Question

ThunderScooter (TS) is an UK-based manufacturer of electric scooters. The company currently sells all its products in the UK. The annual turnover of the company

ThunderScooter ("TS") is an UK-based manufacturer of electric scooters. The company currently sells all its products in the UK. The annual turnover of the company was GBP 15 million last year and TS expects a steady 5% growth from the UK sales, although the net profit margin is only 5%. Recently TS participated in a trade-mission to South Asia and was surprised with a positive response of potential buyers.

Upon return, TS received an inquiry from an Indian trading company which, if signed, would double the turnover of the firm next year. It is expected that further orders may arrive, which together will comprise 2/3 of the total firm's turnover. The profitability of overseas orders would the same as the UK ones at the current spot exchange rate.

All the costs of the company are in Sterling, while the Indian buyer insisted on signing contracts denominated in Indian rupee - TS would have to accept this provision to obtain the contract. TS considers two possibilities to expand its manufacturing capacity.

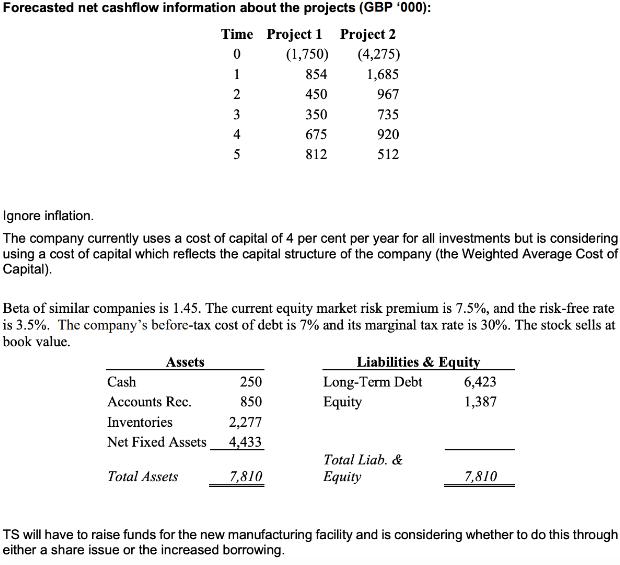

The following forecasts have been predicted and you have been asked to critically evaluate both independent projects over a 5-year period.

a) Using the figures provided and based on the given cost of capital of 4%, you are required to apply a range of methods to carry out the investment appraisal of the proposal and, based on these results, discuss whether the company should go ahead with the proposal. (30 marks) Investment appraisal including profit net cash flow, IRR, ARR, NPV and Payback period.

b) Calculate cost of capital using the CAPM and consider the impact on the proposal, together with an evaluation of the WACC as an appropriate discount rate for this investment. Your analysis MUST include applying the WACC you calculate in the investment appraisal.

c) Advise the company on the financing options available with respect to using debt and/or equity, finance raised in the UK. Your discussions should consider the implications for the company and the possible impacts on the cost of capital of using theory where appropriate.

d) Consider the potential impact of signing the contract with an Indian buyer on the overall risk profile of the company. Please offer a discussion and a tangible set of recommendations on how TS can protect itself from the potential negative impact of the contract on its entire operations, including a general discussion on viability of protection mechanisms.

Forecasted net cashflow information about the projects (GBP '000): Time Project 1 Project 2 0 (1,750) (4,275) 854 1,685 450 967 735 920 512 1 2 3 Assets 4 5 Ignore inflation. The company currently uses a cost of capital of 4 per cent per year for all investments but is considering using a cost of capital which reflects the capital structure of the company (the Weighted Average Cost of Capital). Cash Accounts Rec. Inventories Net Fixed Assets Total Assets Beta of similar companies is 1.45. The current equity market risk premium is 7.5%, and the risk-free rate is 3.5%. The company's before-tax cost of debt is 7% and its marginal tax rate is 30%. The stock sells at book value. 350 675 812 250 850 2,277 4,433 7,810 Liabilities & Equity Long-Term Debt Equity Total Liab. & Equity 6,423 1,387 7,810 TS will have to raise funds for the new manufacturing facility and is considering whether to do this through either a share issue or the increased borrowing.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Part a answer time project 1 project2 Present Value P1 Present Value P2 1750 4275 1750 4275 1 854 1685 821 1620 2 450 967 416 894 3 350 735 311 653 4 675 920 577 786 5 812 512 667 421 NPV 1043 100 IRR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started