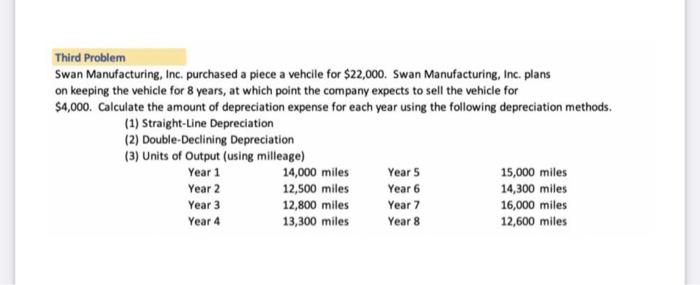

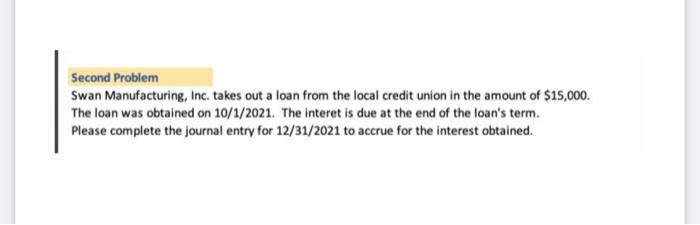

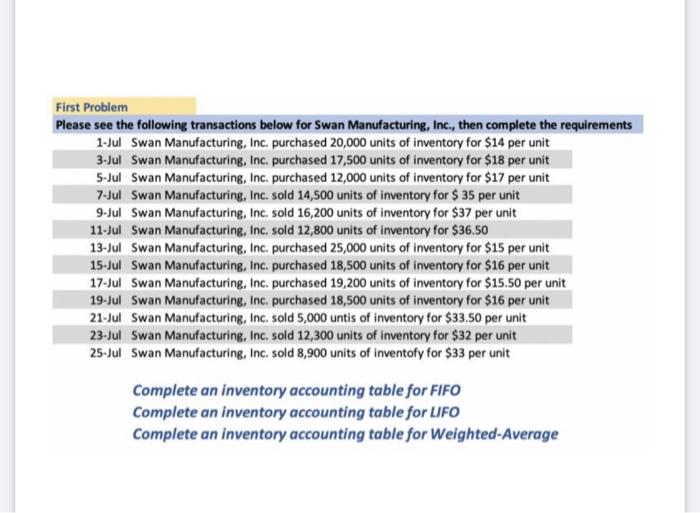

Third Problem Swan Manufacturing, Inc. purchased a piece a vehcile for $22,000. Swan Manufacturing, Inc. plans on keeping the vehicle for 8 years, at which point the company expects to sell the vehicle for $4,000. Calculate the amount of depreciation expense for each year using the following depreciation methods. (1) Straight-Line Depreciation (2) Double-Declining Depreciation (3) Units of Output (using milleage) Year 1 14,000 miles Year 5 15,000 miles Year 2 12,500 miles Year 6 14,300 miles Year 3 12,800 miles Year 7 16,000 miles Year 4 13,300 miles Year 8 12,600 miles Second Problem Swan Manufacturing, Inc. takes out a loan from the local credit union in the amount of $15,000. The loan was obtained on 10/1/2021. The interet is due at the end of the loan's term. Please complete the journal entry for 12/31/2021 to accrue for the interest obtained. First Problem Please see the following transactions below for Swan Manufacturing, Inc., then complete the requirements 1-Jul Swan Manufacturing, Inc. purchased 20,000 units of inventory for $14 per unit 3-Jul Swan Manufacturing, Inc. purchased 17,500 units of inventory for $18 per unit 5-Jul Swan Manufacturing, Inc. purchased 12,000 units of inventory for $17 per unit 7-Jul Swan Manufacturing, Inc. sold 14,500 units of inventory for $ 35 per unit 9-Jul Swan Manufacturing, Inc. sold 16,200 units of inventory for $37 per unit 11-Jul Swan Manufacturing, Inc. sold 12,800 units of inventory for $36.50 13-Jul Swan Manufacturing, Inc. purchased 25,000 units of inventory for $15 per unit 15-Jul Swan Manufacturing, Inc. purchased 18,500 units of inventory for $16 per unit 17-Jul Swan Manufacturing, Inc. purchased 19,200 units of inventory for $15.50 per unit 19-Jul Swan Manufacturing, Inc. purchased 18,500 units of inventory for $16 per unit 21-Jul Swan Manufacturing, Inc. sold 5,000 untis of inventory for $33.50 per unit 23-Jul Swan Manufacturing, Inc. sold 12,300 units of inventory for $32 per unit 25-Jul Swan Manufacturing, Inc. sold 8,900 units of inventofy for $33 per unit Complete an inventory accounting table for FIFO Complete an inventory accounting table for LIFO Complete an inventory accounting table for Weighted-Average