Answered step by step

Verified Expert Solution

Question

1 Approved Answer

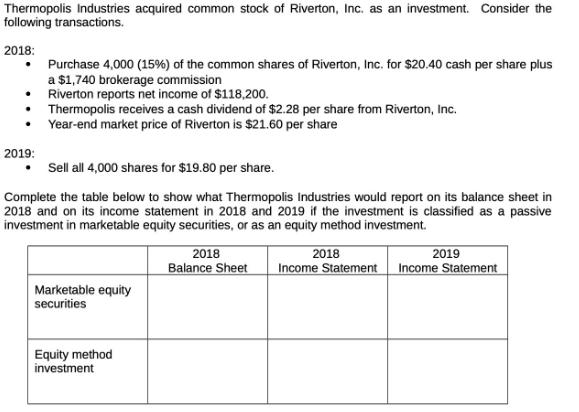

Thermopolis Industries acquired common stock of Riverton, Inc. as an investment. Consider the following transactions. 2018: Purchase 4,000 (15%) of the common shares of

Thermopolis Industries acquired common stock of Riverton, Inc. as an investment. Consider the following transactions. 2018: Purchase 4,000 (15%) of the common shares of Riverton, Inc. for $20.40 cash per share plus a $1,740 brokerage commission Riverton reports net income of $118,200. 2019: Thermopolis receives a cash dividend of $2.28 per share from Riverton, Inc. Year-end market price of Riverton is $21.60 per share Sell all 4,000 shares for $19.80 per share. Complete the table below to show what Thermopolis Industries would report on its balance sheet in 2018 and on its income statement in 2018 and 2019 if the investment is classified as a passive investment in marketable equity securities, or as an equity method investment. Marketable equity securities Equity method investment 2018 2018 2019 Balance Sheet Income Statement Income Statement

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Marketable Equity Securities 2018 Balance Sheet Investment in Riverton Inc 4000 shares at 216...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started