Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is no more information avilable in that question !!! Question 5: Jerry Ltd a UK company sells Standard Rated and zero rated goods in

there is no more information avilable in that question !!!

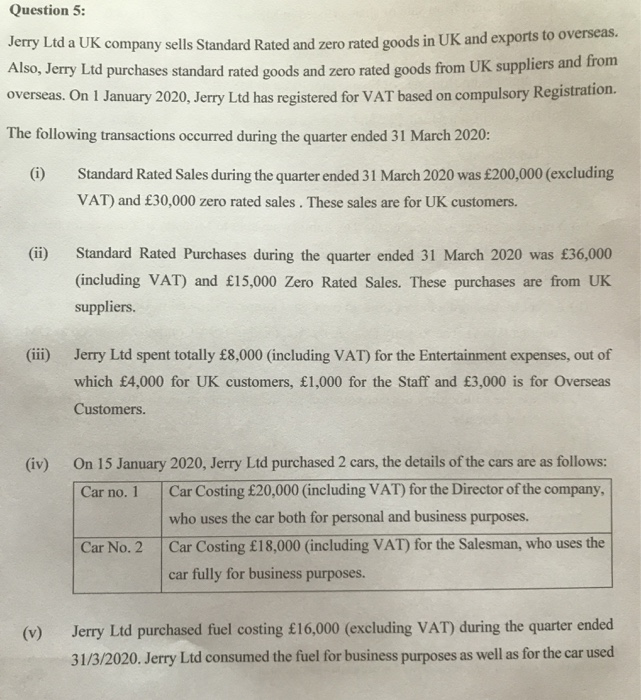

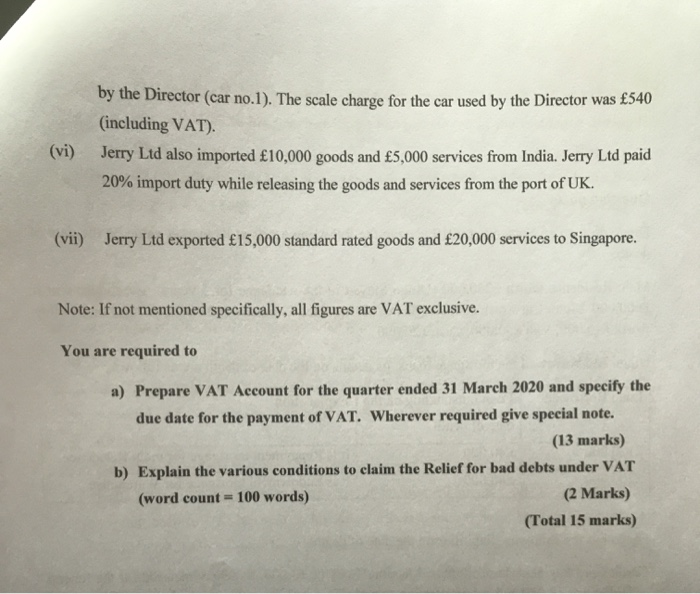

Question 5: Jerry Ltd a UK company sells Standard Rated and zero rated goods in UK and exports to overseas. Also, Jerry Ltd purchases standard rated goods and zero rated goods from UK suppliers and from overseas. On 1 January 2020, Jerry Ltd has registered for VAT based on compulsory Registration. The following transactions occurred during the quarter ended 31 March 2020: (i) Standard Rated Sales during the quarter ended 31 March 2020 was 200,000 (excluding VAT) and 30,000 zero rated sales. These sales are for UK customers. Standard Rated Purchases during the quarter ended 31 March 2020 was 36,000 (including VAT) and 15,000 Zero Rated Sales. These purchases are from UK suppliers. (iii) Jerry Ltd spent totally 8,000 (including VAT) for the Entertainment expenses, out of which 4,000 for UK customers, 1,000 for the staff and 3,000 is for Overseas Customers. (iv) On 15 January 2020, Jerry Ltd purchased 2 cars, the details of the cars are as follows: Car no.1 Car Costing 20,000 (including VAT) for the Director of the company, who uses the car both for personal and business purposes. Car No. 2 Car Costing 18,000 (including VAT) for the Salesman, who uses the car fully for business purposes. (v) Jerry Ltd purchased fuel costing 16,000 (excluding VAT) during the quarter ended 31/3/2020. Jerry Ltd consumed the fuel for business purposes as well as for the car used by the Director (car no.1). The scale charge for the car used by the Director was 540 (including VAT) Jerry Ltd also imported 10,000 goods and 5,000 services from India. Jerry Ltd paid 20% import duty while releasing the goods and services from the port of UK. (vi) (vii) Jerry Ltd exported 15,000 standard rated goods and 20,000 services to Singapore. Note: If not mentioned specifically, all figures are VAT exclusive. You are required to a) Prepare VAT Account for the quarter ended 31 March 2020 and specify the due date for the payment of VAT. Wherever required give special note. (13 marks) b) Explain the various conditions to claim the Relief for bad debts under VAT (word count = 100 words) (2 Marks) (Total 15 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started