Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is about financing growth and on this chapter I am stuck on these two questions, if you can explain how you got your answers

This is about financing growth and on this chapter I am stuck on these two questions, if you can explain how you got your answers it would be greatly apprecatied!

Thanks

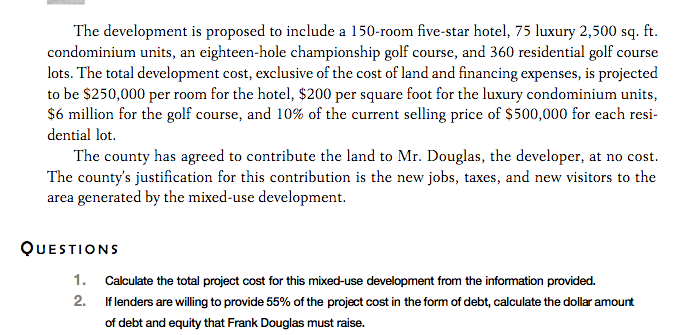

The development i proposed to include a 150-room five-star hotel, 75 luxury 2,500 sq. ft. condominium units, an eighteen-hole championship golf course, and 360 residential golf course lots. The total development cost, exclusive of the cost of land and financing expenses, is projected to be $250,000 per room for the hotel, $200 per square foot for the luxury condominium units $6 million for the golf course, and 10% of the current selling price of $500,000 for each resi- dential lot The county has agreed to contribute the land to Mr. Douglas, the developer, at no cost. The county's justification for this contribution is the new jobs, taxes, and new visitors to the area generated by the mixed-use development QUESTIONS 1. Calculate the total project cost for this mixed-use development from the information provided. 2. lflenders are willing to provide 55% of the project cost in the form of debt, calculate the dollar amount of debt and equity that Frank Douglas must raiseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started