Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the question question formula formula can you use the formula which I have provided pelase e required to calculate The ollowlng tor 201

this is the question

question

formula

formula can you use the formula which I have provided pelase

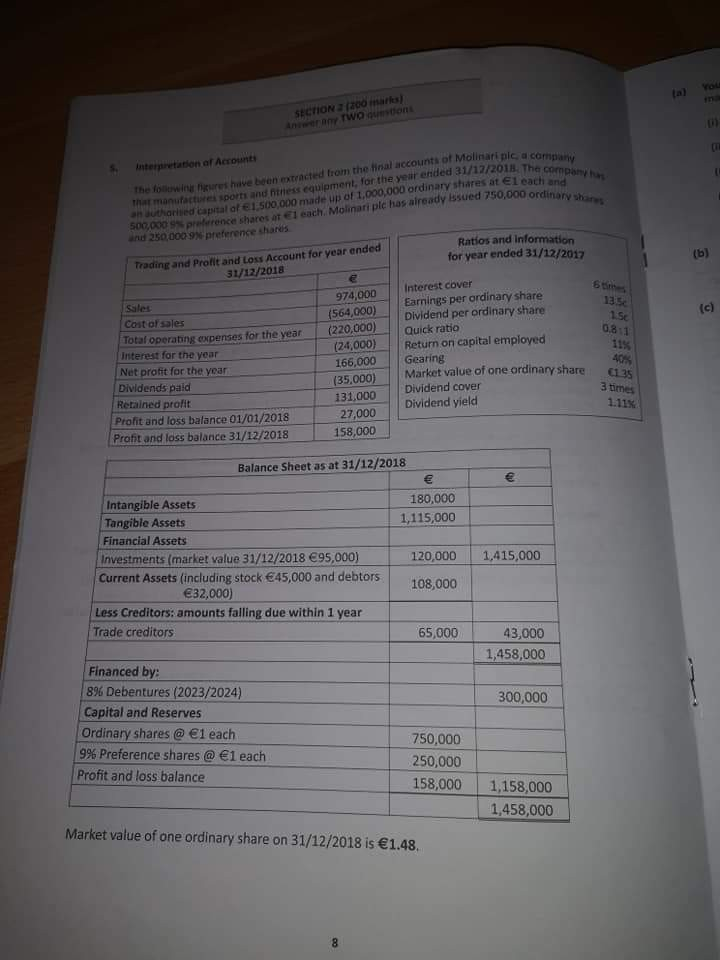

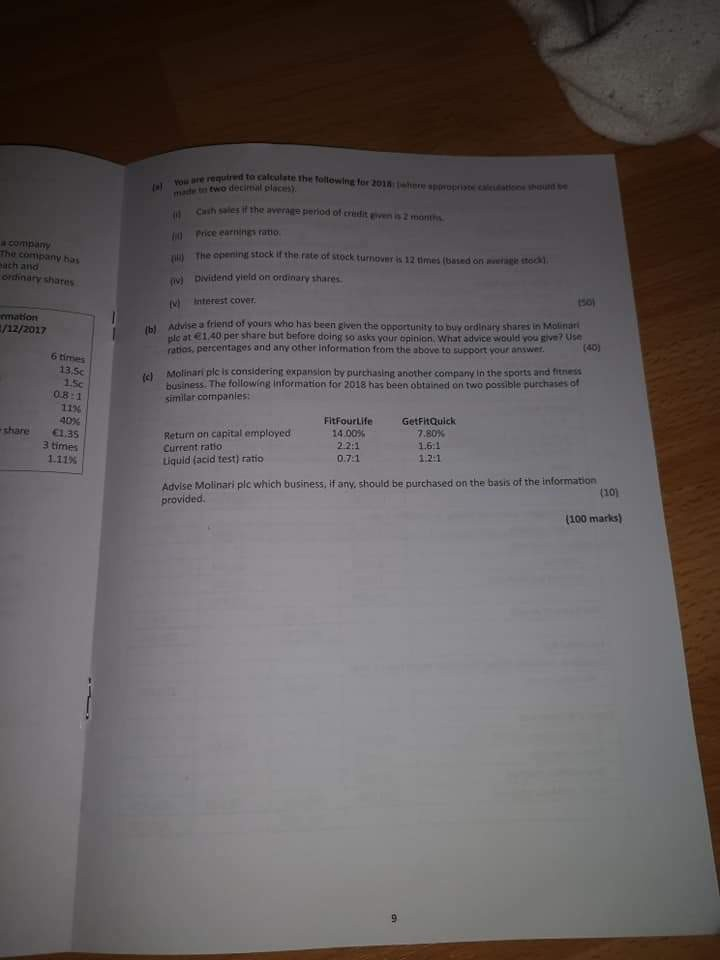

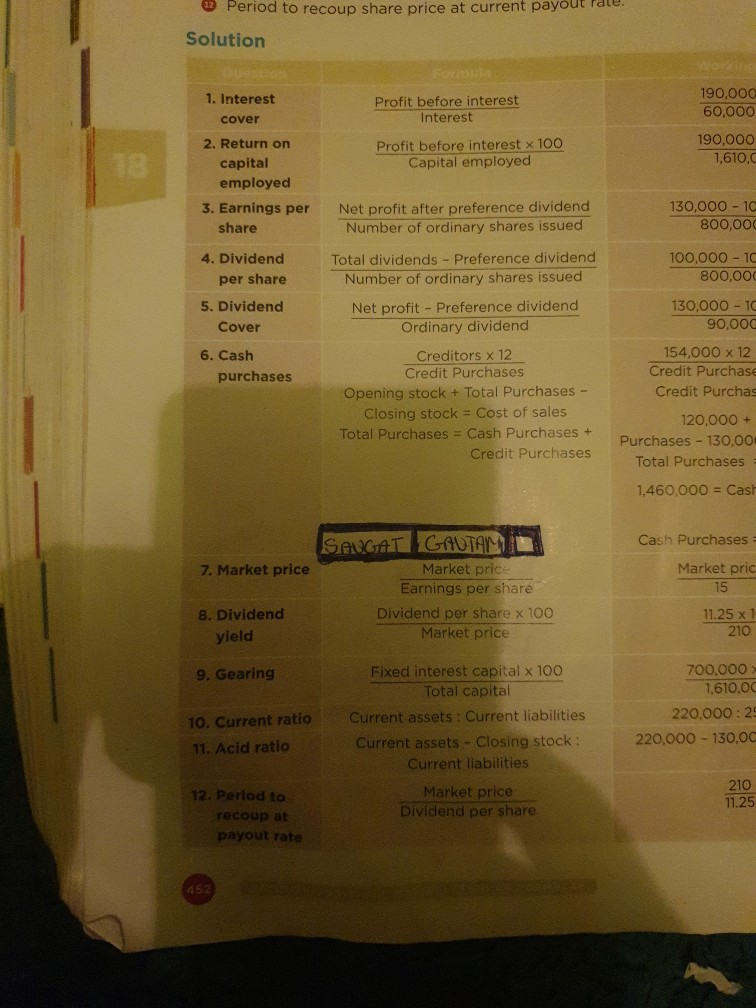

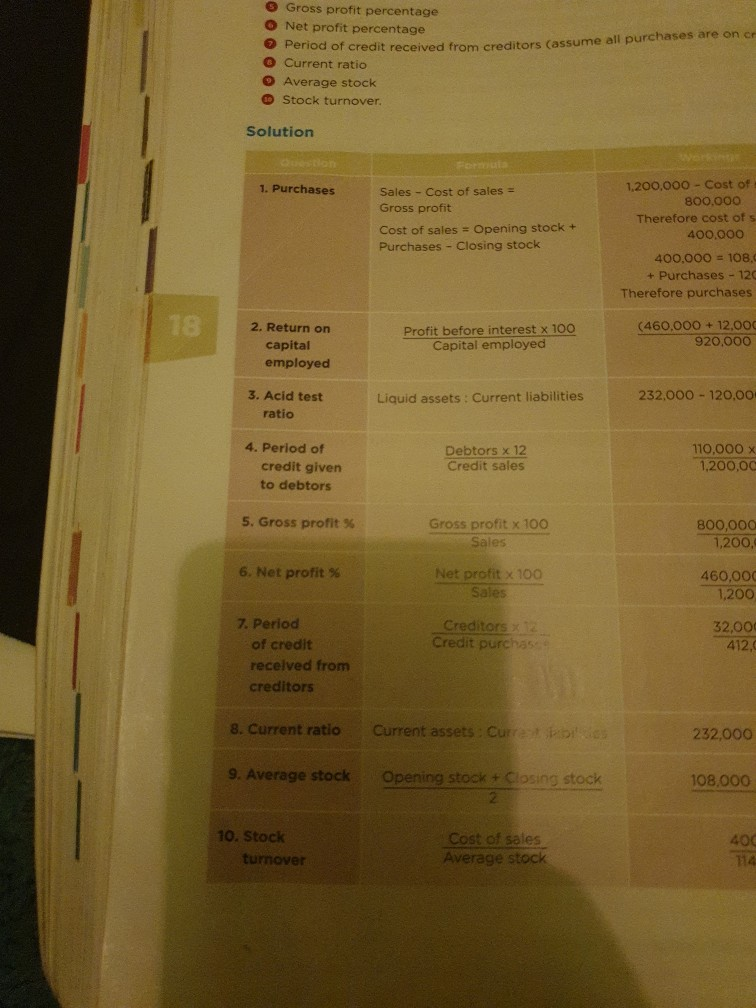

e required to calculate The ollowlng tor 201 ere pooprietios mae t two decimial places cath sales it the average period of cristit even s 2 mont i Price earnings ratio ul The apening The company bas ach and ordinary shares stock if the rate of stock turnover is 12 times (based on erage stock) pividend vield on ordinary shares v Interest cower mation /12/2017 bl Advise a friend of yours who has been given the opportunity to buy ordinary shares in Molinari plc at 1,40 per share but before doing so asks your opinion, What advice would you sive? Use ratios, percentages and any other information from the above to support your answer. 6 tmes ic) Molinari plc is considering expansion by purchasing another company in the ports and fitness 1.5c 08:1 11% business The following information for 2018 has been obtained on two possible prchases of similar cormpanles: share13s 3 times 1.11% Return on capital employed Current ratio Liquid facid test) ratio 1400% Current atiitemployed Fitfourife 7.80% 1.6:1 1.21 0.7:1 Advise Molinari plc which business, if any, should be purchased on the basis of the information (10) (100 marks) Period to recoup share price at current payout rate Solutiorn 190,000 60,000 1. Interest Profit before interest Interest cover Profit before interest x 100 Capital employed 190,000 1,610,0 2. Return on capital employed 130,000 1C 800,000 3. Earnings perNet profit after preference dividend share Number of ordinary shares issued Total dividends - Preference dividend Number of ordinary shares issued 100,000 - 10 800,000 4. Dividend per share Net profit Preference dividend Ordinary dividend Creditors x 12 Credit Purchases Opening stock+Total Purchases - Closing stock Cost of sales Total purchases = Cash Purchases + 5. Dividend Cover 130,000-10 90,000 154,000 x 12 Credit Purchase Credit Purchas 6. Cash purchases 120,000+ Purchases 130,00 Total Purchases Credit Purchases 1,460,000 Cash Cash Purchases Market pric 15 7. Market price Market price Earnings per shar Dividend per share x 100 Market price 8. Dividend 11.25 x 1 yield 9. Gearing 10. Current ratio Current assets: Current liabilities Fixed interest capital 100 Total capital 700,000 1,610,00 220,000: 25 220,000 -130,00 Current assets - Closing stock: Current liabilities Market price Dividend per share 11. Acid ratio 210 11.25 12. Perlod to recoup at payout rate Gross profit percentage O Net profit percentage of credit received from creditors (assume all purchases are on cr Current ratio O Average stock Stock turnover. Solution 1. Purchases 1200,000 - Cost of f Sales - Cost of sales - Gross profit Cost of sales Opening stock + Purchases - Closing stock 800,000o Therefore cost of s 400,00o 400,00O 108, + Purchases 120 Therefore purchases (460,00O+ 12,0o 920,00O 2. Return on Profit before interest x 100 Capital employed capital employed 3. Acid test Liquid assets: Current liabilities 232,000 -120,00 ratio 4. Period of 110,000 Debtors x 12 Credit sales credit given to debtors 1,200,00 5. Gross profit% Gross profit x 100 Sales 800,000 1,200 6. Net profit % Net profit x 100 sales 460,000 1,200 7. Period Creditors x T2 Credit purchas 32,00 412,0 of credit recelved from creditors 8. Current ratio Current assets : Cur 232,000 9. Average stock Opening stook + Closing stock 108,000 10. Stock Cost of sales Average stock 400 114 turnoverStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started