Answered step by step

Verified Expert Solution

Question

1 Approved Answer

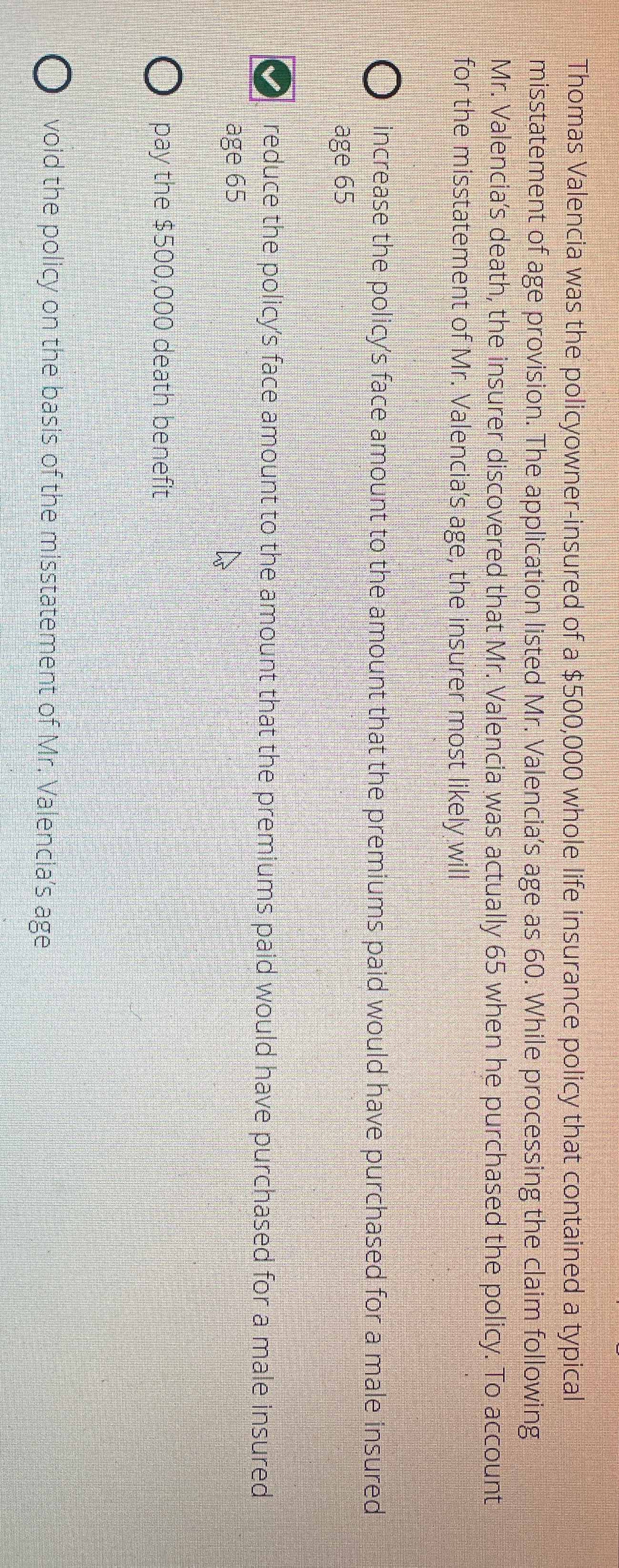

Thomas Valencia was the policyowner - insured of a $ 5 0 0 , 0 0 0 whole life insurance policy that contained a typical

Thomas Valencia was the policyownerinsured of a $ whole life insurance policy that contained a typical misstatement of age provision. The application listed Mr Valencia's age as While processing the claim following Mr Valencia's death, the insurer discovered that Mr Valencia was actually when he purchased the policy. To account for the misstatement of Mr Valencia's age, the insurer most likely will

increase the policy's face amount to the amount that the premiums paid would have purchased for a male insured age

reduce the policy's face amount to the amount that the premiums paid would have purchased for a male insured age

pay the $ death benefit

void the policy on the basis of the misstatement of Mr Valencla's age

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started