Answered step by step

Verified Expert Solution

Question

1 Approved Answer

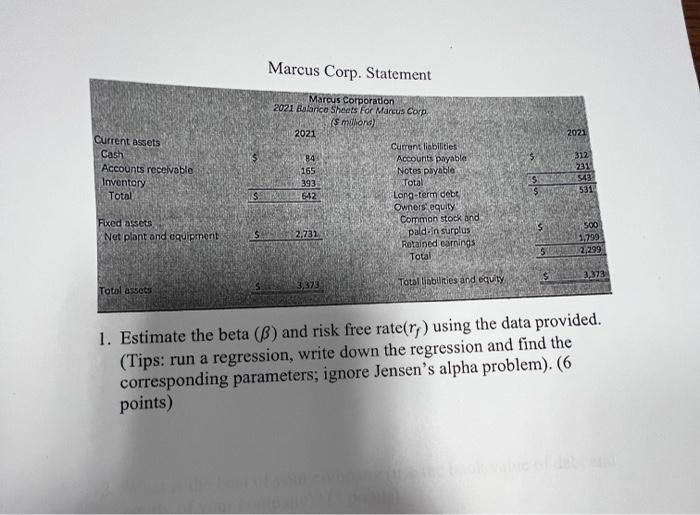

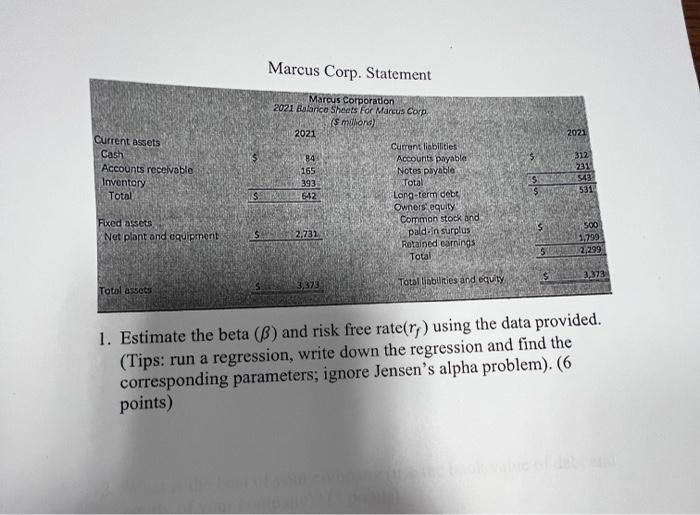

this one question please can you help me Marcus Corp. Statement 2021 Current assets Gash Accounts receivable Inventory Total Marcus Corporation 2021 Balance Sheets For

this one question please can you help me

Marcus Corp. Statement 2021 Current assets Gash Accounts receivable Inventory Total Marcus Corporation 2021 Balance Sheets For Marcus Corp. ( son) 2021 Current liabilities 84 Accounts payable 165 Notes payable 393 Total 642 Long-term debt Owners, equity Common stock and 2,731 paldun surplus Rotained carnings Total 312 231 543 531 $ Fixed assets Net plnt and equipment 500 3.799 2,299 5 3,373 3,373 Totol assets Total lobllities and equity 1. Estimate the beta (B) and risk free rate(ry) using the data provided. (Tips: run a regression, write down the regression and find the corresponding parameters; ignore Jensen's alpha problem). (6 points) 2. What is unlevered beta of the company? (3 points) 3. What is the beta of your company (use the book value of debt and equity of your company)? (3 points) 4. What is the cost of equity of your company (Last year's market return is 8%)? (3 points) Marcus Corp. Statement 2021 Current assets Gash Accounts receivable Inventory Total Marcus Corporation 2021 Balance Sheets For Marcus Corp. ( son) 2021 Current liabilities 84 Accounts payable 165 Notes payable 393 Total 642 Long-term debt Owners, equity Common stock and 2,731 paldun surplus Rotained carnings Total 312 231 543 531 $ Fixed assets Net plnt and equipment 500 3.799 2,299 5 3,373 3,373 Totol assets Total lobllities and equity 1. Estimate the beta (B) and risk free rate(ry) using the data provided. (Tips: run a regression, write down the regression and find the corresponding parameters; ignore Jensen's alpha problem). (6 points) 2. What is unlevered beta of the company? (3 points) 3. What is the beta of your company (use the book value of debt and equity of your company)? (3 points) 4. What is the cost of equity of your company (Last year's market return is 8%)? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started