Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thrasher Construction Co. was contracted to construct a building for $1,045,000. The building is owned by the customer throughout the contract period. The contract provides

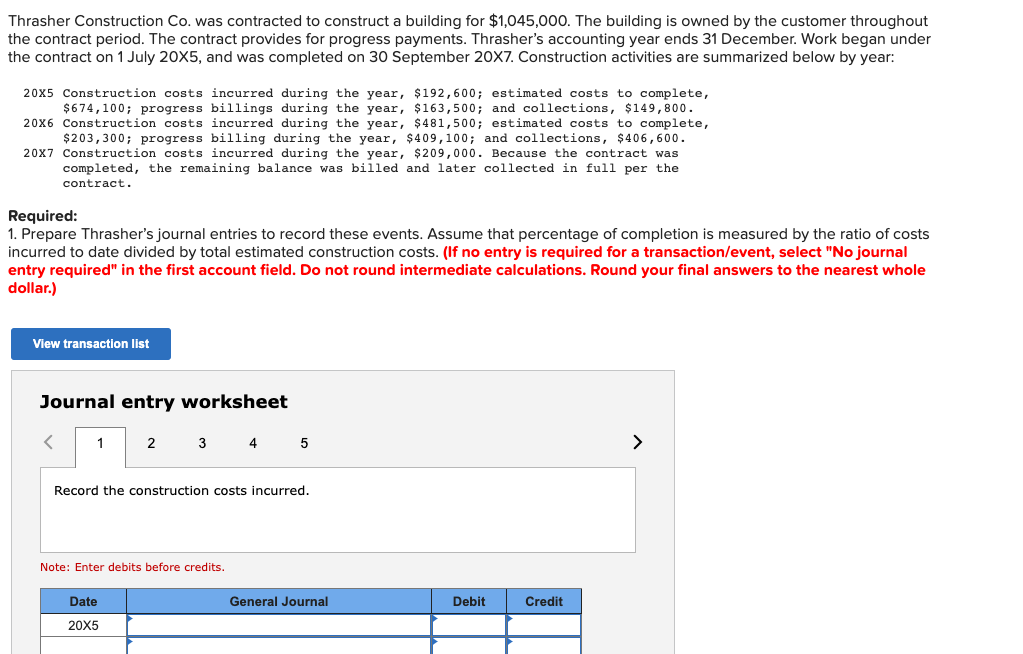

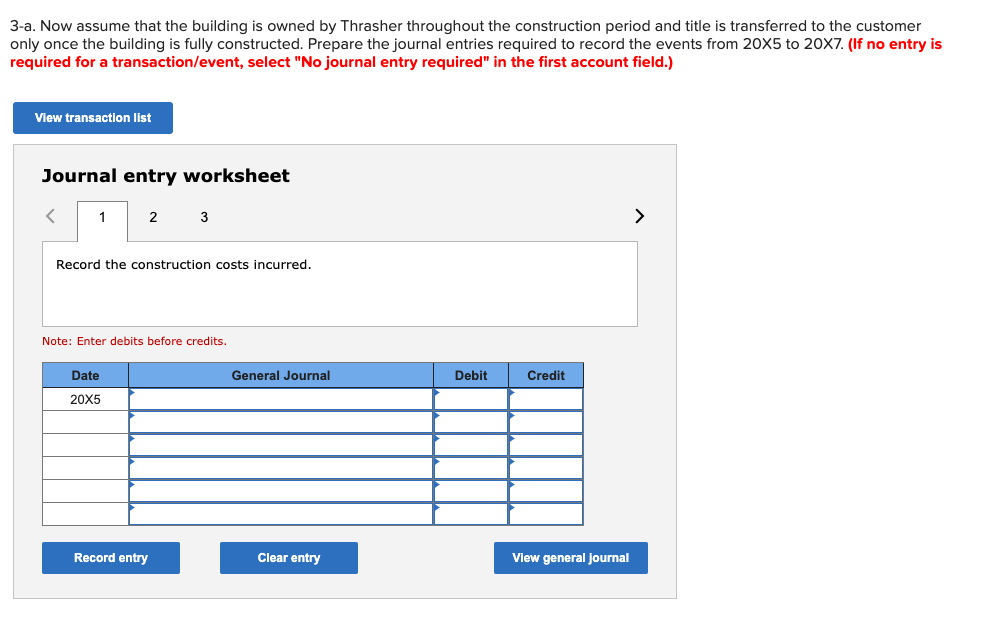

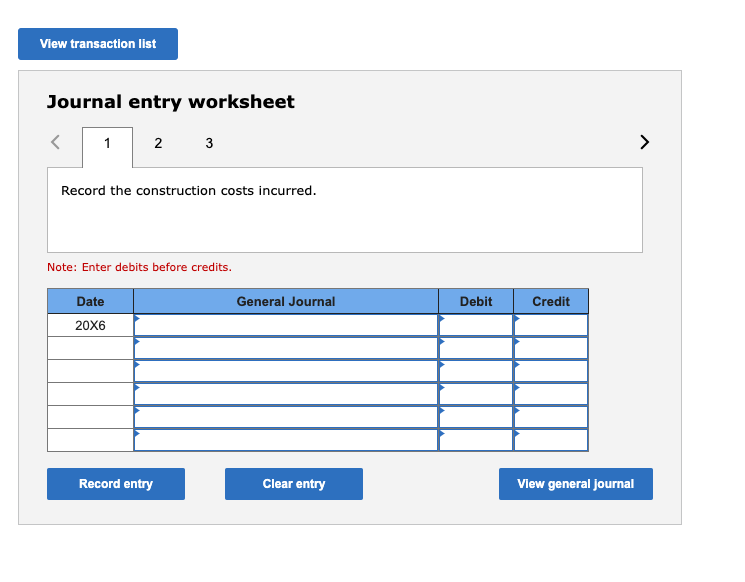

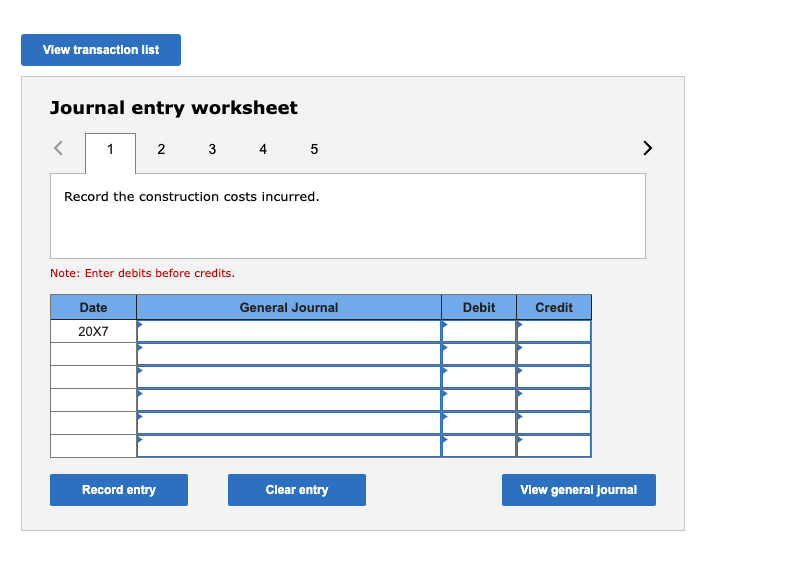

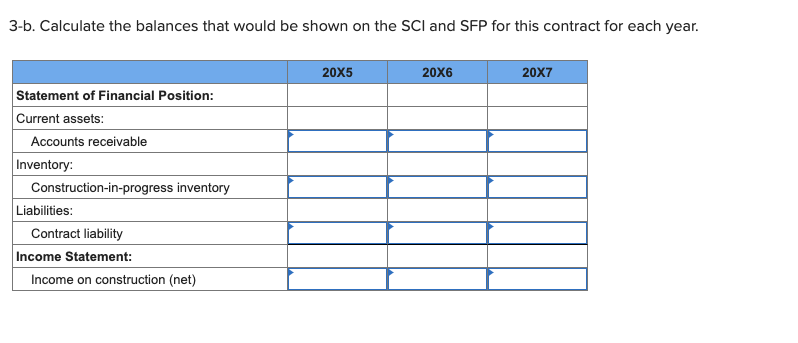

Thrasher Construction Co. was contracted to construct a building for $1,045,000. The building is owned by the customer throughout the contract period. The contract provides for progress payments. Thrasher's accounting year ends 31 December. Work began under the contract on 1 July 20X5, and was completed on 30 September 20X7. Construction activities are summarized below by year: 205 Construction costs incurred during the year, $192,600; estimated costs to complete, \$674,100; progress billings during the year, $163,500; and collections, $149,800. 206 Construction costs incurred during the year, $481,500; estimated costs to complete, \$203,300; progress billing during the year, $409,100; and collections, $406,600. 207 Construction costs incurred during the year, $209,000. Because the contract was completed, the remaining balance was billed and later collected in full per the contract. 205 Construction costs incurred during the year, $192,600; estimated costs to complete, $674,100; progress billings during the year, $163,500; and collections, \$149,800. 206 Construction costs incurred during the year, $481,500; estimated costs to complete, $203,300; progress billing during the year, $409,100; and collections, $406,600. 207 Construction costs incurred during the year, \$209,000. Because the contract was completed, the remaining balance was billed and later collected in full per the contract. Required: 1. Prepare Thrasher's journal entries to record these events. Assume that percentage of completion is measured by the ratio of costs incurred to date divided by total estimated construction costs. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) 3-a. Now assume that the building is owned by Thrasher throughout the construction period and title is transferred to the customer only once the building is fully constructed. Prepare the journal entries required to record the events from 205 to 207. (If no entry is equired for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the construction costs incurred. Note: Enter debits before credits. Journal entry worksheet Record the construction costs incurred. Note: Enter debits before credits. Journal entry worksheet 45 Record the construction costs incurred. Note: Enter debits before credits. 3-b. Calculate the balances that would be shown on the SCI and SFP for this contract for each year

Thrasher Construction Co. was contracted to construct a building for $1,045,000. The building is owned by the customer throughout the contract period. The contract provides for progress payments. Thrasher's accounting year ends 31 December. Work began under the contract on 1 July 20X5, and was completed on 30 September 20X7. Construction activities are summarized below by year: 205 Construction costs incurred during the year, $192,600; estimated costs to complete, \$674,100; progress billings during the year, $163,500; and collections, $149,800. 206 Construction costs incurred during the year, $481,500; estimated costs to complete, \$203,300; progress billing during the year, $409,100; and collections, $406,600. 207 Construction costs incurred during the year, $209,000. Because the contract was completed, the remaining balance was billed and later collected in full per the contract. 205 Construction costs incurred during the year, $192,600; estimated costs to complete, $674,100; progress billings during the year, $163,500; and collections, \$149,800. 206 Construction costs incurred during the year, $481,500; estimated costs to complete, $203,300; progress billing during the year, $409,100; and collections, $406,600. 207 Construction costs incurred during the year, \$209,000. Because the contract was completed, the remaining balance was billed and later collected in full per the contract. Required: 1. Prepare Thrasher's journal entries to record these events. Assume that percentage of completion is measured by the ratio of costs incurred to date divided by total estimated construction costs. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) 3-a. Now assume that the building is owned by Thrasher throughout the construction period and title is transferred to the customer only once the building is fully constructed. Prepare the journal entries required to record the events from 205 to 207. (If no entry is equired for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the construction costs incurred. Note: Enter debits before credits. Journal entry worksheet Record the construction costs incurred. Note: Enter debits before credits. Journal entry worksheet 45 Record the construction costs incurred. Note: Enter debits before credits. 3-b. Calculate the balances that would be shown on the SCI and SFP for this contract for each year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started