Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There will be a single income tax rate of 2% for everyone. Each taxpayer will receive a deduction of $10,000 regardless of their income amount

There will be a single income tax rate of 2% for everyone. Each taxpayer will receive a deduction of $10,000 regardless of their income amount in order to remove the need to keep receipts of various tax deductible expenditures. For each dependent child there will be a deduction of $2000.

A taxpayers income is reduced by the total amount of their deductions before the amount of tax payable is calculated.

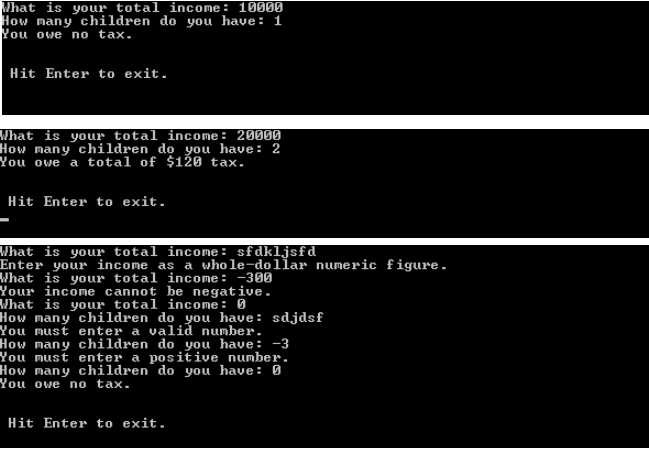

Write code in C# to produce the messages above.

lhat is your total income: 10000 low many children do you have: 1 ou owe no tax Hit Enter to exit. What is your total income: 20000 How many children do you have: 2 You owe a total of $120 tax. Hit Enter to exit What is your total income: sfdkljsfd Enter your income as a whole-dollar numeric figure What is your total income: -300 Your income cannot be negative What is your total income: 0 How many children do you have sdjdsf You nust enter a valid number How nany children do you have:3 You nust enter a positive number How nany children do you have: 0 You owe no tax Hit Enter to exitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started