Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the only information I have Exercise 4. (Heterogeneous Households) (25%) Consider a two-period model with two types of households, say, type A and

This is the only information I have

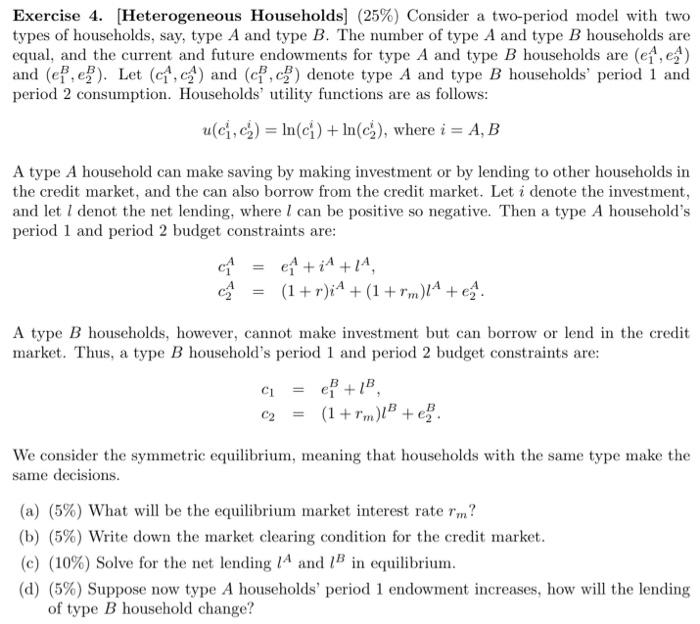

Exercise 4. (Heterogeneous Households) (25%) Consider a two-period model with two types of households, say, type A and type B. The number of type A and type B households are equal, and the current and future endowments for type A and type B households are (C1, ea) and (epie). Let (1,ca) and (c,c) denote type A and type B households' period 1 and period 2 consumption. Households' utility functions are as follows: u(c,c) = n(ci) + In(c), where i = A, B A type A household can make saving by making investment or by lending to other households in the credit market, and the can also borrow from the credit market. Let i denote the investment, and let 1 denot the net lending, where I can be positive so negative. Then a type A household's period 1 and period 2 budget constraints are: en + i +14, (1+r)i + (1 + rm)/4 + ca. A type B households, however, cannot make investment but can borrow or lend in the credit market. Thus, a type B household's period 1 and period 2 budget constraints are: CI C2 (1 + rm) + +B. We consider the symmetric equilibrium, meaning that households with the same type make the same decisions. (a) (5%) What will be the equilibrium market interest rate rm? (b) (5%) Write down the market clearing condition for the credit market. (c) (10%) Solve for the net lending 14 and B in equilibrium. (d) (5%) Suppose now type A households' period 1 endowment increases, how will the lending of type B household change? Exercise 4. (Heterogeneous Households) (25%) Consider a two-period model with two types of households, say, type A and type B. The number of type A and type B households are equal, and the current and future endowments for type A and type B households are (C1, ea) and (epie). Let (1,ca) and (c,c) denote type A and type B households' period 1 and period 2 consumption. Households' utility functions are as follows: u(c,c) = n(ci) + In(c), where i = A, B A type A household can make saving by making investment or by lending to other households in the credit market, and the can also borrow from the credit market. Let i denote the investment, and let 1 denot the net lending, where I can be positive so negative. Then a type A household's period 1 and period 2 budget constraints are: en + i +14, (1+r)i + (1 + rm)/4 + ca. A type B households, however, cannot make investment but can borrow or lend in the credit market. Thus, a type B household's period 1 and period 2 budget constraints are: CI C2 (1 + rm) + +B. We consider the symmetric equilibrium, meaning that households with the same type make the same decisions. (a) (5%) What will be the equilibrium market interest rate rm? (b) (5%) Write down the market clearing condition for the credit market. (c) (10%) Solve for the net lending 14 and B in equilibrium. (d) (5%) Suppose now type A households' period 1 endowment increases, how will the lending of type B household change Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started