Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is audit. Please help me solve this questions. Your firm, AJ & Co has been appointed as the external auditor of Leek Sdn Bhd,

This is audit. Please help me solve this questions.

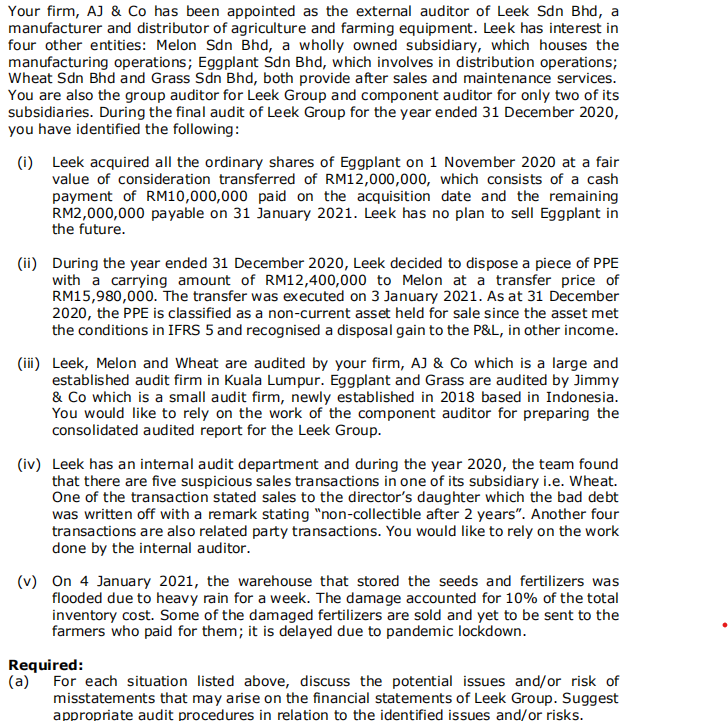

Your firm, AJ & Co has been appointed as the external auditor of Leek Sdn Bhd, a manufacturer and distributor of agriculture and farming equipment. Leek has interest in four other entities: Melon Sdn Bhd, a wholly owned subsidiary, which houses the manufacturing operations; Eggplant Sdn Bhd, which involves in distribution operations; Wheat Sdn Bhd and Grass Sdn Bhd, both provide after sales and maintenance services. You are also the group auditor for Leek Group and component auditor for only two of its subsidiaries. During the final audit of Leek Group for the year ended 31 December 2020, you have identified the following: (1) Leek acquired all the ordinary shares of Eggplant on 1 November 2020 at a fair value of consideration transferred of RM12,000,000, which consists of a cash payment of RM10,000,000 paid on the acquisition date and the remaining RM2,000,000 payable on 31 January 2021. Leek has no plan to sell Eggplant in the future. (ii) During the year ended 31 December 2020, Leek decided to dispose a piece of PPE with a carrying amount of RM12,400,000 to Melon at a transfer price of RM15,980,000. The transfer was executed on 3 January 2021. As at 31 December 2020, the PPE is classified as a non-current asset held for sale since the asset met the conditions in IFRS 5 and recognised a disposal gain to the P&L, in other income. (ii) Leek, Melon and Wheat are audited by your firm, AJ & Co which is a large and established audit firm in Kuala Lumpur. Eggplant and Grass are audited by Jimmy & Co which is a small audit firm, newly established in 2018 based in Indonesia. You would like to rely on the work of the component auditor for preparing the consolidated audited report for the Leek Group. (iv) Leek has an intemal audit department and during the year 2020, the team found that there are five suspicious sales transactions in one of its subsidiary i.e. Wheat. One of the transaction stated sales to the director's daughter which the bad debt was written off with a remark stating "non-collectible after 2 years". Another four transactions are also related party transactions. You would like to rely on the work done by the internal auditor. (v) On 4 January 2021, the warehouse that stored the seeds and fertilizers was flooded due to heavy rain for a week. The damage accounted for 10% of the total inventory cost. Some of the damaged fertilizers are sold and yet to be sent to the farmers who paid for them; it is delayed due to pandemic lockdown. Required: (a) For each situation listed above, discuss the potential issues and/or risk of misstatements that may arise on the financial statements of Leek Group. Suggest appropriate audit procedures in relation to the identified issues and/or risks. Your firm, AJ & Co has been appointed as the external auditor of Leek Sdn Bhd, a manufacturer and distributor of agriculture and farming equipment. Leek has interest in four other entities: Melon Sdn Bhd, a wholly owned subsidiary, which houses the manufacturing operations; Eggplant Sdn Bhd, which involves in distribution operations; Wheat Sdn Bhd and Grass Sdn Bhd, both provide after sales and maintenance services. You are also the group auditor for Leek Group and component auditor for only two of its subsidiaries. During the final audit of Leek Group for the year ended 31 December 2020, you have identified the following: (1) Leek acquired all the ordinary shares of Eggplant on 1 November 2020 at a fair value of consideration transferred of RM12,000,000, which consists of a cash payment of RM10,000,000 paid on the acquisition date and the remaining RM2,000,000 payable on 31 January 2021. Leek has no plan to sell Eggplant in the future. (ii) During the year ended 31 December 2020, Leek decided to dispose a piece of PPE with a carrying amount of RM12,400,000 to Melon at a transfer price of RM15,980,000. The transfer was executed on 3 January 2021. As at 31 December 2020, the PPE is classified as a non-current asset held for sale since the asset met the conditions in IFRS 5 and recognised a disposal gain to the P&L, in other income. (ii) Leek, Melon and Wheat are audited by your firm, AJ & Co which is a large and established audit firm in Kuala Lumpur. Eggplant and Grass are audited by Jimmy & Co which is a small audit firm, newly established in 2018 based in Indonesia. You would like to rely on the work of the component auditor for preparing the consolidated audited report for the Leek Group. (iv) Leek has an intemal audit department and during the year 2020, the team found that there are five suspicious sales transactions in one of its subsidiary i.e. Wheat. One of the transaction stated sales to the director's daughter which the bad debt was written off with a remark stating "non-collectible after 2 years". Another four transactions are also related party transactions. You would like to rely on the work done by the internal auditor. (v) On 4 January 2021, the warehouse that stored the seeds and fertilizers was flooded due to heavy rain for a week. The damage accounted for 10% of the total inventory cost. Some of the damaged fertilizers are sold and yet to be sent to the farmers who paid for them; it is delayed due to pandemic lockdown. Required: (a) For each situation listed above, discuss the potential issues and/or risk of misstatements that may arise on the financial statements of Leek Group. Suggest appropriate audit procedures in relation to the identified issues and/or risksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started