Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the second time I've posted this and I need the correct answers because I want to make sure I understand what I'm doing.

this is the second time I've posted this and I need the correct answers because I want to make sure I understand what I'm doing.

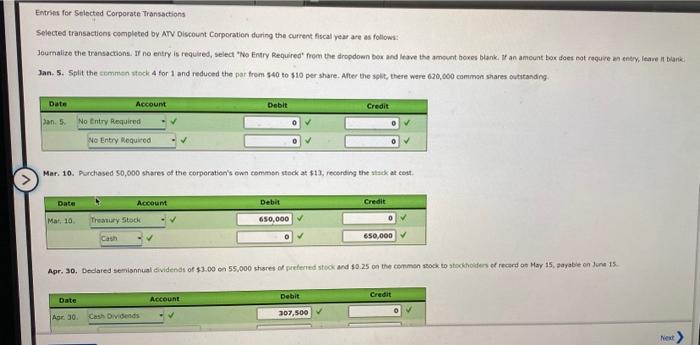

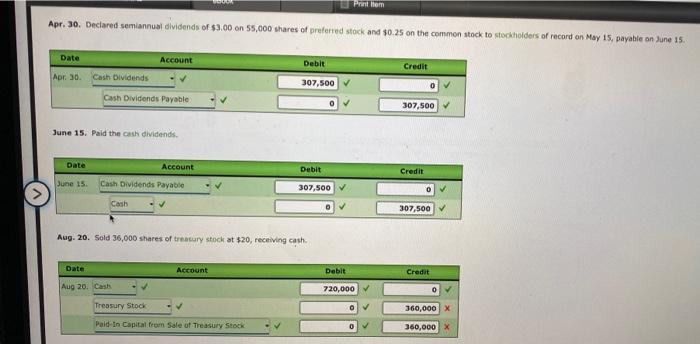

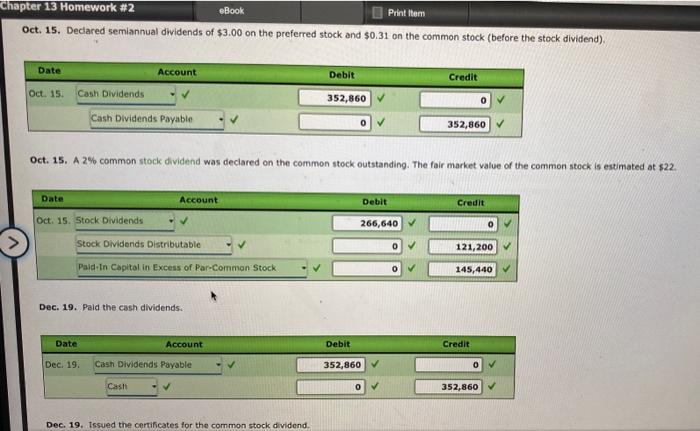

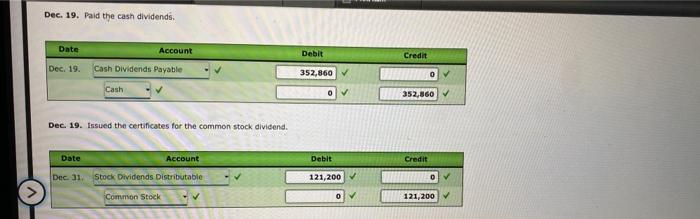

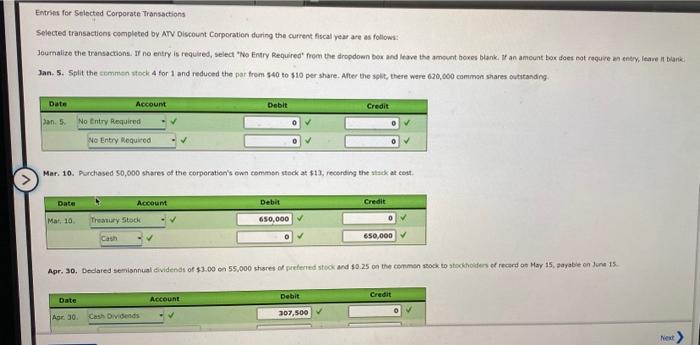

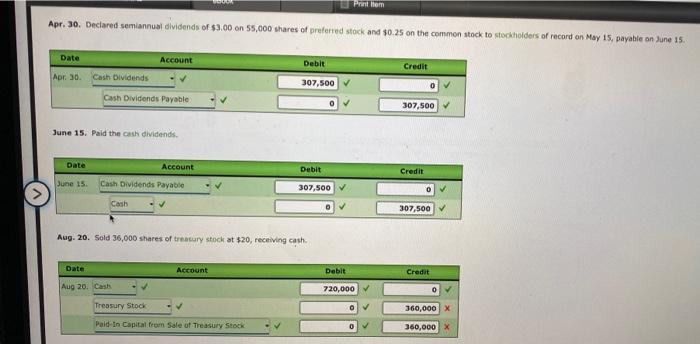

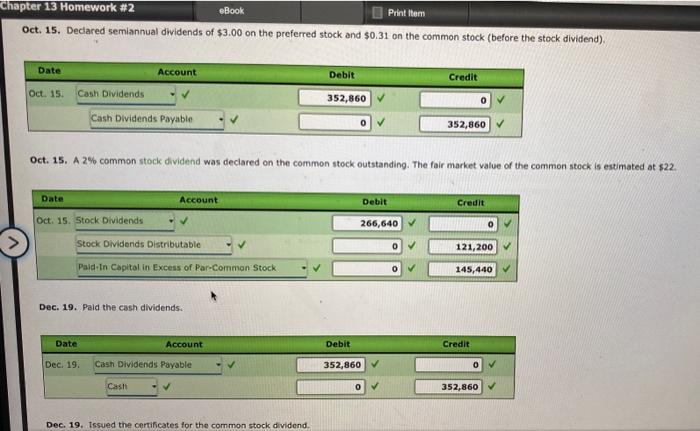

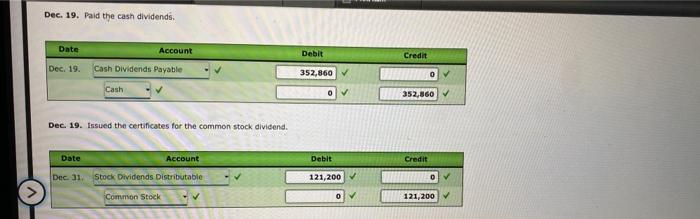

Entries for Selected Corporate Transactions Selected transactions completed by ATV Discount Corporation during the current fiscal vear are as follows: Jan. 5. Split the sommon whock 4 for 1 and reduced the par frem 340 to 310 per share. After the splt, there ware 620,000 camimon shares outitanding. Mar, 10. Aarchased 50,000 shares of the corporation's own eommen stock as $13, recording the uladk at cott. Apr. 30. Deciared semiannusi dlvidends of 53.00 on 55,000 shares of preferied stock and 50.25 on the common stock to stockhoiders of record an May 15 , payable on lune 15 . 3une 15. Paid the cash dividendis. Asg. 20. Sold 36,000 shares of treatury stock at $20, receiving cash. Oct. 15. Declared semiannual dividends of $3.00 on the preferred stock and $0.31 on the common stock (before the stock dividend). Oct. 15. A 2% common stock dividend was declared on the common stock outstanding. The fair market value of the common stock is estimated at 522 . Dec. 19. Pald the cash dividends. Dec. 19. tssued the certificates for the common stock dividend. Dec. 19. Paid the cash dividends. Dec. 19. Issued the certificates for the common stock dividend. Entries for Selected Corporate Transactions Selected transactions completed by ATV Discount Corporation during the current fiscal vear are as follows: Jan. 5. Split the sommon whock 4 for 1 and reduced the par frem 340 to 310 per share. After the splt, there ware 620,000 camimon shares outitanding. Mar, 10. Aarchased 50,000 shares of the corporation's own eommen stock as $13, recording the uladk at cott. Apr. 30. Deciared semiannusi dlvidends of 53.00 on 55,000 shares of preferied stock and 50.25 on the common stock to stockhoiders of record an May 15 , payable on lune 15 . 3une 15. Paid the cash dividendis. Asg. 20. Sold 36,000 shares of treatury stock at $20, receiving cash. Oct. 15. Declared semiannual dividends of $3.00 on the preferred stock and $0.31 on the common stock (before the stock dividend). Oct. 15. A 2% common stock dividend was declared on the common stock outstanding. The fair market value of the common stock is estimated at 522 . Dec. 19. Pald the cash dividends. Dec. 19. tssued the certificates for the common stock dividend. Dec. 19. Paid the cash dividends. Dec. 19. Issued the certificates for the common stock dividend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started