Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This isnt personal this a question on my homework made up More info For all payroll calculations, use the following tax rates and round amounts

This isnt personal this a question on my homework made up

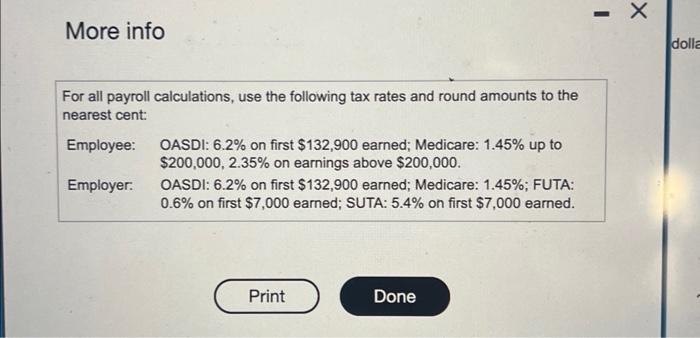

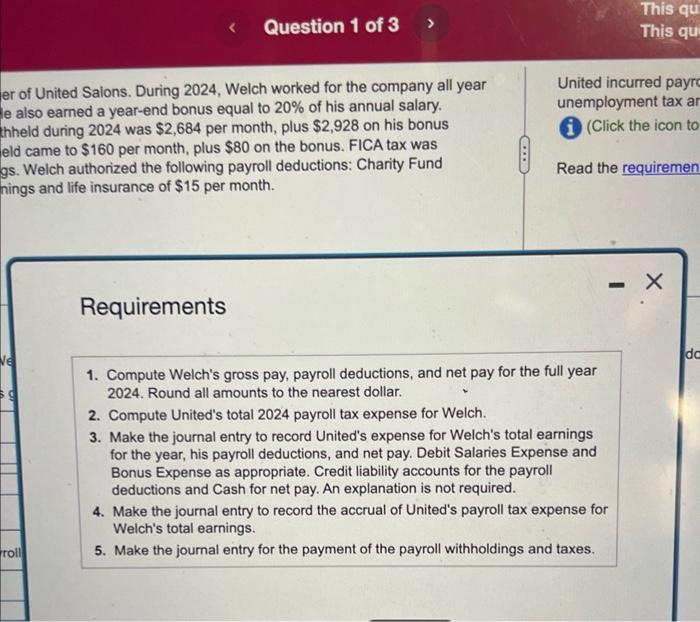

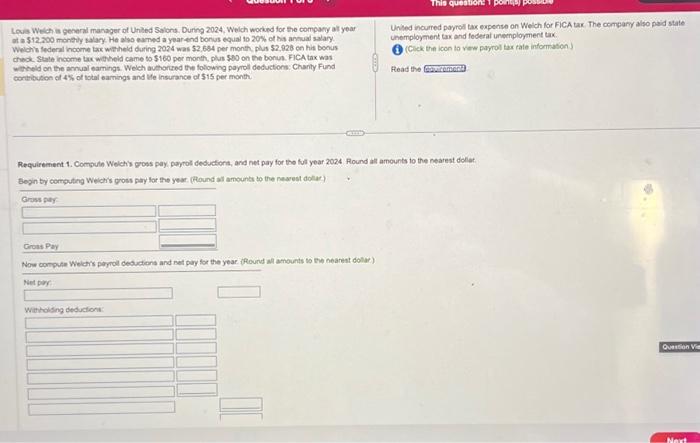

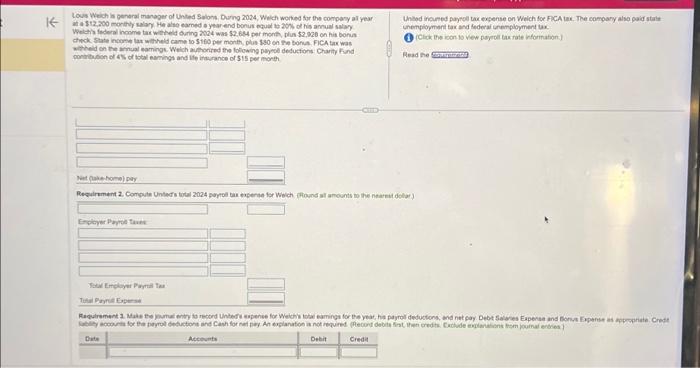

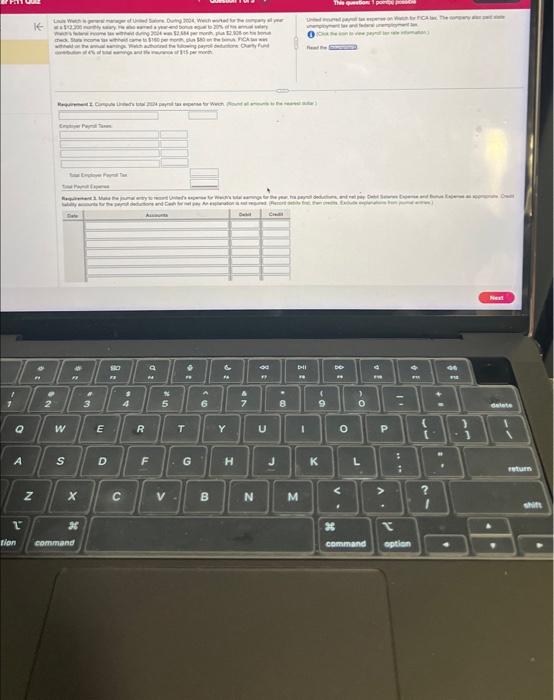

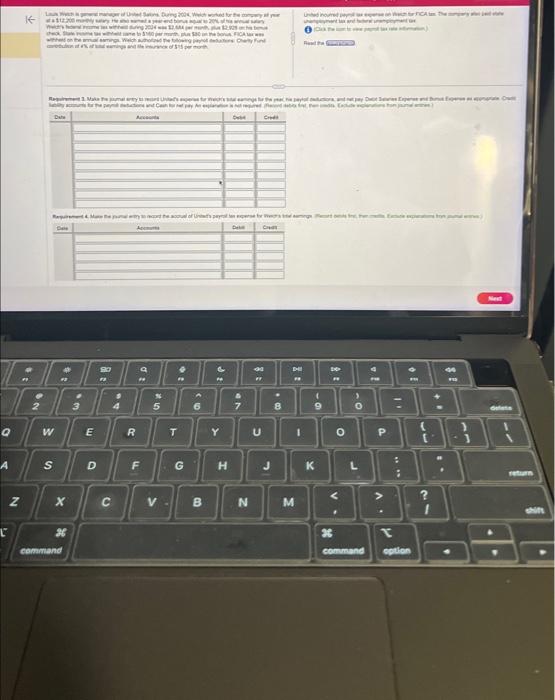

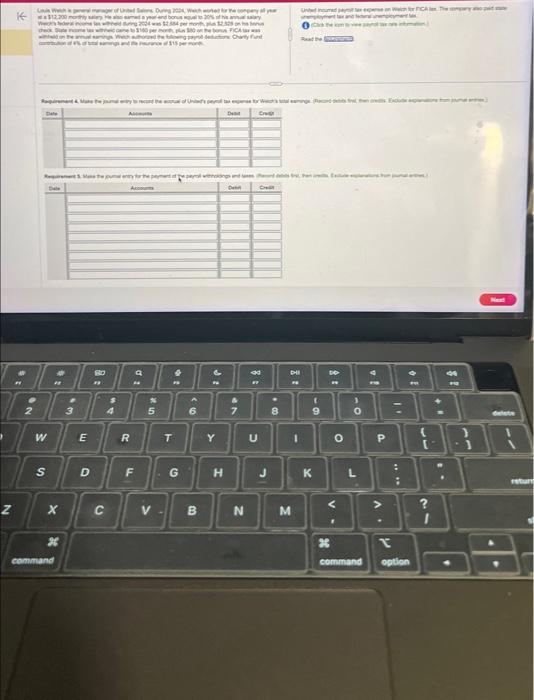

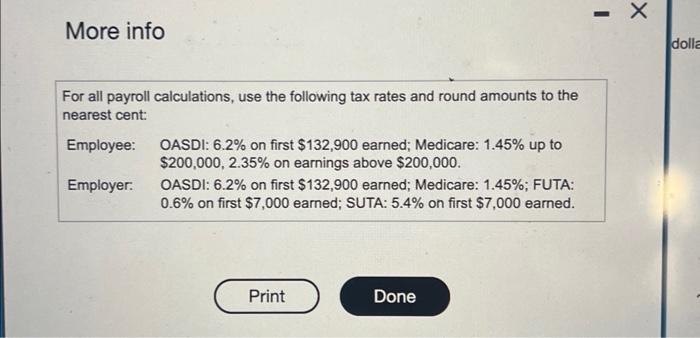

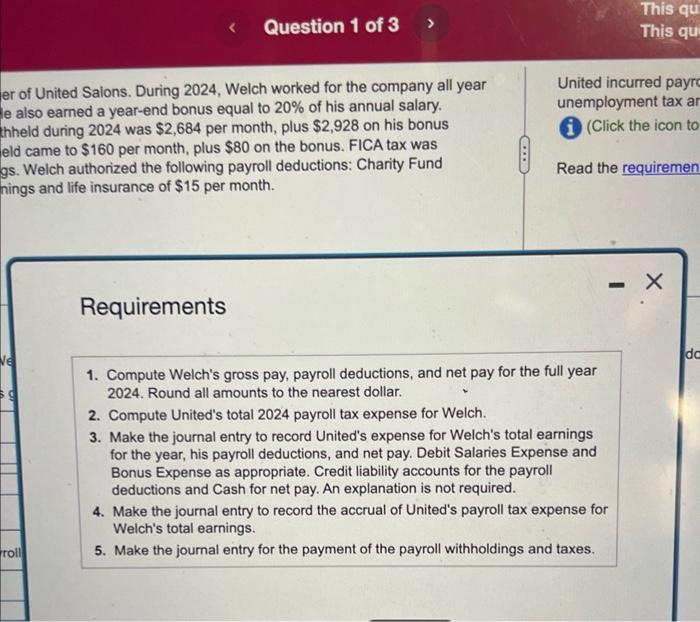

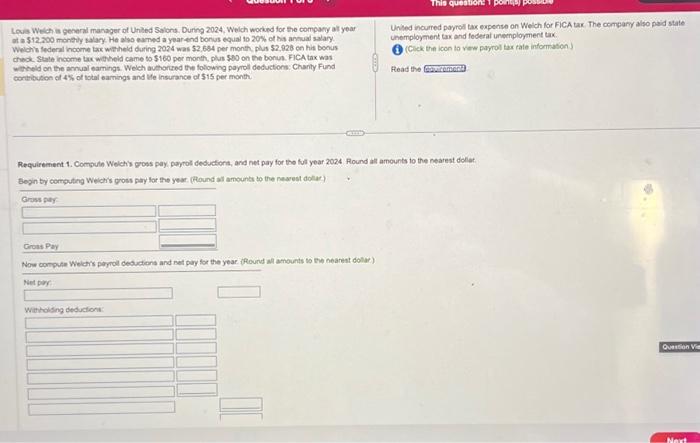

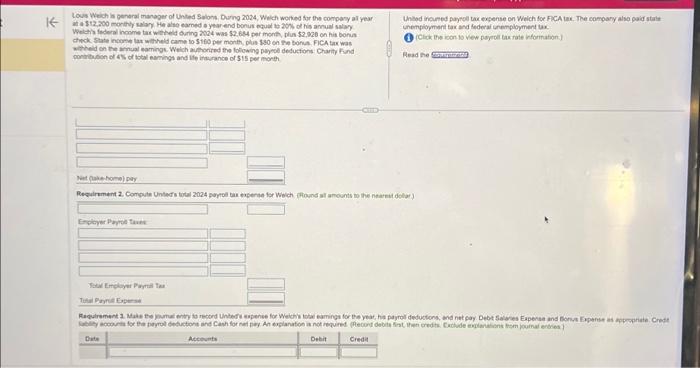

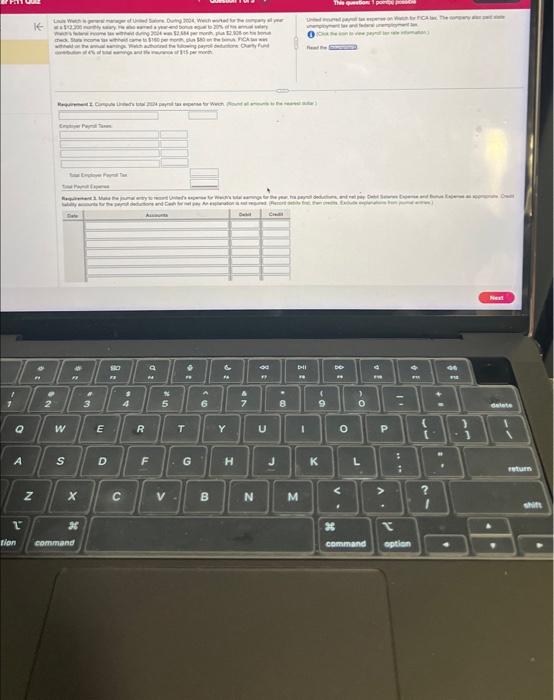

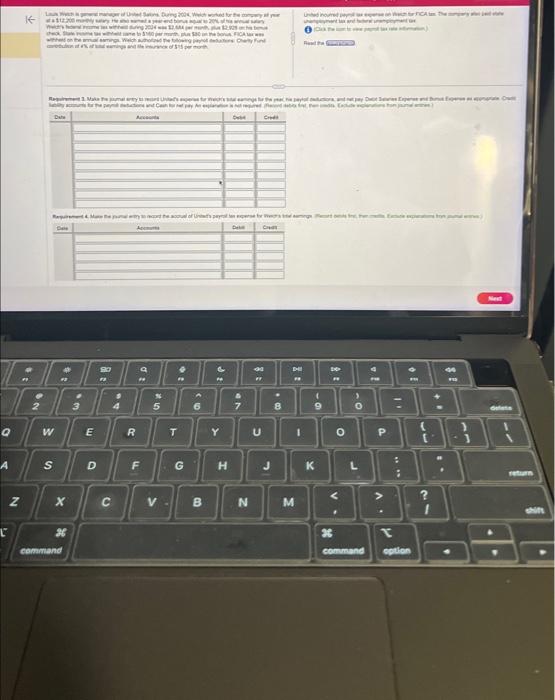

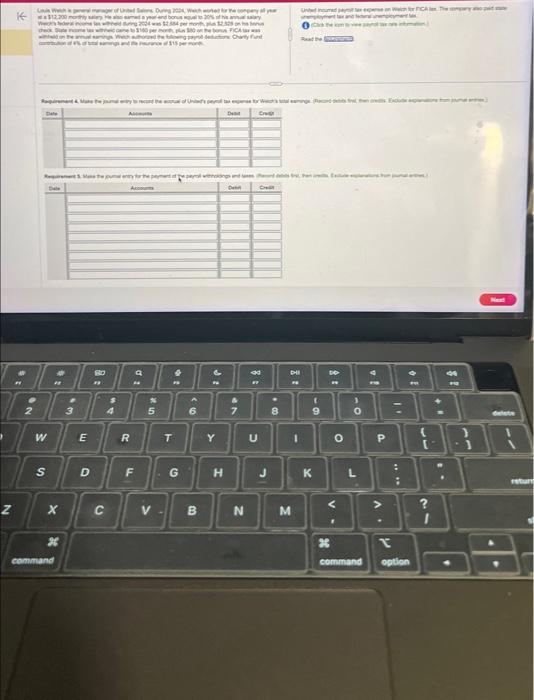

More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. er of United Salons. During 2024, Welch worked for the company all year e also earned a year-end bonus equal to 20% of his annual salary. United incurred payr theld during 2024 was $2,684 per month, plus $2,928 on his bonus eld came to $160 per month, plus $80 on the bonus. FICA tax was gs. Welch authorized the following payroll deductions: Charity Fund hings and life insurance of $15 per month. unemployment tax ar (Click the icon to Read the requiremen Requirements 1. Compute Welch's gross pay, payroll deductions, and net pay for the full year 2024. Round all amounts to the nearest dollar. 2. Compute United's total 2024 payroll tax expense for Welch. 3. Make the journal entry to record United's expense for Welch's total earnings for the year, his payroll deductions, and net pay. Debit Salaries Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required. 4. Make the journal entry to record the accrual of United's payroll tax expense for Welch's total earnings. 5. Make the journal entry for the payment of the payroll withholdings and taxes. Leva Welch a genand manager of Uniled Silons. Durng 2024. Welch wocked for the company at year at a $12.200 monthly salary. He also earned a yearend boris equal 1020% of his anhual salary. Welohis lederal hoome bx witheld during 2024 was $2.684 per month, plus $2,026 en his bonus chack. State income trx wetheld came to $160 per month, plus $90 on the bonus. FICA tax was whicheld on the annual eamings. Welch aulhorred the foliowng payrol deductions: Chanty Fund cortribution of 4% of total earnings and Ve insurance of $15 per month. Uniled incurred payrol tax expense on Welch for FICA tax. The compary also paid state untmployment tox and federal unemployment tax. (i) (Click the icon to ver payrol tax rate information) Fead the Requirement 1. Compute Welch's gross pay, payrol deductions, and net pay for the fult year 2024 found all amounts to the nearest dolier. Eegin by compating Welch's goss pay for the yeur. (Round all amounts to the newrest dolar) Lows Weich is general inanager of Unted Salohs, Durng 2024, Which wohed for the conpary al year Unlod iroumed payrel twe expense en Walch for FACA tax. The compary alsa paid stalt inemplionmant tar and federai unemployment tax. Aread he Anstits and the More info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. er of United Salons. During 2024, Welch worked for the company all year e also earned a year-end bonus equal to 20% of his annual salary. United incurred payr theld during 2024 was $2,684 per month, plus $2,928 on his bonus eld came to $160 per month, plus $80 on the bonus. FICA tax was gs. Welch authorized the following payroll deductions: Charity Fund hings and life insurance of $15 per month. unemployment tax ar (Click the icon to Read the requiremen Requirements 1. Compute Welch's gross pay, payroll deductions, and net pay for the full year 2024. Round all amounts to the nearest dollar. 2. Compute United's total 2024 payroll tax expense for Welch. 3. Make the journal entry to record United's expense for Welch's total earnings for the year, his payroll deductions, and net pay. Debit Salaries Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required. 4. Make the journal entry to record the accrual of United's payroll tax expense for Welch's total earnings. 5. Make the journal entry for the payment of the payroll withholdings and taxes. Leva Welch a genand manager of Uniled Silons. Durng 2024. Welch wocked for the company at year at a $12.200 monthly salary. He also earned a yearend boris equal 1020% of his anhual salary. Welohis lederal hoome bx witheld during 2024 was $2.684 per month, plus $2,026 en his bonus chack. State income trx wetheld came to $160 per month, plus $90 on the bonus. FICA tax was whicheld on the annual eamings. Welch aulhorred the foliowng payrol deductions: Chanty Fund cortribution of 4% of total earnings and Ve insurance of $15 per month. Uniled incurred payrol tax expense on Welch for FICA tax. The compary also paid state untmployment tox and federal unemployment tax. (i) (Click the icon to ver payrol tax rate information) Fead the Requirement 1. Compute Welch's gross pay, payrol deductions, and net pay for the fult year 2024 found all amounts to the nearest dolier. Eegin by compating Welch's goss pay for the yeur. (Round all amounts to the newrest dolar) Lows Weich is general inanager of Unted Salohs, Durng 2024, Which wohed for the conpary al year Unlod iroumed payrel twe expense en Walch for FACA tax. The compary alsa paid stalt inemplionmant tar and federai unemployment tax. Aread he Anstits and the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started