this is the next question!

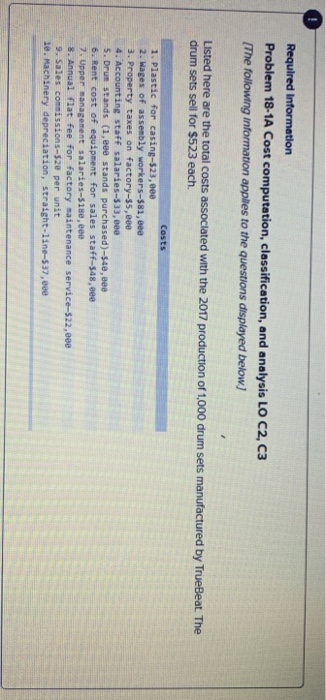

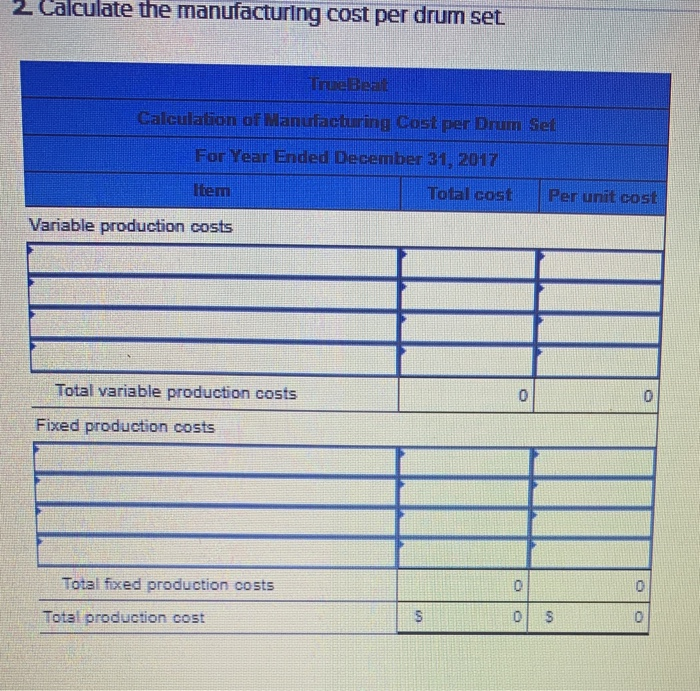

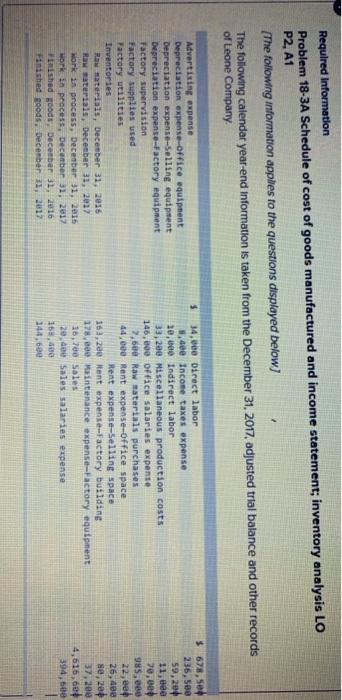

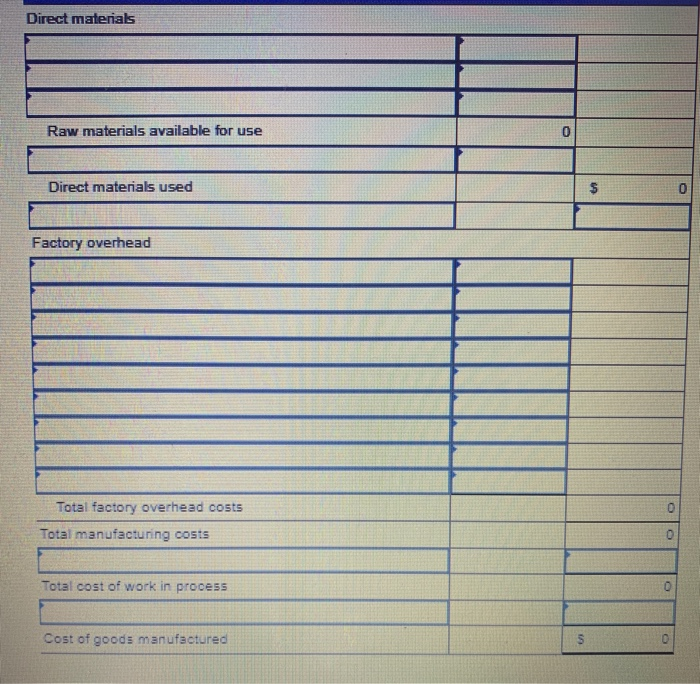

Required Information Problem 18-1A Cost computation, classification, and analysis LO C2, C3 [The following information applies to the questions displayed below) Listed here are the total costs associated with the 2017 production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $523 each. 1. Plastic for casing-$23, cee 2. Wages of assembly workers-581, eee 3. Property taxes on factory-55, eee 4. Accounting staff salaries-333, eee 5. Drum stands (1, eee stands purchased)-$49, eee 6. Rent cost of equipment for sales staff-$48, eee 7. Upper management salaries-5180, eee 8. Annual flat fee for factory saintenance service-$22,00 9. Sales comissions-$20 per unit le. Machinery depreciation, straight-line-537,000 2 Calculate the manufacturing cost per drum set TrueBeat Calculation of Manufacturing Cost per Drum Set For Year Ended December 31, 2017 Item Total cost Per unit cost Variable production costs Total variable production costs Fixed production costs Total fixed production costs Total production cost Required Information Problem 18-3A Schedule of cost of goods manufactured and income statement; inventory analysis LO P2, A1 (The following information applies to the questions displayed below] The following calendar year-end Information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Inventories Raw materials, December 31, 2016 Raw materials, December 31, 2017 Work in process, December 31, 2016 work in process, December 31, 2017 Finished goods, December 31, 2016 Finished goods, December 31, 2017 34,000 Direct labor 8,400 Income taxes expense 10,088 Indirect labor 33,200 Miscellaneous production costs 146,800 Office salaries expense 7,600 Raw materials purchases 44,eee Rent expense-Office space Rent expense-Selling space 163,200 Rent expense-Factory building 178,008 Maintenance expense-Factory equipment 16,780 Sales 20,488 Sales salaries expense 165,400 144,680 678,50 236, see 59,20 11,eee 70,000 985, eee 22.ee 26, 4ee se, ze 37,200 4,616, 604 394, 680 Direct materials Raw materials available for use Direct materials used $ Factory overhead Total factory overhead costs Total manufacturing costs Total cost of work in process Cost of goods manufactured