Answered step by step

Verified Expert Solution

Question

1 Approved Answer

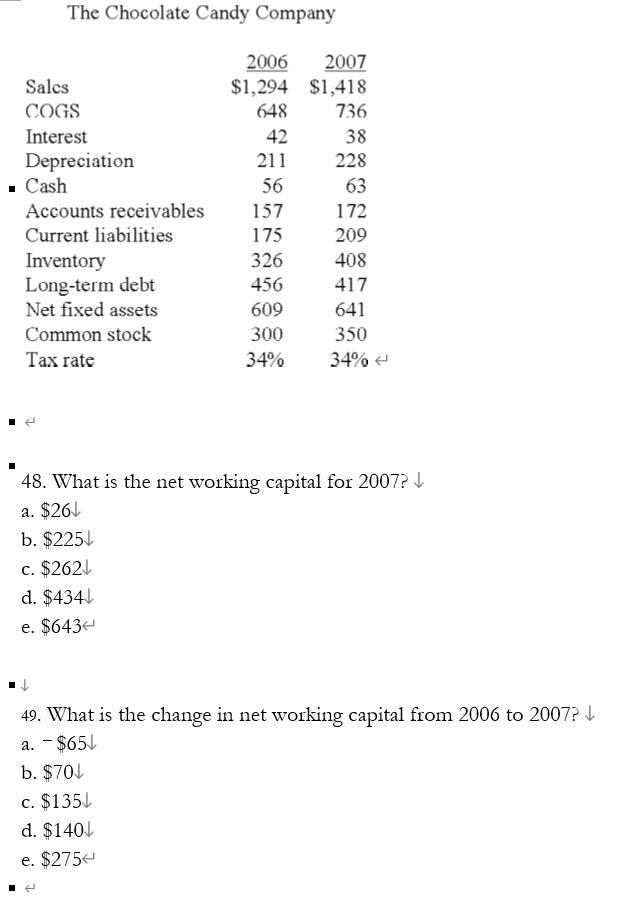

these questions are based on the same table The Chocolate Candy Company Sales COGS Interest Depreciation . Cash Accounts receivables Current liabilities Inventory Long-term debt

these questions are based on the same table

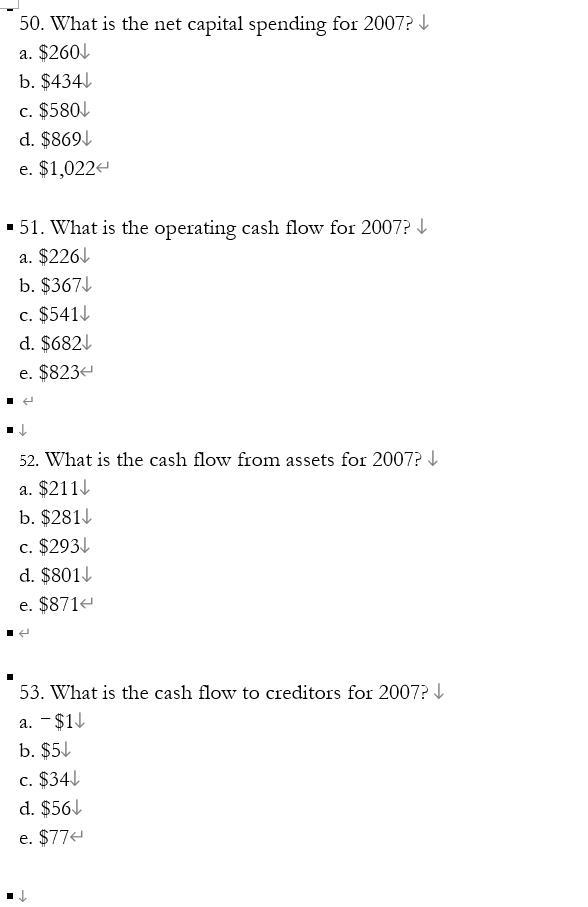

The Chocolate Candy Company Sales COGS Interest Depreciation . Cash Accounts receivables Current liabilities Inventory Long-term debt Net fixed assets Common stock Tax rate 2006 2007 $1,294 $1,418 648 736 42 38 211 228 56 63 157 172 175 209 326 408 456 417 609 641 300 350 34% 34% 48. What is the net working capital for 2007? a. $261 b. $2251 c. $2621 d. $4341 e. $643 49. What is the change in net working capital from 2006 to 2007? a. - $651 b. $701 c. $1354 d. $1401 e. $2754 50. What is the net capital spending for 2007? a. $2601 b. $4341 c. $5801 d. $8691 e. $1,022 .51. What is the operating cash flow for 2007? a. $226/ b. $3671 c. $541 d. $6821 e. $823+ 52. What is the cash flow from assets for 2007? a. $2111 b. $281) c. $2931 d. $801 e. $8714 53. What is the cash flow to creditors for 2007? a. - $11 b. $51 c. $341 d. $561 e. $774Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started