Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a question from my Accounting Major course, the course focuses on taxation in Bangladesh. The format we are taught contains 2 categories, Admissible

This is a question from my Accounting Major course, the course focuses on taxation in Bangladesh. The format we are taught contains 2 categories, Admissible and Inadmissible cost which are adjusted accordingly to the net profit (may vary, not sure) to find the taxable income (or whatever the question requires).

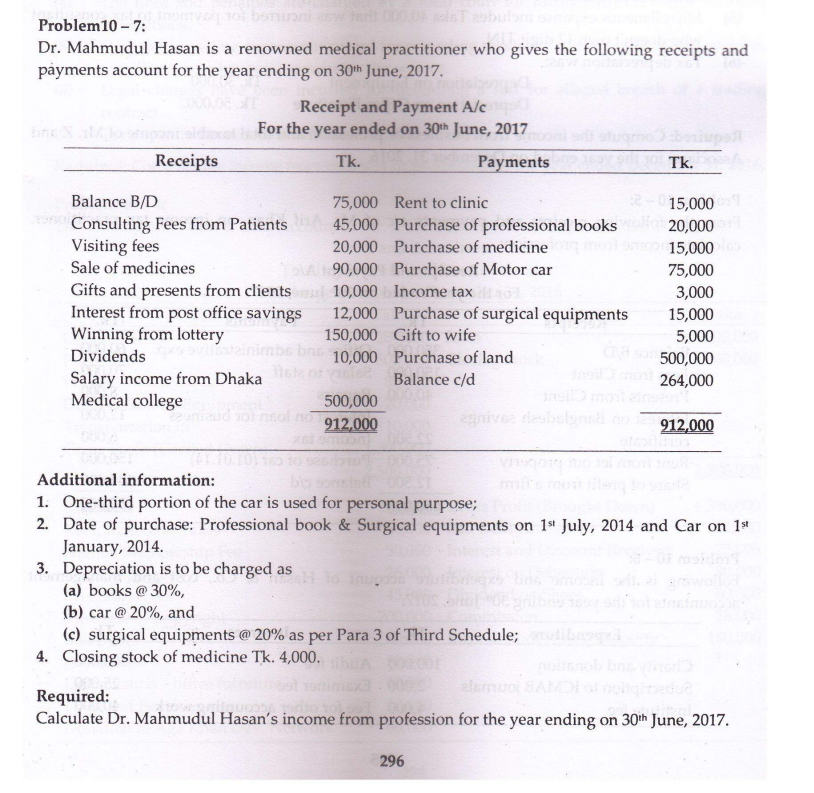

Problem 10 - 7: Dr. Mahmudul Hasan is a renowned medical practitioner who gives the following receipts and payments account for the year ending on 30th June, 2017. Receipt and Payment A/c For the year ended on 30th June, 2017 Receipts Tk. Payments Tk. Balance B/D 75,000 Rent to clinic Consulting Fees from Patients 45,000 Purchase of professional books Visiting fees 20,000 Purchase of medicine Sale of medicines 90,000 Purchase of Motor car Gifts and presents from clients 10,000 Income taxe Interest from post office savings 12,000 Purchase of surgical equipments Winning from lottery 150,000 Gift to wife Dividends 10,000 Purchase of land Salary income from Dhaka Balance c/d Medical college 500,000 912,000 15,000 20,000 15,000 75,000 3,000 15,000 5,000 500,000 264,000 912,000 Additional information: 1. One-third portion of the car is used for personal purpose; 2. Date of purchase: Professional book & Surgical equipments on 1st July, 2014 and Car on 13 January, 2014. 3. Depreciation is to be charged as (a) books @ 30%, (b) car @ 20%, and (c) surgical equipments @ 20% as per Para 3 of Third Schedule; 4. Closing stock of medicine Tk. 4,000. Required: Calculate Dr. Mahmudul Hasan's income from profession for the year ending on 30ih June, 2017 296

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started