Question

This formula explains how a higher ROIC is the result of a competitive advantage from being able to charge a higher price or being able

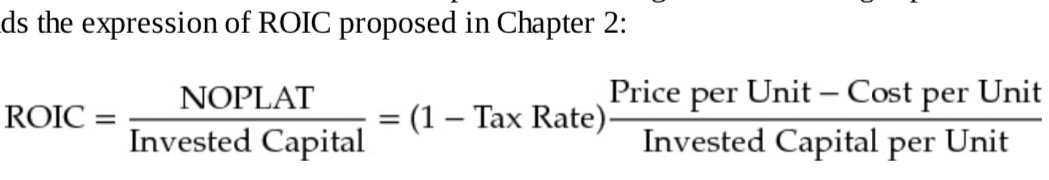

This formula explains how a higher ROIC is the result of a competitive advantage from being able to charge a higher price or being able to produce at a lower cost. The structure-conduct- performance (SCP) framework provides a strategy model for competitive advantage. One of the most widely used approaches in analyzing strategy is Porter's framework, which focuses on threat of entry, pressure from substitute products, bargaining power of buyers, bargaining power of suppliers, and the degree of rivalry among existing competitors. These forces differ widely by industry. Five pricing advantages and four cost advantages determine overall competitive advantage. The five pricing advantages are innovative products, quality, brand, customer lock-in, and rational price discipline. The four cost advantages are innovative business methods, unique resources, economies of scale, and scalable products/processes. In a competitive economy, the pricing and cost advantages can erode through competition, and the sustainability of the high ROIC from a competitive advantage depends on issues such as the length of the life cycle of the business and the potential for renewing products. The evidence shows that the relative ROIC of a firm to the average of all other firms and to the firms in the industry remains fairly sustainable for periods of 10 years or more; however, there will be some reversion to the median and/or mean. 1. List Michael Porter's five forces:

A. ________________________________________. B.________________________________________. C._______________________________________. D.______________________________________. E.______________________________________. 2.ThekeydriverofROICis____________________.

A. ________________________________________. B.________________________________________. C._______________________________________. D.______________________________________. E.______________________________________. 2.ThekeydriverofROICis____________________.

3. According to empirical studies over the past five decades, how successful have firms been in sustaining their rates of ROIC?

4.ExplainwhatqualitymeansinthecontextofcompetitiveadvantageandROIC.

5.Forapricingadvantage,usingrationalpricingdisciplinerequireseithera__________or __________. 6.Explainthedifferencebetweeneconomiesofscaleandscalableproducts.

7.Between1963andtheearly2000s,themedianROICwasabout__________percent,and the interquartile range was from __________ percent to __________ percent.

8.Sincetheearly2000s,themedianROICwasabout__________percent,andthe interquartile range was from __________ percent to _________ percent.

9.TheincreaseinmedianROICandthewideningofthedistributionofROICsaretheresult of ____________________.

10.ThereasonfortheincreasingdifferencebetweenROICwithoutgoodwillandROIC including goodwill is___________________.

11.Fromhighesttolowest,rankthefollowingthreeindustriesbasedonROIC.Theyhavebeen selected based on branding advantages and barriers to entry. A. Paper, forest products.

1. __________ B. Pharmaceuticals

2. __________ C. Consumer staples

3. __________ D. Health care equipment, supplies

4. __________

12. If a firm establishes it self as a high-ROIC firm, within 10 years it is expected that the ROIC will:

A. Have fallen to the average or be below the average ROIC.

B. Have fallen, but will still be above the average ROIC.

C.Nothavefallen,andwillmaintainaboutthesame.

D. Have continued to trend up.

13.Giventhatacompanycharges$3.40perunit,hasacostperunitof$1.80,hasataxrateof 32 percent, and requires $16 of invested capital per unit, what is the ROIC?

A. 6.8percent.

B. 10.2 percent.

C. 15.6 percent.

D. 30.3 percent.

14.Cerealmanufacturershavebeensuccessfulatbrandingtheirproducts,whilemeat producers have been unable to do so to a large degree. Based on this fact, which of the following is the most accurate concerning the pricing advantage that cereal manufacturers have over meat producers?

A.TheROICforcerealmanufacturersislessthanthatofmeatproducersbecause branding does not create value and branding has a cost.

B. The ROIC for cereal manufacturers is equal to that of meat producers because the costs and benefits reach an equilibrium.

C.TheROICforcerealmanufacturersistwiceashighasthatofmeatproducers.

D.TheROICforcerealmanufacturersisthreetimesashighasthatofmeatproducers.

ds the expression of ROIC proposed in Chapter 2 : ROIC=InvestedCapitalNOPLAT=(1TaxRate)InvestedCapitalperUnitPriceperUnitCostperUnitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started