Answered step by step

Verified Expert Solution

Question

1 Approved Answer

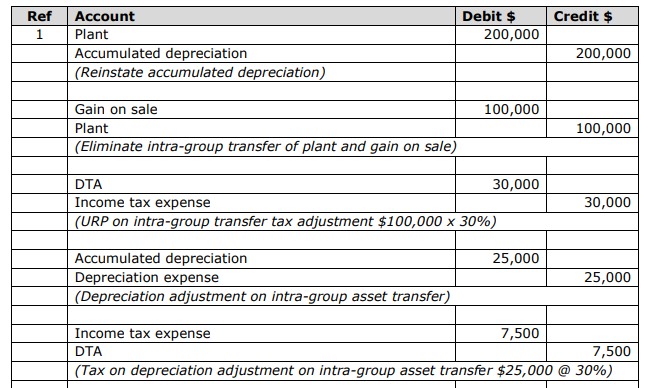

This is the consolidated journal entries. How do we come to the accumulated depreciation of 25,000? Further to E4.1, entities within the Tree Ltd group

This is the consolidated journal entries.

How do we come to the accumulated depreciation of 25,000?

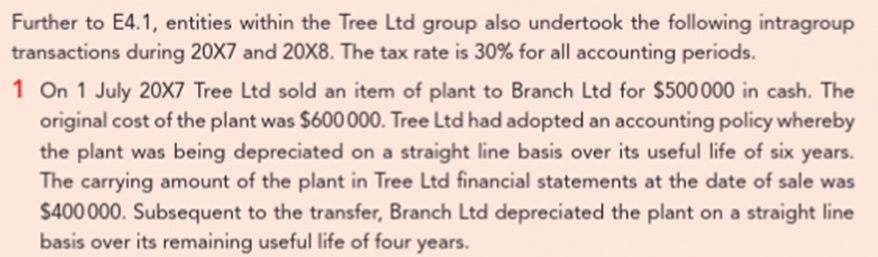

Further to E4.1, entities within the Tree Ltd group also undertook the following intragroup transactions during 207 and 208. The tax rate is 30% for all accounting periods. 1 On 1 July 207 Tree Ltd sold an item of plant to Branch Ltd for $500000 in cash. The original cost of the plant was $600000. Tree Ltd had adopted an accounting policy whereby the plant was being depreciated on a straight line basis over its useful life of six years. The carrying amount of the plant in Tree Ltd financial statements at the date of sale was $400000. Subsequent to the transfer, Branch Ltd depreciated the plant on a straight line basis over its remaining useful life of four yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started