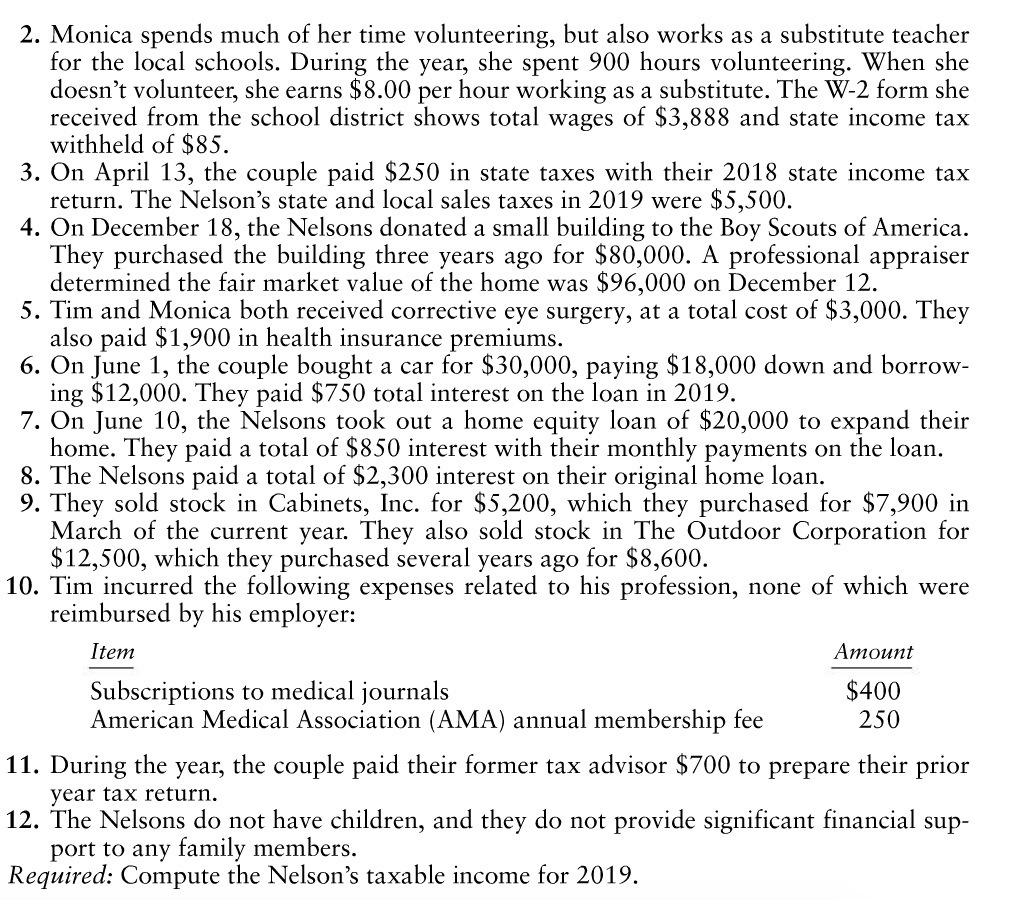

Tim and Monica Nelson are married, file a joint return, and are your newest tax clients. They provide you with the following information relating to their 2019 tax return: 1. Tim works as a pediatrician for the county hospital. The W-2 form he received from ospital shows wages of $150,000 and state income tax withheld of $8,500. 2. Monica spends much of her time volunteering, but also works as a substitute teacher for the local schools. During the year, she spent 900 hours volunteering. When she doesn't volunteer, she earns $8.00 per hour working as a substitute. The W-2 form she received from the school district shows total wages of $3,888 and state income tax withheld of $85. 3. On April 13, the couple paid $250 in state taxes with their 2018 state income tax return. The Nelson's state and local sales taxes in 2019 were $5,500. 4. On December 18, the Nelsons donated a small building to the Boy Scouts of America. They purchased the building three years ago for $80,000. A professional appraiser determined the fair market value of the home was $96,000 on December 12. 5. Tim and Monica both received corrective eye surgery, at a total cost of $3,000. They also paid $1,900 in health insurance premiums. 6. On June 1, the couple bought a car for $30,000, paying $18,000 down and borrow- ing $12,000. They paid $750 total interest on the loan in 2019. 7. On June 10, the Nelsons took out a home equity loan of $20,000 to expand their home. They paid a total of $850 interest with their monthly payments on the loan. 8. The Nelsons paid a total of $2,300 interest on their original home loan. 9. They sold stock in Cabinets, Inc. for $5,200, which they purchased for $7,900 in March of the current year. They also sold stock in The Outdoor Corporation for $12,500, which they purchased several years ago for $8,600. 10. Tim incurred the following expenses related to his profession, none of which were reimbursed by his employer: Item Amount Subscriptions to medical journals $400 American Medical Association (AMA) annual membership fee 250 11. During the year, the couple paid their former tax advisor $700 to prepare their prior year tax return. 12. The Nelsons do not have children, and they do not provide significant financial sup- port to any family members. Required: Compute the Nelson's taxable income for 2019. Tim and Monica Nelson are married, file a joint return, and are your newest tax clients. They provide you with the following information relating to their 2019 tax return: 1. Tim works as a pediatrician for the county hospital. The W-2 form he received from ospital shows wages of $150,000 and state income tax withheld of $8,500. 2. Monica spends much of her time volunteering, but also works as a substitute teacher for the local schools. During the year, she spent 900 hours volunteering. When she doesn't volunteer, she earns $8.00 per hour working as a substitute. The W-2 form she received from the school district shows total wages of $3,888 and state income tax withheld of $85. 3. On April 13, the couple paid $250 in state taxes with their 2018 state income tax return. The Nelson's state and local sales taxes in 2019 were $5,500. 4. On December 18, the Nelsons donated a small building to the Boy Scouts of America. They purchased the building three years ago for $80,000. A professional appraiser determined the fair market value of the home was $96,000 on December 12. 5. Tim and Monica both received corrective eye surgery, at a total cost of $3,000. They also paid $1,900 in health insurance premiums. 6. On June 1, the couple bought a car for $30,000, paying $18,000 down and borrow- ing $12,000. They paid $750 total interest on the loan in 2019. 7. On June 10, the Nelsons took out a home equity loan of $20,000 to expand their home. They paid a total of $850 interest with their monthly payments on the loan. 8. The Nelsons paid a total of $2,300 interest on their original home loan. 9. They sold stock in Cabinets, Inc. for $5,200, which they purchased for $7,900 in March of the current year. They also sold stock in The Outdoor Corporation for $12,500, which they purchased several years ago for $8,600. 10. Tim incurred the following expenses related to his profession, none of which were reimbursed by his employer: Item Amount Subscriptions to medical journals $400 American Medical Association (AMA) annual membership fee 250 11. During the year, the couple paid their former tax advisor $700 to prepare their prior year tax return. 12. The Nelsons do not have children, and they do not provide significant financial sup- port to any family members. Required: Compute the Nelson's taxable income for 2019