Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*************************************************************************************************************************************************** THIS IS TAXATION MALAYSIA ACCA QUESTION 5 Cemara Technology Sdn Bhd (Cemara) is a resident company in the business of the manufacture and sale

***************************************************************************************************************************************************

THIS IS TAXATION MALAYSIA ACCA

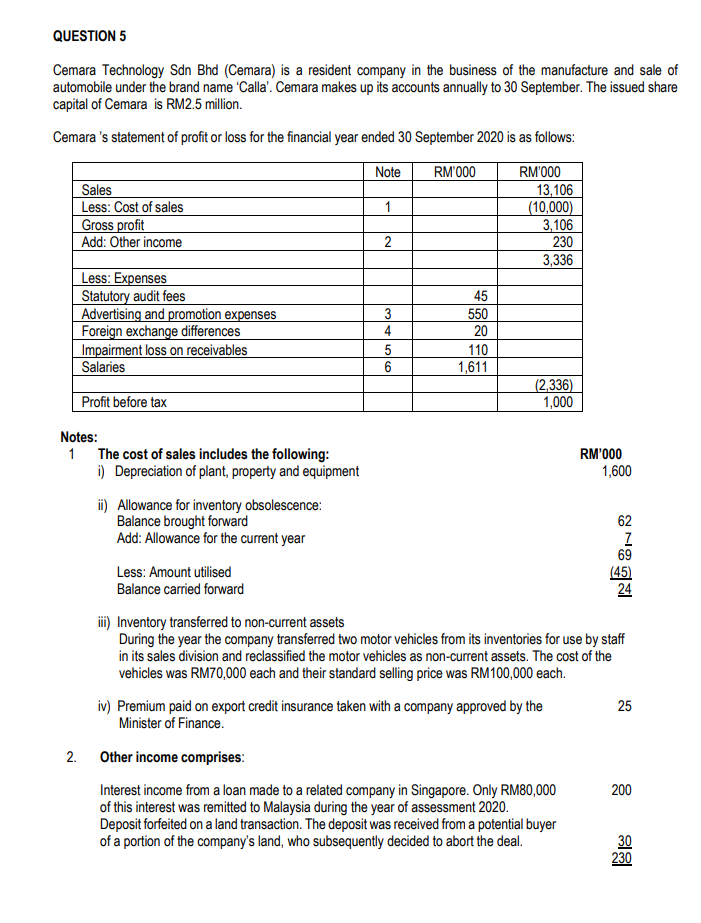

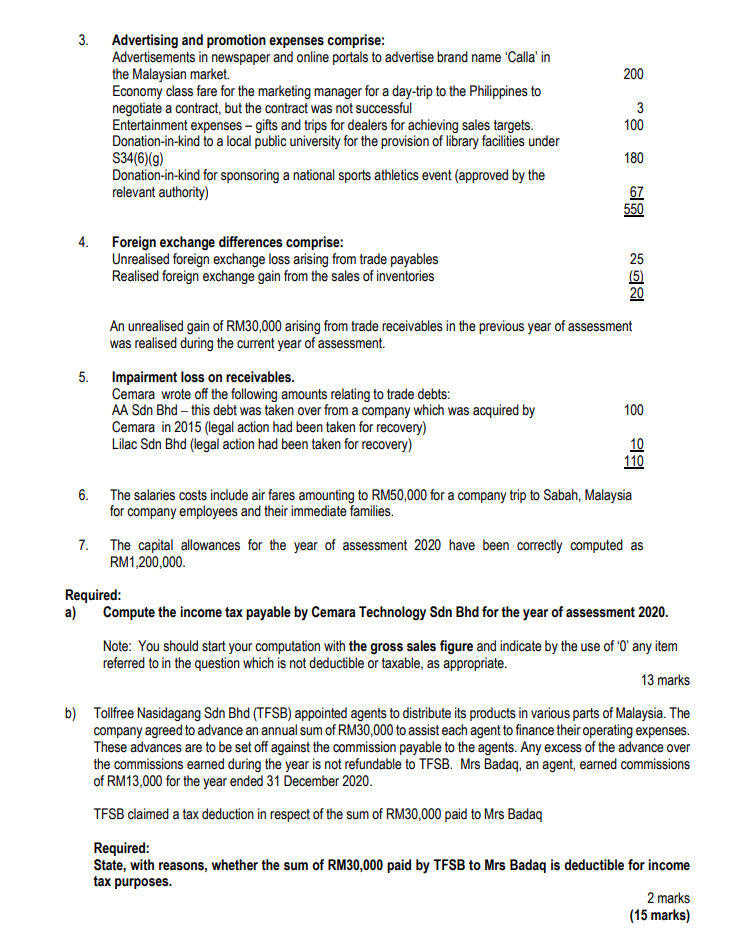

QUESTION 5 Cemara Technology Sdn Bhd (Cemara) is a resident company in the business of the manufacture and sale of automobile under the brand name 'Calla'. Cemara makes up its accounts annually to 30 September. The issued share capital of Cemara is RM2.5 million. Cemara 's statement of profit or loss for the financial year ended 30 September 2020 is as follows: Note RM'000 1 Sales Less: Cost of sales Gross profit Add: Other income RM'000 13,106 (10,000) 3,106 230 3,336 2 45 550 Less: Expenses Statutory audit fees Advertising and promotion expenses Foreign exchange differences Impairment loss on receivables Salaries 3 4 5 6 20 110 1,611 Profit before tax (2,336) 1,000 Notes: 1 The cost of sales includes the following: RM'000 i) Depreciation of plant, property and equipment 1,600 ii) Allowance for inventory obsolescence: Balance brought forward 62 Add: Allowance for the current year Z 69 Less: Amount utilised (45) Balance carried forward 24 iii) Inventory transferred to non-current assets During the year the company transferred two motor vehicles from its inventories for use by staff in its sales division and reclassified the motor vehicles as non-current assets. The cost of the vehicles was RM70,000 each and their standard selling price was RM100,000 each. iv) Premium paid on export credit insurance taken with a company approved by the 25 Minister of Finance 2. Other income comprises: Interest income from a loan made to a related company in Singapore. Only RM80,000 200 of this interest was remitted to Malaysia during the year of assessment 2020. Deposit forfeited on a land transaction. The deposit was received from a potential buyer of a portion of the company's land, who subsequently decided to abort the deal. 30 230 3. 200 Advertising and promotion expenses comprise: Advertisements in newspaper and online portals to advertise brand name 'Calla' in the Malaysian market. Economy class fare for the marketing manager for a day-trip to the Philippines to negotiate a contract, but the contract was not successful Entertainment expenses - gifts and trips for dealers for achieving sales targets. Donation-in-kind to a local public university for the provision of library facilities under S34(6)(9) Donation-in-kind for sponsoring a national sports athletics event (approved by the relevant authority) 3 100 180 67 550 4. Foreign exchange differences comprise: Unrealised foreign exchange loss arising from trade payables Realised foreign exchange gain from the sales of inventories 25 (5) 20 An unrealised gain of RM30,000 arising from trade receivables in the previous year of assessment was realised during the current year of assessment. 5. Impairment loss on receivables. Cemara wrote off the following amounts relating to trade debts: AA Sdn Bhd this debt was taken over from a company which was acquired by Cemara in 2015 (legal action had been taken for recovery) Lilac Sdn Bhd (legal action had been taken for recovery) 100 10 110 6. The salaries costs include air fares amounting to RM50,000 for a company trip to Sabah, Malaysia for company employees and their immediate families. 7. The capital allowances for the year of assessment 2020 have been correctly computed as RM1,200,000 Required: a) Compute the income tax payable by Cemara Technology Sdn Bhd for the year of assessment 2020. Note: You should start your computation with the gross sales figure and indicate by the use of 'O' any item referred to in the question which is not deductible or taxable, as appropriate. 13 marks b) Tollfree Nasidagang Sdn Bhd (TFSB) appointed agents to distribute its products in various parts of Malaysia. The company agreed to advance an annual sum of RM30,000 to assist each agent to finance their operating expenses. These advances are to be set off against the commission payable to the agents. Any excess of the advance over the commissions earned during the year is not refundable to TFSB. Mrs Badaq, an agent, earned commissions of RM13,000 for the year ended 31 December 2020. TFSB claimed a tax deduction in respect of the sum of RM30,000 paid to Mrs Badaq Required: State, with reasons, whether the sum of RM30,000 paid by TFSB to Mrs Badaq is deductible for income tax purposes. 2 marks (15 marks) QUESTION 5 Cemara Technology Sdn Bhd (Cemara) is a resident company in the business of the manufacture and sale of automobile under the brand name 'Calla'. Cemara makes up its accounts annually to 30 September. The issued share capital of Cemara is RM2.5 million. Cemara 's statement of profit or loss for the financial year ended 30 September 2020 is as follows: Note RM'000 1 Sales Less: Cost of sales Gross profit Add: Other income RM'000 13,106 (10,000) 3,106 230 3,336 2 45 550 Less: Expenses Statutory audit fees Advertising and promotion expenses Foreign exchange differences Impairment loss on receivables Salaries 3 4 5 6 20 110 1,611 Profit before tax (2,336) 1,000 Notes: 1 The cost of sales includes the following: RM'000 i) Depreciation of plant, property and equipment 1,600 ii) Allowance for inventory obsolescence: Balance brought forward 62 Add: Allowance for the current year Z 69 Less: Amount utilised (45) Balance carried forward 24 iii) Inventory transferred to non-current assets During the year the company transferred two motor vehicles from its inventories for use by staff in its sales division and reclassified the motor vehicles as non-current assets. The cost of the vehicles was RM70,000 each and their standard selling price was RM100,000 each. iv) Premium paid on export credit insurance taken with a company approved by the 25 Minister of Finance 2. Other income comprises: Interest income from a loan made to a related company in Singapore. Only RM80,000 200 of this interest was remitted to Malaysia during the year of assessment 2020. Deposit forfeited on a land transaction. The deposit was received from a potential buyer of a portion of the company's land, who subsequently decided to abort the deal. 30 230 3. 200 Advertising and promotion expenses comprise: Advertisements in newspaper and online portals to advertise brand name 'Calla' in the Malaysian market. Economy class fare for the marketing manager for a day-trip to the Philippines to negotiate a contract, but the contract was not successful Entertainment expenses - gifts and trips for dealers for achieving sales targets. Donation-in-kind to a local public university for the provision of library facilities under S34(6)(9) Donation-in-kind for sponsoring a national sports athletics event (approved by the relevant authority) 3 100 180 67 550 4. Foreign exchange differences comprise: Unrealised foreign exchange loss arising from trade payables Realised foreign exchange gain from the sales of inventories 25 (5) 20 An unrealised gain of RM30,000 arising from trade receivables in the previous year of assessment was realised during the current year of assessment. 5. Impairment loss on receivables. Cemara wrote off the following amounts relating to trade debts: AA Sdn Bhd this debt was taken over from a company which was acquired by Cemara in 2015 (legal action had been taken for recovery) Lilac Sdn Bhd (legal action had been taken for recovery) 100 10 110 6. The salaries costs include air fares amounting to RM50,000 for a company trip to Sabah, Malaysia for company employees and their immediate families. 7. The capital allowances for the year of assessment 2020 have been correctly computed as RM1,200,000 Required: a) Compute the income tax payable by Cemara Technology Sdn Bhd for the year of assessment 2020. Note: You should start your computation with the gross sales figure and indicate by the use of 'O' any item referred to in the question which is not deductible or taxable, as appropriate. 13 marks b) Tollfree Nasidagang Sdn Bhd (TFSB) appointed agents to distribute its products in various parts of Malaysia. The company agreed to advance an annual sum of RM30,000 to assist each agent to finance their operating expenses. These advances are to be set off against the commission payable to the agents. Any excess of the advance over the commissions earned during the year is not refundable to TFSB. Mrs Badaq, an agent, earned commissions of RM13,000 for the year ended 31 December 2020. TFSB claimed a tax deduction in respect of the sum of RM30,000 paid to Mrs Badaq Required: State, with reasons, whether the sum of RM30,000 paid by TFSB to Mrs Badaq is deductible for income tax purposes. 2 marks (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started