Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is financial math IBM stock currently sells for $139. Assume that it follows a GBM process with a dividend yield d = 3.77%. Interest

this is financial math

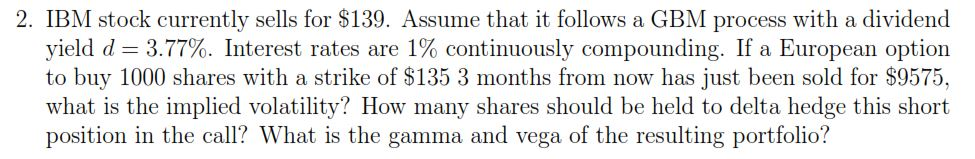

IBM stock currently sells for $139. Assume that it follows a GBM process with a dividend yield d = 3.77%. Interest rates are 1% continuously compounding. If a European option to buy 1000 shares with a strike of $135 3 months from now has just been sold for $9575, what is the implied volatility? How many shares should be held to delta hedge this short position in the call? What is the gamma and vega of the resulting portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started