Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is no table provided Refer to Table 10-1, assume interest rates in the market (yield to maturity) are 11 percent for 20 years on

there is no table provided

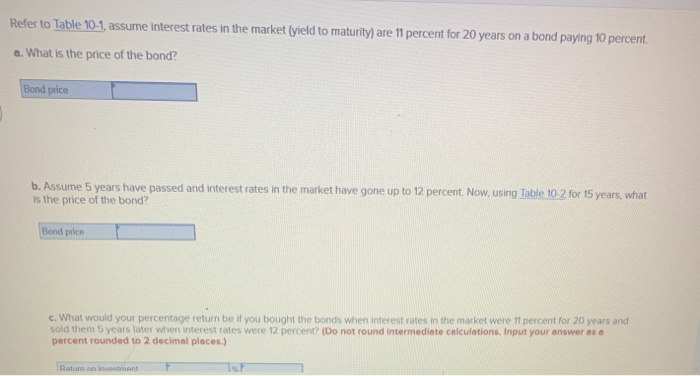

Refer to Table 10-1, assume interest rates in the market (yield to maturity) are 11 percent for 20 years on a bond paying 10 percent. a. What is the price of the bond? Bond price b. Assume 5 years have passed and interest rates in the market have gone up to 12 percent. Now, using Table 10.2 for 15 years, what is the price of the bond? Bond price c. What would your percentage return be if you bought the bonds when interest rates in the market were 11 percent for 20 years and sold them 5 years later when interest rates were 12 percent? (Do not round intermediete calculations. Input your answer as e percent rounded to 2 decimal places.) Retum on Investment Bond price c. What would your percentage return be if you bought the bonds when interest rates in the market were 11 percent for 20 years and sold them 5 years later when interest rates were 12 percent? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Returm on investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started