Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This method of valuation was useful as a first cut. But Krishnuvara was a trained engineer who understood that there was lot of risk

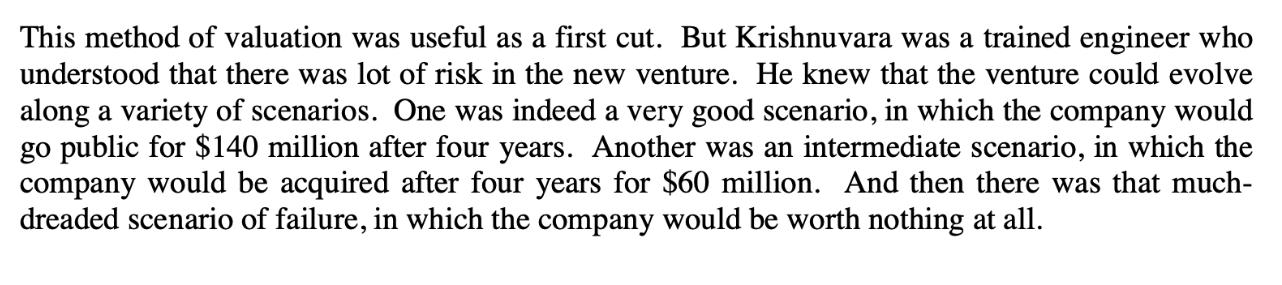

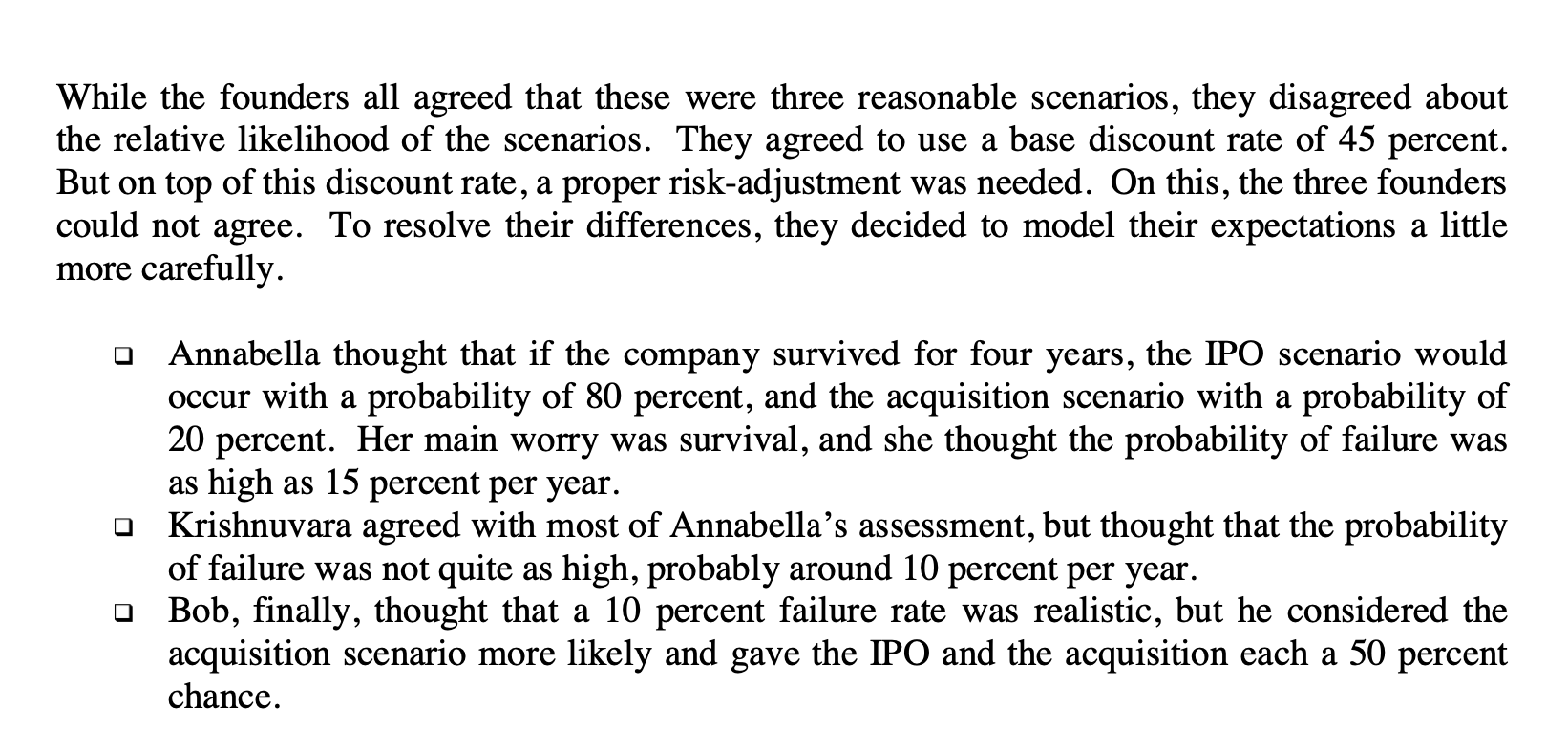

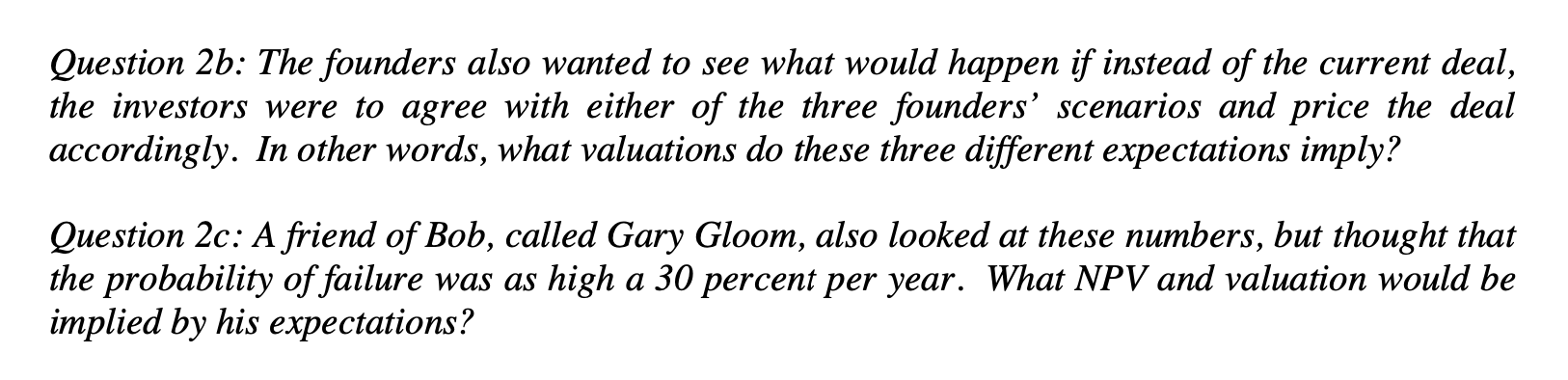

This method of valuation was useful as a first cut. But Krishnuvara was a trained engineer who understood that there was lot of risk in the new venture. He knew that the venture could evolve along a variety of scenarios. One was indeed a very good scenario, in which the company would go public for $140 million after four years. Another was an intermediate scenario, in which the company would be acquired after four years for $60 million. And then there was that much- dreaded scenario of failure, in which the company would be worth nothing at all. While the founders all agreed that these were three reasonable scenarios, they disagreed about the relative likelihood of the scenarios. They agreed to use a base discount rate of 45 percent. But on top of this discount rate, a proper risk-adjustment was needed. On this, the three founders could not agree. To resolve their differences, they decided to model their expectations a little more carefully. Annabella thought that if the company survived for four years, the IPO scenario would occur with a probability of 80 percent, and the acquisition scenario with a probability of 20 percent. Her main worry was survival, and she thought the probability of failure was as high as 15 percent per year. Krishnuvara agreed with most of Annabella's assessment, but thought that the probability of failure was not quite as high, probably around 10 percent per year. Bob, finally, thought that a 10 percent failure rate was realistic, but he considered the acquisition scenario more likely and gave the IPO and the acquisition each a 50 percent chance. Question 2b: The founders also wanted to see what would happen if instead of the current deal, the investors were to agree with either of the three founders' scenarios and price the deal accordingly. In other words, what valuations do these three different expectations imply? Question 2c: A friend of Bob, called Gary Gloom, also looked at these numbers, but thought that the probability of failure was as high a 30 percent per year. What NPV and valuation would be implied by his expectations?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the valuations implied by the different expectations of the three founders and Bobs fri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started