Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a picture of my question Consider a risky asset X with an expected rate of return of 12% and a standard deviation of

This is a picture of my question

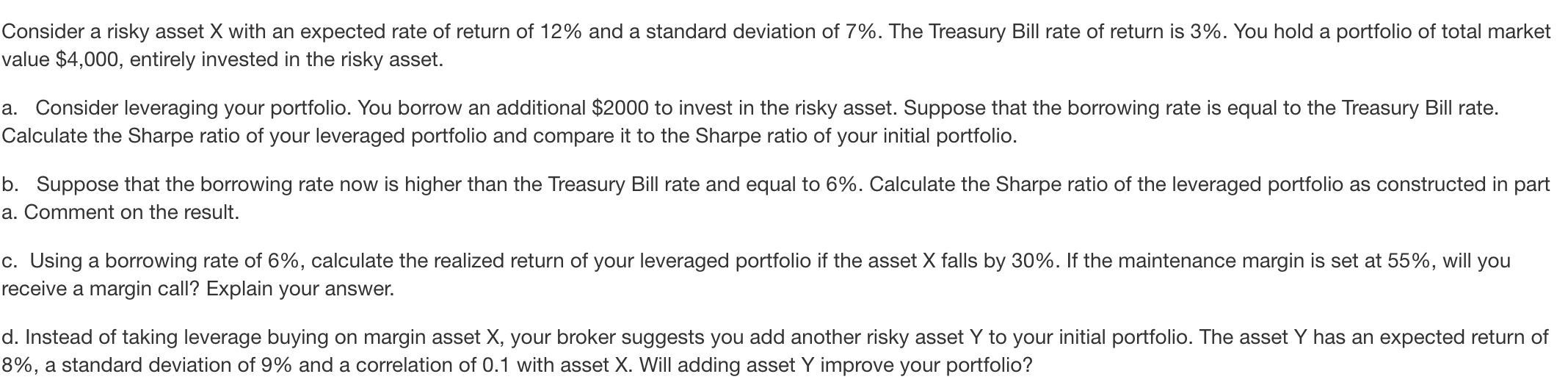

Consider a risky asset X with an expected rate of return of 12% and a standard deviation of 7%. The Treasury Bill rate of return is 3%. You hold a portfolio of total market value $4,000, entirely invested in the risky asset. a. Consider leveraging your portfolio. You borrow an additional $2000 to invest in the risky asset. Suppose that the borrowing rate is equal to the Treasury Bill rate. Calculate the Sharpe ratio of your leveraged portfolio and compare it to the Sharpe ratio of your initial portfolio. b. Suppose that the borrowing rate now is higher than the Treasury Bill rate and equal to 6%. Calculate the Sharpe ratio of the leveraged portfolio as constructed in part a. Comment on the result. 0. Using a borrowing rate of 6%, calculate the realized return of your leveraged portfolio if the asset X falls by 30%. If the maintenance margin is set at 55%, will you receive a margin call? Explain your answer. d. Instead of taking leverage buying on margin asset X, your broker suggests you add another risky asset Y to your initial portfolio. The asset Y has an expected return of 8%, a standard deviation of 9% and a correlation of 0.1 with asset X. Will adding asset Y improve your portfolio

Consider a risky asset X with an expected rate of return of 12% and a standard deviation of 7%. The Treasury Bill rate of return is 3%. You hold a portfolio of total market value $4,000, entirely invested in the risky asset. a. Consider leveraging your portfolio. You borrow an additional $2000 to invest in the risky asset. Suppose that the borrowing rate is equal to the Treasury Bill rate. Calculate the Sharpe ratio of your leveraged portfolio and compare it to the Sharpe ratio of your initial portfolio. b. Suppose that the borrowing rate now is higher than the Treasury Bill rate and equal to 6%. Calculate the Sharpe ratio of the leveraged portfolio as constructed in part a. Comment on the result. 0. Using a borrowing rate of 6%, calculate the realized return of your leveraged portfolio if the asset X falls by 30%. If the maintenance margin is set at 55%, will you receive a margin call? Explain your answer. d. Instead of taking leverage buying on margin asset X, your broker suggests you add another risky asset Y to your initial portfolio. The asset Y has an expected return of 8%, a standard deviation of 9% and a correlation of 0.1 with asset X. Will adding asset Y improve your portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started