Question

Timlee Ltd (Timlee), a Hong Kong-incorporated company, carrying on business in Hong Kong as a music instruments trading company in the Asia region. For the

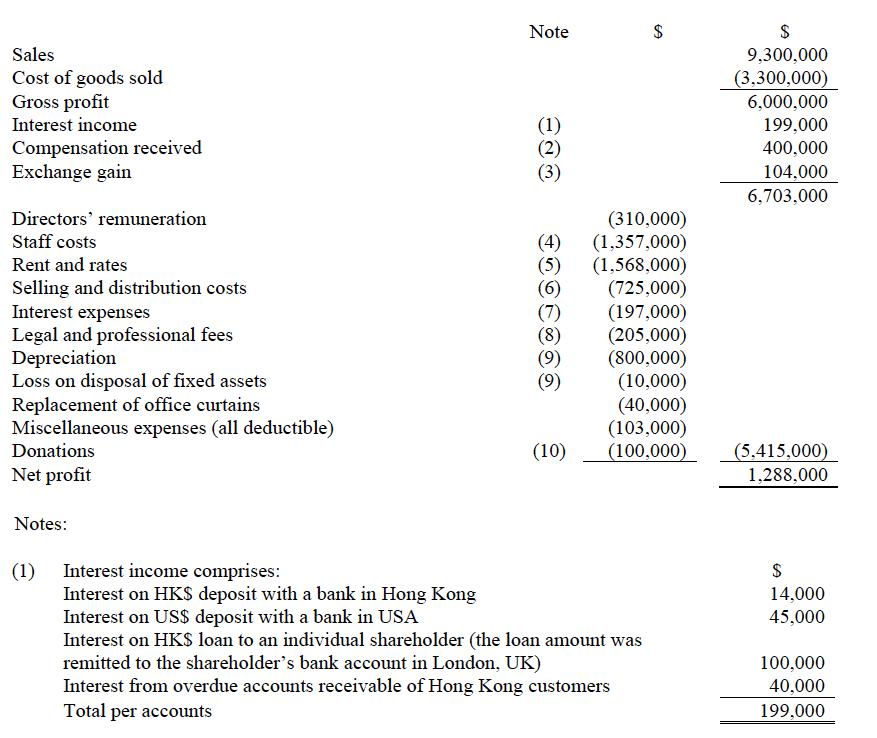

Timlee Ltd (Timlee), a Hong Kong-incorporated company, carrying on business in Hong Kong as a music instruments trading company in the Asia region. For the year ended 31 December 2020,

Timlee’s profit and loss account contained the following details:

Required:

Calculate Timlee Ltd’s profits tax liability in respect of the year ended 31 December 2020.

Clearly identify the year of assessment, the relevant basis period, the assessable profits/adjusted

loss, the net assessable profits/adjusted loss and profits tax payable, if any. Show all workings

including the depreciation allowance schedules with details of calculation.

Note: You should ignore provisional tax, any one-off tax concessions and overseas tax.

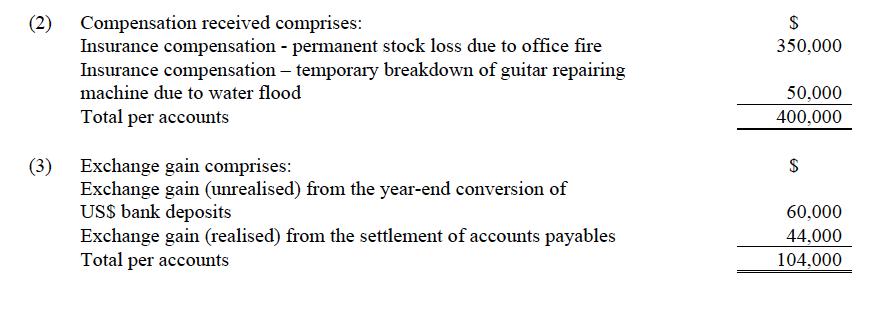

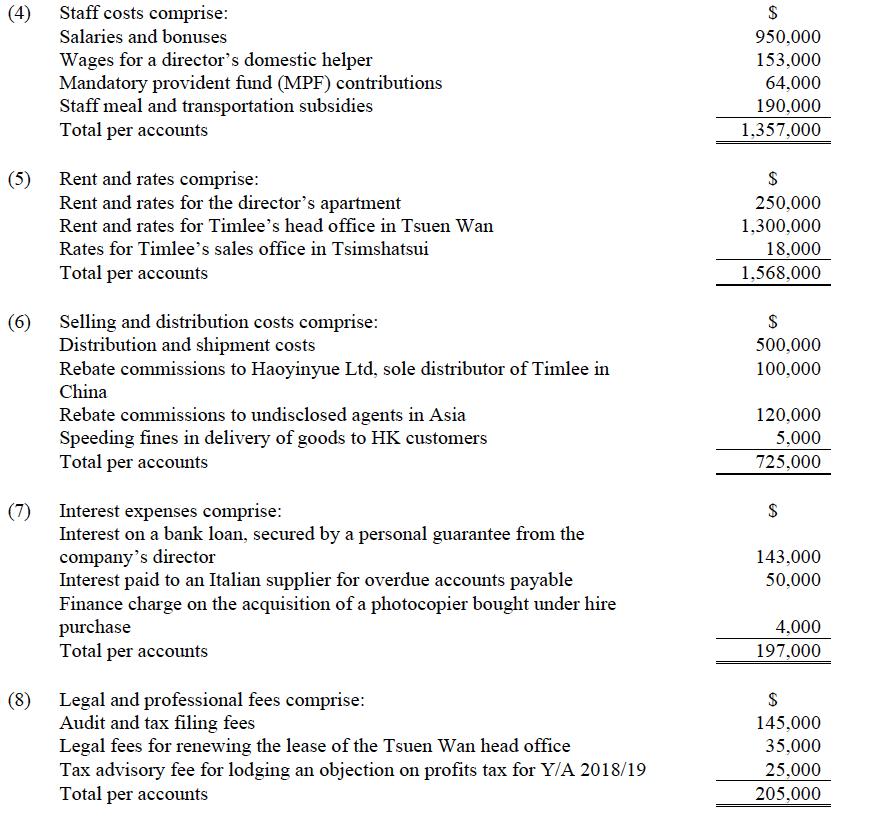

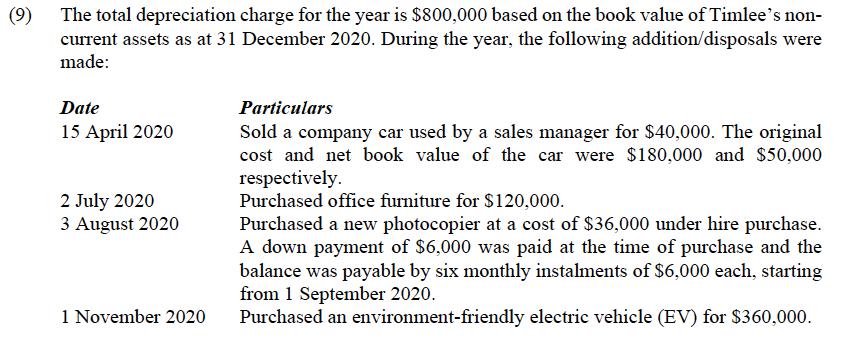

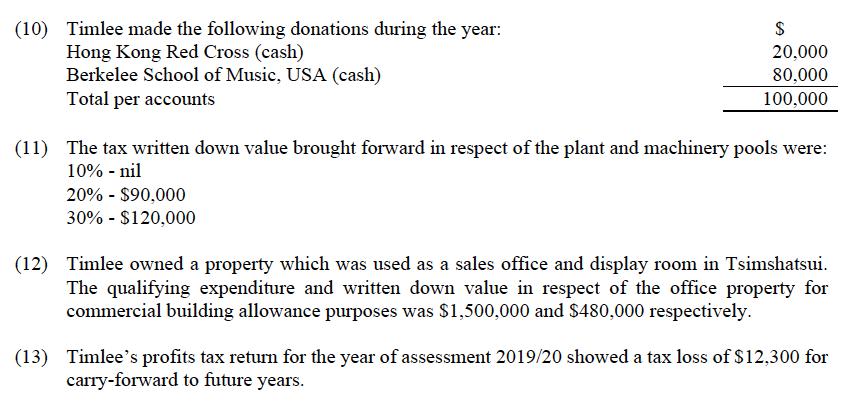

Note 2$ $ Sales Cost of goods sold Gross profit 9,300,000 (3,300,000) 6,000,000 199,000 Interest income Compensation received Exchange gain (1) (2) (3) 400,000 104,000 6,703,000 Directors' remuneration (310,000) (1,357,000) (1,568,000) (725,000) (197,000) (205,000) (800,000) (10,000) (40,000) (103,000) (100,000) Staff costs (4) (5) (6) Rent and rates Selling and distribution costs Interest expenses Legal and professional fees Depreciation Loss on disposal of fixed assets Replacement of office curtains Miscellaneous expenses (all deductible) (9) (9) (5.415,000) 1,288,000 Donations (10) Net profit Notes: Interest income comprises: (1) Interest on HKS deposit with a bank in Hong Kong Interest on USS deposit with a bank in USA Interest on HKS loan to an individual shareholder (the loan amount was remitted to the shareholder's bank account in London, UK) Interest from overdue accounts receivable of Hong Kong customers Total per accounts 14,000 45,000 100,000 40,000 199,000

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started