Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Thomas is age 40 and was widowed in 2019. He has a daughter, Christina, age 6. - Thomas provided the entire cost of maintaining

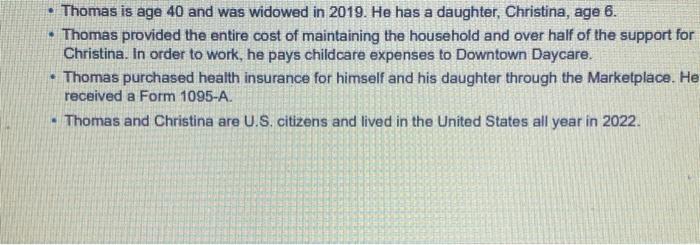

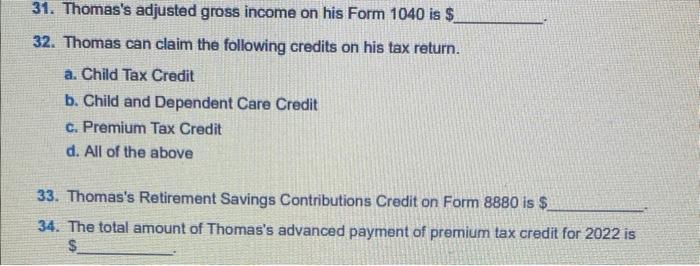

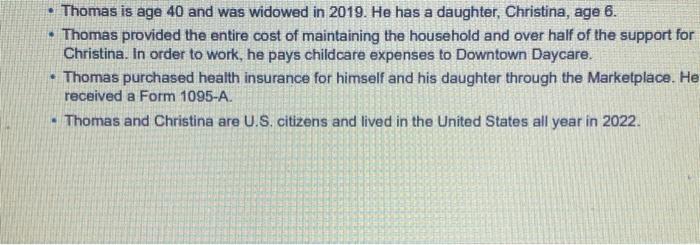

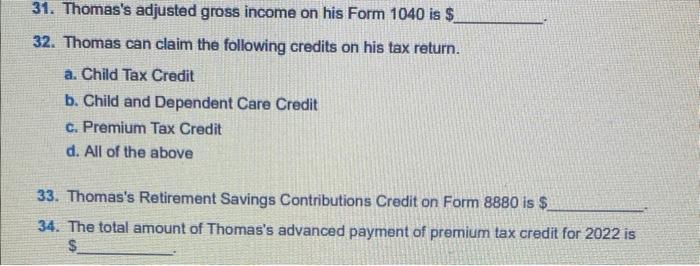

- Thomas is age 40 and was widowed in 2019. He has a daughter, Christina, age 6. - Thomas provided the entire cost of maintaining the household and over half of the support for Christina. In order to work, he pays childcare expenses to Downtown Daycare. - Thomas purchased health insurance for himself and his daughter through the Marketplace. He received a form 1095-A. - Thomas and Christina are U.S. citizens and lived in the United States all year in 2022. 31. Thomas's adjusted gross income on his Form 1040 is 32. Thomas can claim the following credits on his tax return. a. Child Tax Credit b. Child and Dependent Care Credit c. Premium Tax Credit d. All of the above 33. Thomas's Retirement Savings Contributions Credit on Form 8880 is $ 34. The total amount of Thomas's advanced payment of premium tax credit for 2022 is

- Thomas is age 40 and was widowed in 2019. He has a daughter, Christina, age 6. - Thomas provided the entire cost of maintaining the household and over half of the support for Christina. In order to work, he pays childcare expenses to Downtown Daycare. - Thomas purchased health insurance for himself and his daughter through the Marketplace. He received a form 1095-A. - Thomas and Christina are U.S. citizens and lived in the United States all year in 2022. 31. Thomas's adjusted gross income on his Form 1040 is 32. Thomas can claim the following credits on his tax return. a. Child Tax Credit b. Child and Dependent Care Credit c. Premium Tax Credit d. All of the above 33. Thomas's Retirement Savings Contributions Credit on Form 8880 is $ 34. The total amount of Thomas's advanced payment of premium tax credit for 2022 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started