Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To complete the assignment, you will be using financial statement excerpts from the 2018 10Ks of Ford Motor Company. I have extracted the portions of

To complete the assignment, you will be using financial statement excerpts from the 2018 10Ks of Ford Motor Company. I have extracted the portions of the 10K you will require for the assignment and posted the information

3. What is Ford Motor Companys effective tax rate for 2018, 2017 and 2016? Describe the key driver for the significant change in effective tax rates between the three years.

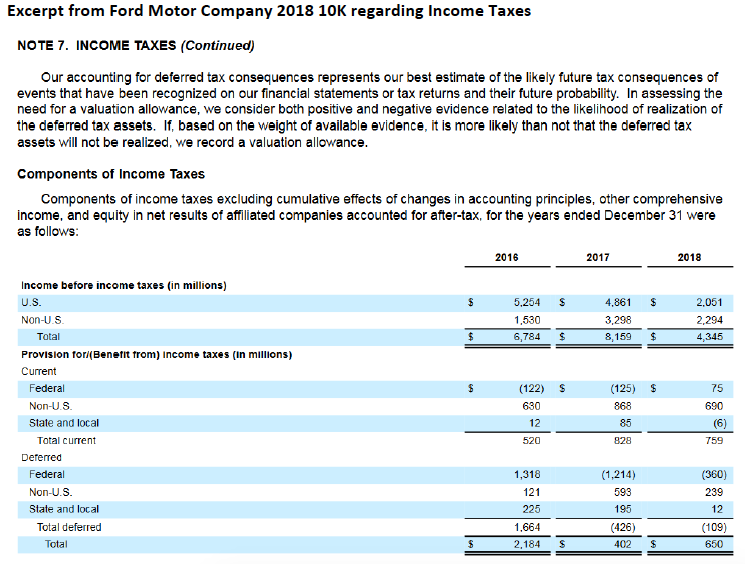

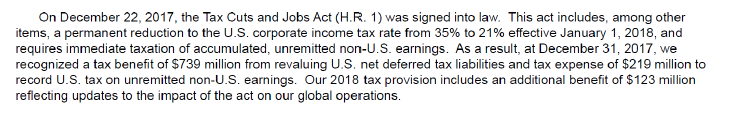

Excerpt from Ford Motor Company 2018 10K regarding Income Taxes NOTE 7. INCOME TAXES (Continued) Our accounting for deferred tax consequences represents our best estimate of the likely future tax consequences of events that have been recognized on our financial statements or tax returns and their future probability. In assessing the need for a valuation allowance, we consider both positive and negative evidence related to the likelihood of realization of the deferred tax assets. If, based on the weight of available evidence, it is more likely than not that the deferred tax assets will not be realized, we record a valuation allowance Components of Income Taxes Components of income taxes excluding cumulative effects of changes in accounting principles, other comprehensive income, and equity in net results of affliated companies accounted for after-tax. for the years ended December 31 were as follows: 2016 2017 2018 Income before income taxes (in millions) U.S S 5,254 S 4,861 $ 2,051 Non-U.S 1,530 3,298 2,294 Total 6,784 8,159 4,345 Provision tori(Benetit from) income taxes (In millions) Current Federal (122) (125) 75 Non-U.S 630 868 690 State and local 12 85 (6) Total current 520 828 759 Deferred Federal 1,318 (1,214) (360) Non-U.S 593 121 239 State and local 225 195 12 Total deferred 1,664 (426) (109) Total 2,184 S 402 650 On December 22, 2017, the Tax Cuts and Jobs Act (H.R. 1) was signed into law, This act includes, among other items, a permanent reduction to the U.S. corporate income tax rate from 35% to 21% effective January 1, 2018, and requires immediate taxation of accumulated, unremitted non-U.S. earnings. As a result, at December 31, 2017, we recognized a tax benefit of $739 million from revaluing U.S. net deferred tax liabilities and tax expense of $219 million to record U.S. tax on unremitted non-U.S. earnings. Our 2018 tax provision includes an additional benefit of $123 million reflecting updates to the impact of the act on our global operations. Excerpt from Ford Motor Company 2018 10K regarding Income Taxes NOTE 7. INCOME TAXES (Continued) Our accounting for deferred tax consequences represents our best estimate of the likely future tax consequences of events that have been recognized on our financial statements or tax returns and their future probability. In assessing the need for a valuation allowance, we consider both positive and negative evidence related to the likelihood of realization of the deferred tax assets. If, based on the weight of available evidence, it is more likely than not that the deferred tax assets will not be realized, we record a valuation allowance Components of Income Taxes Components of income taxes excluding cumulative effects of changes in accounting principles, other comprehensive income, and equity in net results of affliated companies accounted for after-tax. for the years ended December 31 were as follows: 2016 2017 2018 Income before income taxes (in millions) U.S S 5,254 S 4,861 $ 2,051 Non-U.S 1,530 3,298 2,294 Total 6,784 8,159 4,345 Provision tori(Benetit from) income taxes (In millions) Current Federal (122) (125) 75 Non-U.S 630 868 690 State and local 12 85 (6) Total current 520 828 759 Deferred Federal 1,318 (1,214) (360) Non-U.S 593 121 239 State and local 225 195 12 Total deferred 1,664 (426) (109) Total 2,184 S 402 650 On December 22, 2017, the Tax Cuts and Jobs Act (H.R. 1) was signed into law, This act includes, among other items, a permanent reduction to the U.S. corporate income tax rate from 35% to 21% effective January 1, 2018, and requires immediate taxation of accumulated, unremitted non-U.S. earnings. As a result, at December 31, 2017, we recognized a tax benefit of $739 million from revaluing U.S. net deferred tax liabilities and tax expense of $219 million to record U.S. tax on unremitted non-U.S. earnings. Our 2018 tax provision includes an additional benefit of $123 million reflecting updates to the impact of the act on our global operationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started