 with probability 1/2. Which choice (C = 0 or C = 1) has a higher certainty equivalent