Answered step by step

Verified Expert Solution

Question

1 Approved Answer

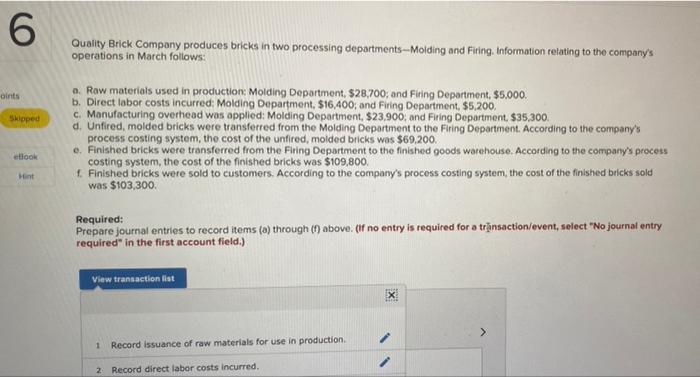

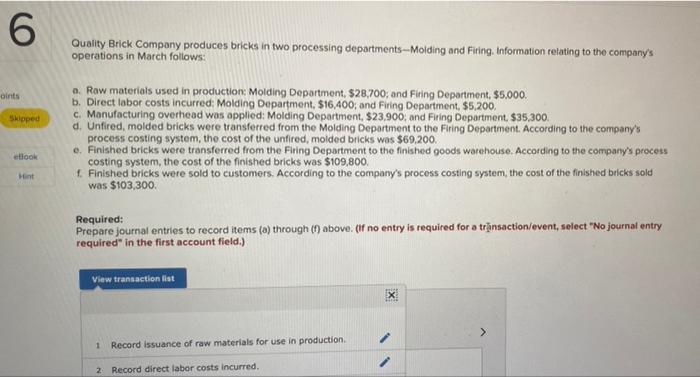

these are two questions 6 Quality Brick Company produces bricks in two processing departments --Molding and Firing Information relating to the company's operations in March

these are two questions

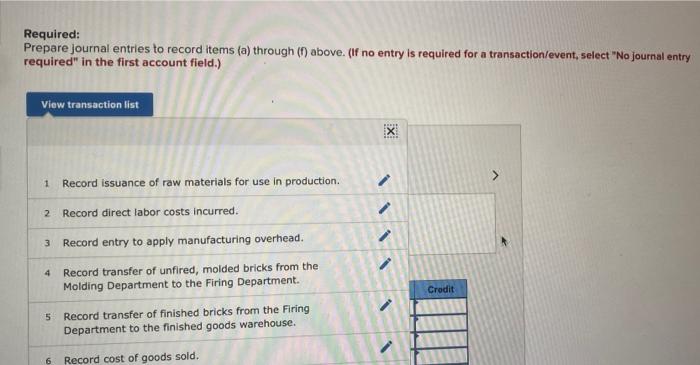

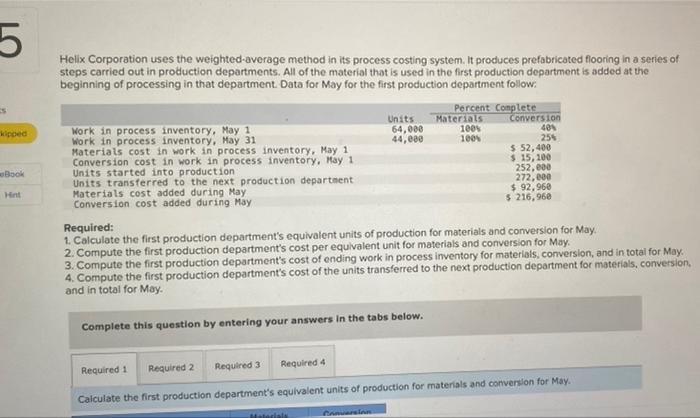

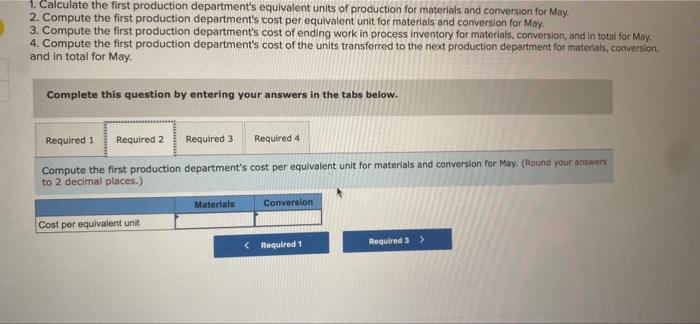

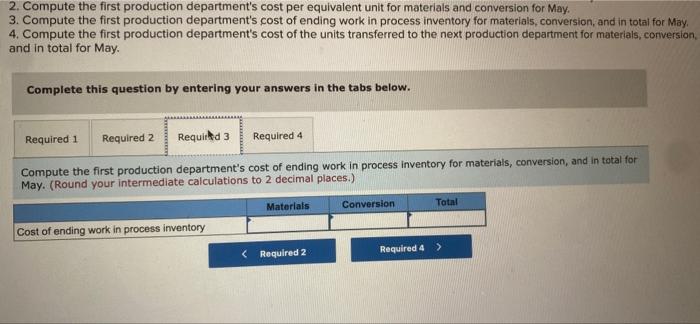

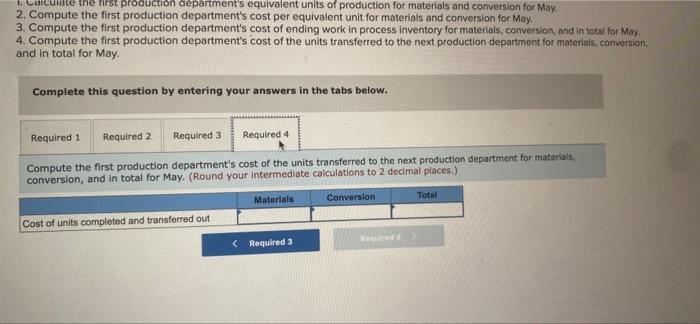

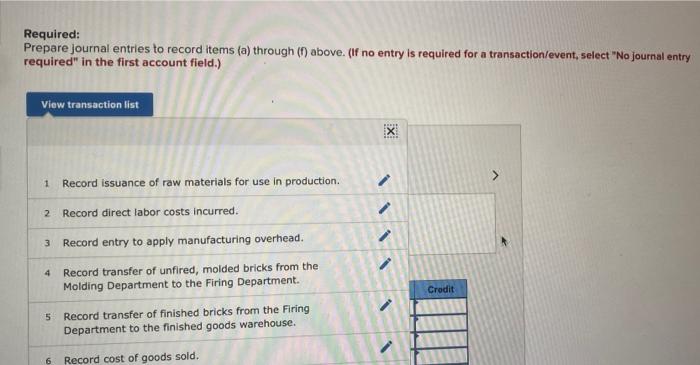

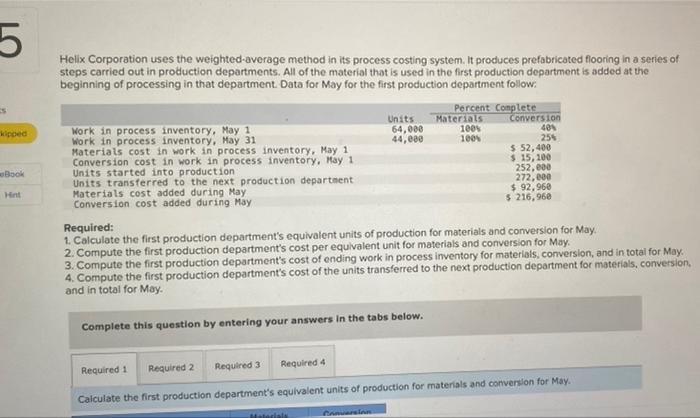

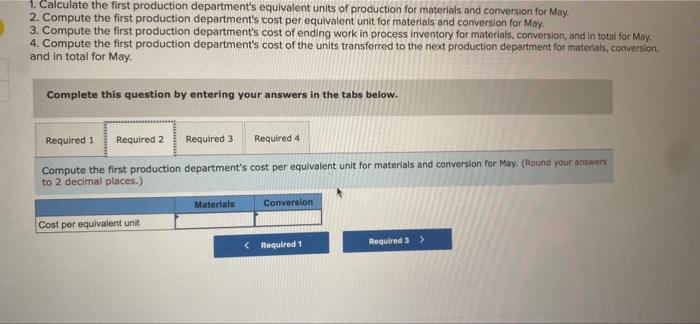

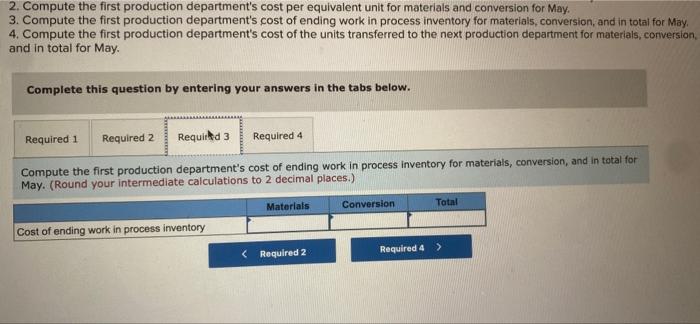

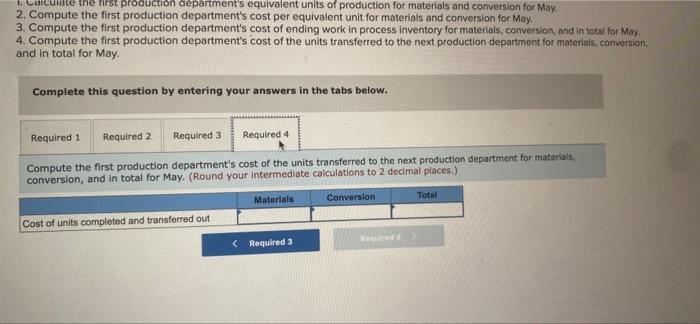

6 Quality Brick Company produces bricks in two processing departments --Molding and Firing Information relating to the company's operations in March follows: oints Skloped a. Row materials used in production: Molding Department, $28,700; and Firing Department, $5,000, b. Direct labor costs incurred: Molding Department, $16,400, and Firing Department, $5,200. c. Manufacturing overhead was applied: Molding Department. $23,900, and Firing Department. $35,300. d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's process costing system, the cost of the unfired, molded bricks was $69,200. e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process costing system, the cost of the finished bricks was $109,800 1. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold was $103,300 took Hint Required: Prepare journal entries to record items (a) through (1) above. (if no entry is required for a trnsaction/event, select "No journal entry required" in the first account field.) View transaction fiat EX > 1 Record issuance of raw materials for use in production 2 Record direct labor costs incurred. Required: Prepare journal entries to record items (a) through (1) above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list X 1 Record issuance of raw materials for use in production. 2 Record direct labor costs incurred. 3 Record entry to apply manufacturing overhead. 4 Record transfer of unfired, molded bricks from the Molding Department to the Firing Department. Credit 5 Record transfer of finished bricks from the Firing Department to the finished goods warehouse. 6 Record cost of goods sold. 5 kiped Book Hellx Corporation uses the weighted-average method in its process costing system. It produces prefabricated flooring in a series of steps carried out in production departments. All of the material that is used in the first production department is added at the beginning of processing in that department Data for May for the first production department follow. Percent Complete Units Materials Conversion Work in process inventory, May 1 64,000 100% 401 Work in process inventory, May 31 44,000 1001 255 Materials cost in work in process inventory, May 1 $ 52,400 Conversion cost in work in process inventory, May 1 $ 15,100 Units started into production 252,000 Units transferred to the next production department 272,000 Materials cost added during May $ 92,960 Conversion cost added during May $ 216,960 Required: 1. Calculate the first production department's equivalent units of production for materia and conversion for May 2. Compute the first production department's cost per equivalent unit for materials and conversion for May. 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May. 4. Compute the first production department's cost of the units transferred to the next production department for materials, conversion, and in total for May. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the first production department's equivalent units of production for materials and conversion for May. Malas 1. Calculate the first production department's equivalent units of production for materials and conversion for May 2. Compute the first production department's cost per equivalent unit for materials and conversion for May 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May. 4. Compute the first production department's cost of the units transferred to the next production department for materials, conversion, and in total for May Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the first production department's cost per equivalent unit for materials and conversion for May (Round your answers to 2 decimal places.) Materials Conversion Cost per equivalent unit 2. Compute the first production department's cost per equivalent unit for materials and conversion for May. 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May 4. Compute the first production department's cost of the units transferred to the next production department for materials, conversion and in total for May Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May. (Round your intermediate calculations to 2 decimal places.) Materials Conversion Total Cost of ending work in process inventory Required 2 Required 4 > 1. Calculate the first production department's equivalent units of production for materials and conversion for May 2. Compute the first production department's cost per equivalent unit for materials and conversion for May 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May. 4. Compute the first production department's cost of the units transferred to the next production department for materials, conversion, and in total for May Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the first production department's cost of the units transferred to the next production department for materials, conversion, and in total for May. (Round your intermediate calculations to 2 decimal places.) Materials Conversion Total Cost of units completed and transferred out

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started