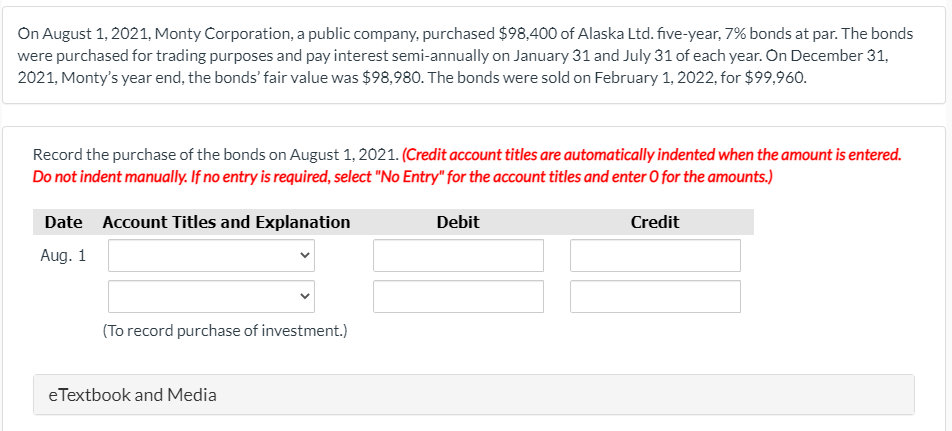

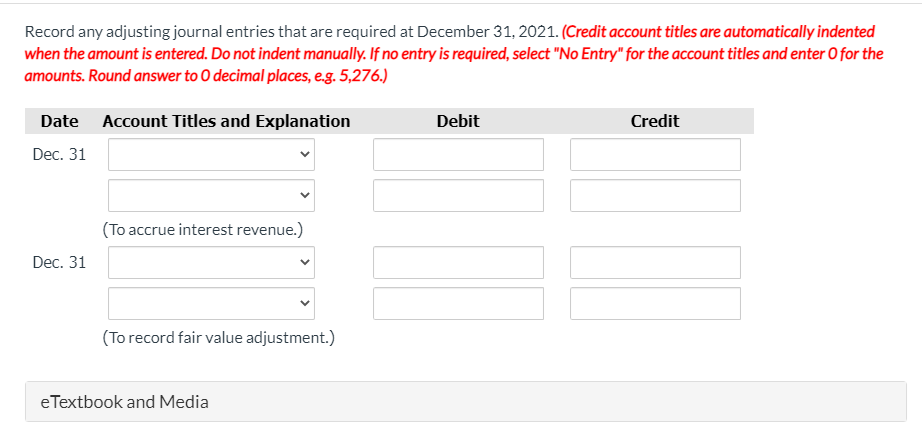

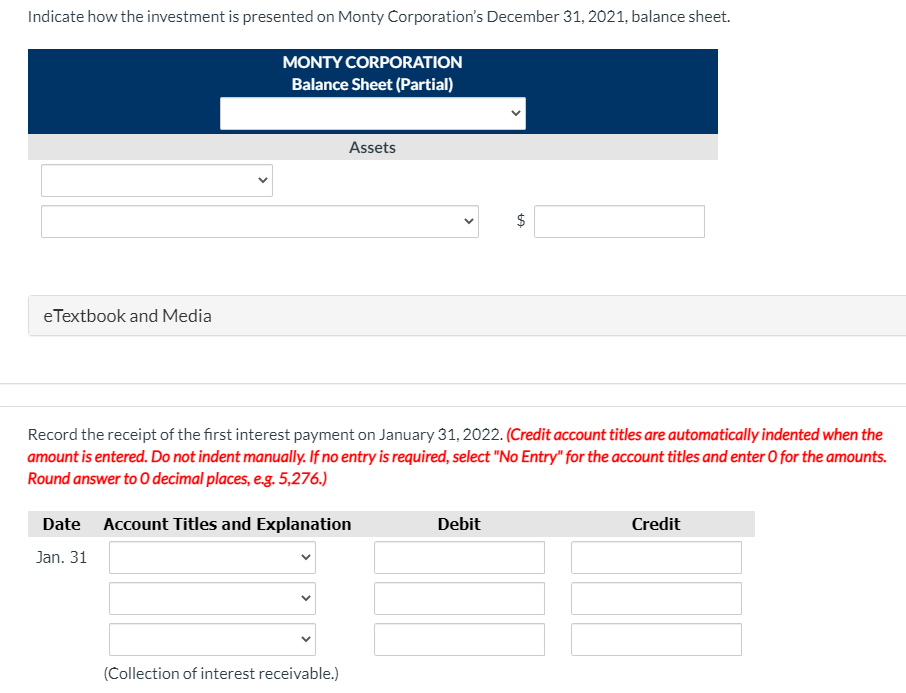

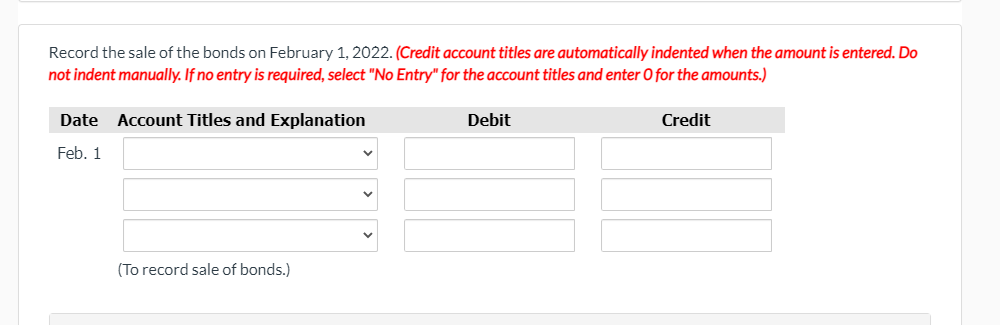

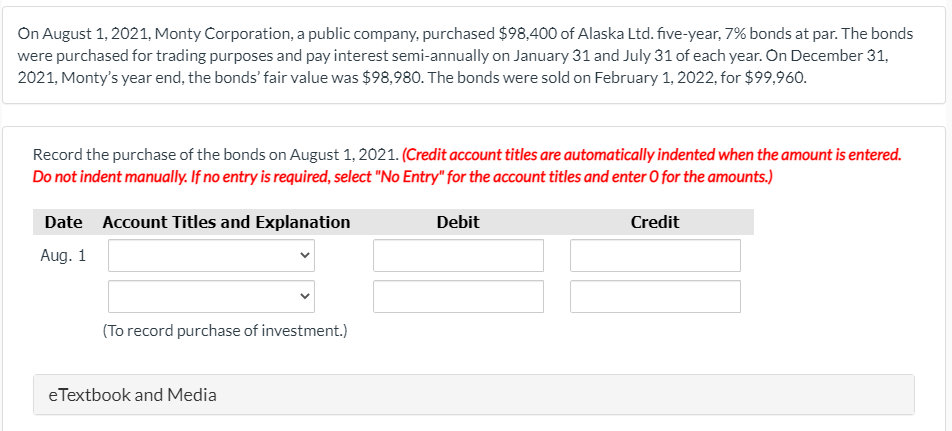

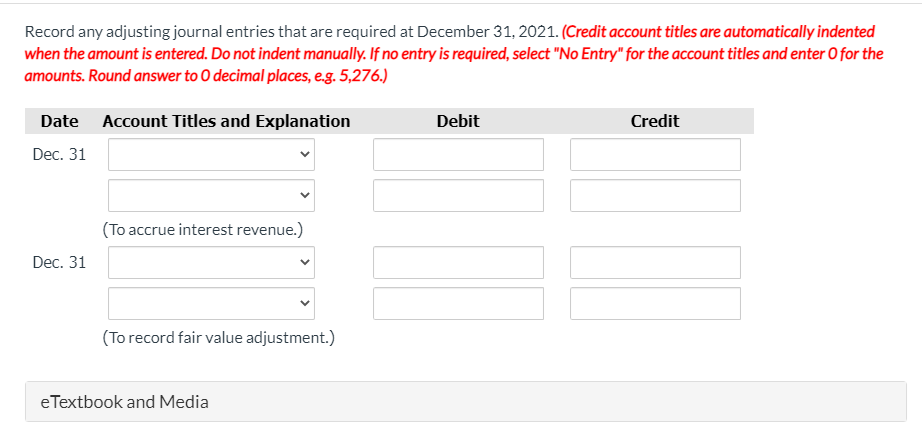

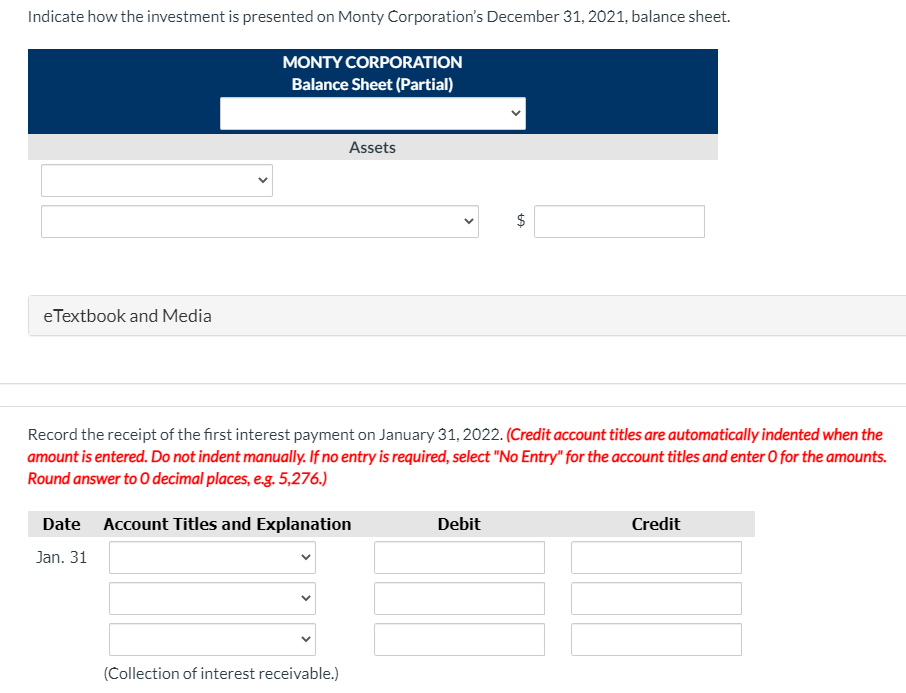

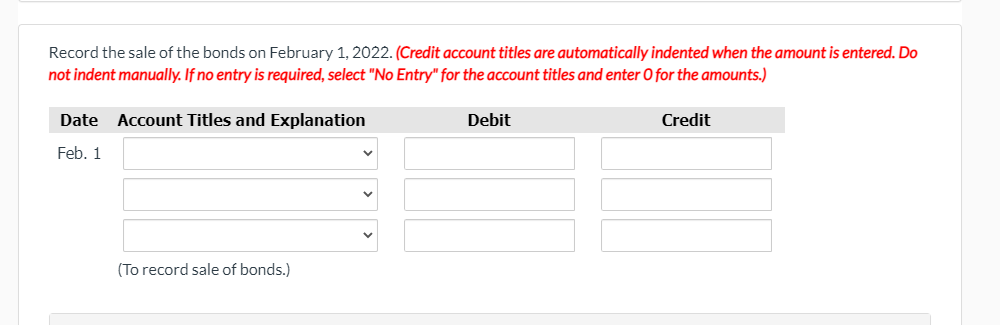

On August 1, 2021, Monty Corporation, a public company, purchased $98,400 of Alaska Ltd. five-year, 7% bonds at par. The bonds were purchased for trading purposes and pay interest semi-annually on January 31 and July 31 of each year. On December 31, 2021, Monty's year end, the bonds fair value was $98,980. The bonds were sold on February 1, 2022, for $99,960. Record the purchase of the bonds on August 1, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Aug. 1 (To record purchase of investment.) e Textbook and Media Record any adjusting journal entries that are required at December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Round answer to 0 decimal places, e.g. 5,276.) Date Account Titles and Explanation Debit Credit Dec. 31 (To accrue interest revenue.) Dec. 31 (To record fair value adjustment.) e Textbook and Media Indicate how the investment is presented on Monty Corporation's December 31, 2021, balance sheet. MONTY CORPORATION Balance Sheet (Partial) Assets $ $ e Textbook and Media Record the receipt of the first interest payment on January 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answer to 0 decimal places, e.g. 5,276.) Debit Credit Date Account Titles and Explanation Jan. 31 (Collection of interest receivable.) Record the sale of the bonds on February 1, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Feb. 1 (To record sale of bonds.)